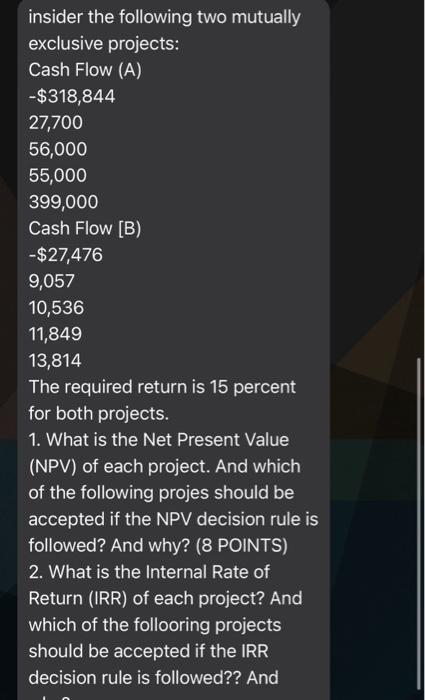

Question: insider the following two mutually exclusive projects: Cash Flow (A) -$318,844 27,700 56,000 55,000 399,000 Cash Flow [B) -$27,476 9,057 10,536 11,849 13,814 The required

insider the following two mutually exclusive projects: Cash Flow (A) $318,844 27,700 56,000 55,000 399,000 Cash Flow [B) $27,476 9,057 10,536 11,849 13,814 The required return is 15 percent for both projects. 1. What is the Net Present Value (NPV) of each project. And which of the following projes should be accepted if the NPV decision rule is followed? And why? (8 POINTS) 2. What is the Internal Rate of Return (IRR) of each project? And which of the follooring projects should be accepted if the IRR decision rule is followed?? And

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts