Question: Instead we shall consider a numerical example. The form we have left the solution in proves a good one for solving particular numerical examples. adt.(8)

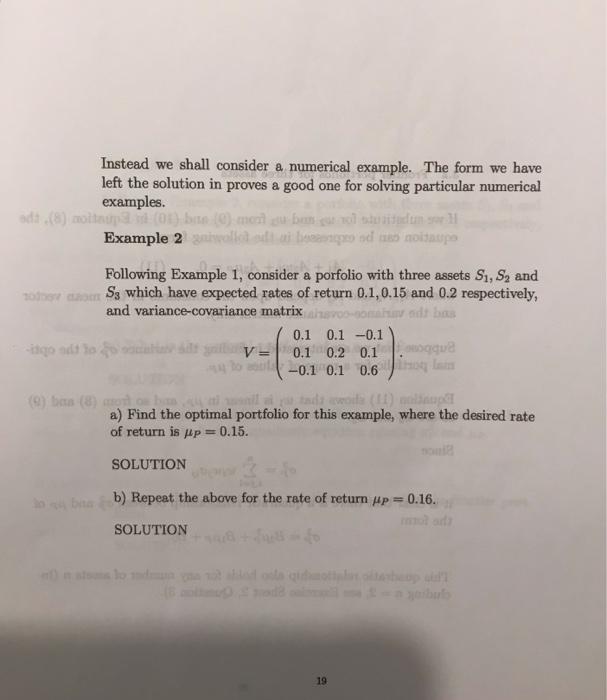

Instead we shall consider a numerical example. The form we have left the solution in proves a good one for solving particular numerical examples. adt.(8) molt 10) moet u betalitedom Example 2 salveze s notassipo Following Example 1, consider a porfolio with three assets Si, S, and noncho S3 which have expected rates of return 0.1,0.15 and 0.2 respectively, and variance covariance matrix ba 0.1 0.1 -0.1 V= 0.1 0.2 0.1 que -0.1 0.1 0.6 ho la (9) bus (8) and wo (1) a) Find the optimal portfolio for this example, where the desired rate of return is fp = 0.15. G SOLUTION b) Repeat the above for the rate of return up = 0.16. SOLUTION 19 Instead we shall consider a numerical example. The form we have left the solution in proves a good one for solving particular numerical examples. adt.(8) molt 10) moet u betalitedom Example 2 salveze s notassipo Following Example 1, consider a porfolio with three assets Si, S, and noncho S3 which have expected rates of return 0.1,0.15 and 0.2 respectively, and variance covariance matrix ba 0.1 0.1 -0.1 V= 0.1 0.2 0.1 que -0.1 0.1 0.6 ho la (9) bus (8) and wo (1) a) Find the optimal portfolio for this example, where the desired rate of return is fp = 0.15. G SOLUTION b) Repeat the above for the rate of return up = 0.16. SOLUTION 19

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts