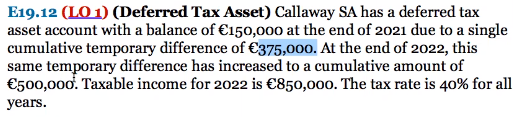

Question: instruction: 1-prepare journal entry 2- prepare income statement E19.12 (LO 1) (Deferred Tax Asset) Callaway SA has a deferred tax asset account with a balance

instruction:

1-prepare journal entry

2- prepare income statement

E19.12 (LO 1) (Deferred Tax Asset) Callaway SA has a deferred tax asset account with a balance of 150,000 at the end of 2021 due to a single cumulative temporary difference of 375,000. At the end of 2022, this same temporary difference has increased to a cumulative amount of 500,000. Taxable income for 2022 is 850,000. The tax rate is 40% for all years. 2022, we expected that only 130,000 of DTA will be realized, 2023 taxable income 700,000 and the DTA is realized

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock