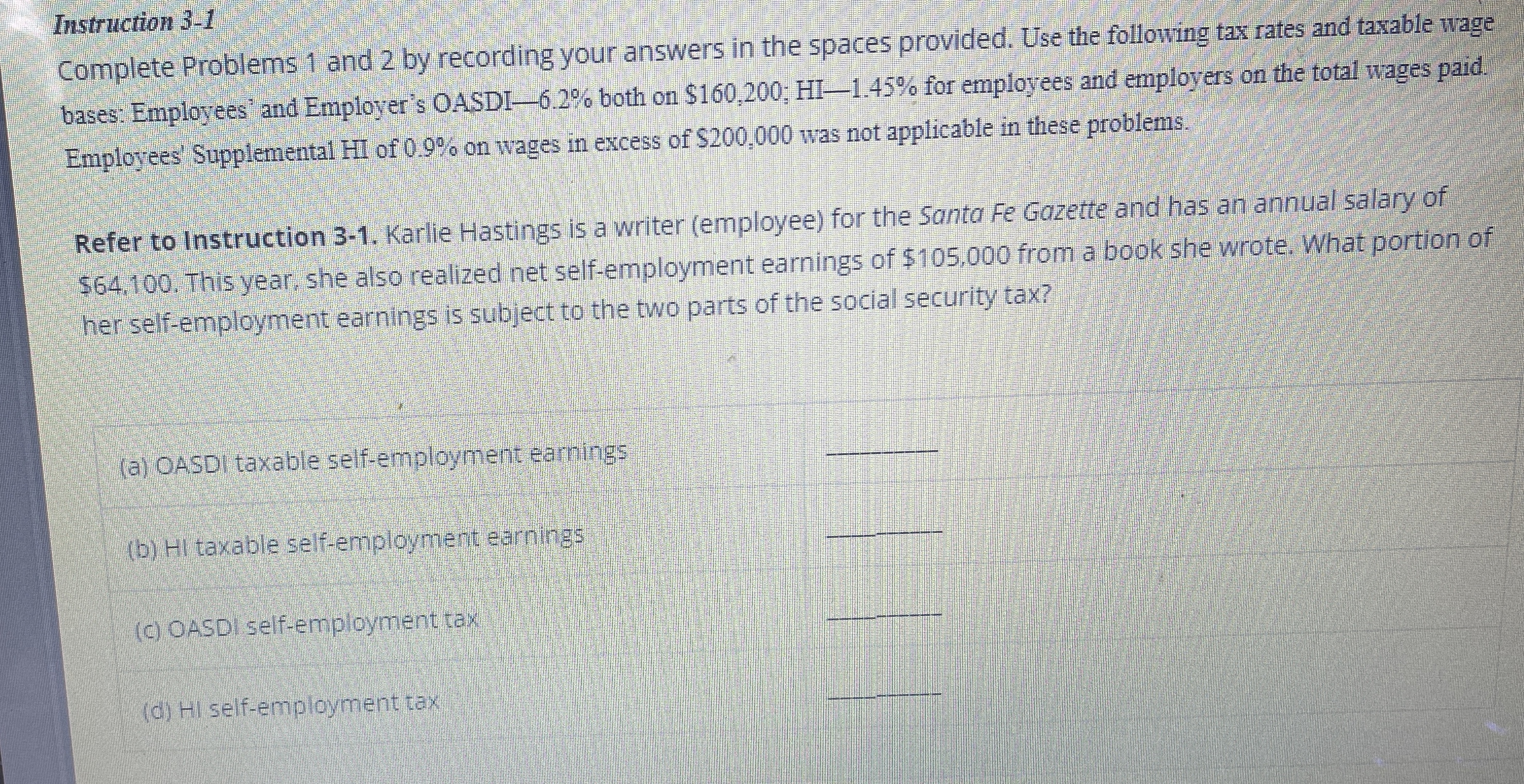

Question: Instruction 3 - 1 Complete Problems 1 and 2 by recording your answers in the spaces provided. Use the following tax rates and taxable wage

Instruction

Complete Problems and by recording your answers in the spaces provided. Use the following tax rates and taxable wage

bases: Employees' and Employer's OASDI both on $; HI for employees and employers on the total wages paid.

Employees' Supplemental HI of on wages in excess of $ was not applicable in these problems.

Refer to Instruction Karlie Hastings is a writer employee for the Santa Fe Gazette and has an annual salary of

$ This year, she also realized net selfemployment earnings of $ from a book she wrote. What portion of

her selfemployment earnings is subject to the two parts of the social security tax?

a OASDI taxable selfemployment earnings

b HI taxable selfemployment earnings

c OASDI selfemployment tax

d Hi selfemployment tax

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock