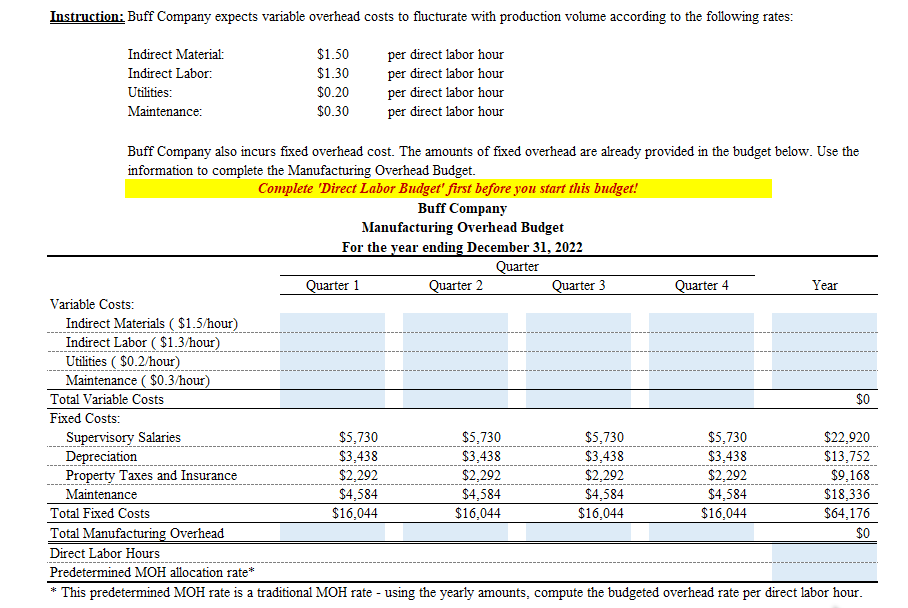

Question: Instruction: Buff Company expects variable overhead costs to flucturate with production volume according to the following rates: Indirect Material: Indirect Labor: Utilities: Maintenance $1.50 $1.30

Instruction: Buff Company expects variable overhead costs to flucturate with production volume according to the following rates: Indirect Material: Indirect Labor: Utilities: Maintenance $1.50 $1.30 $0.20 $0.30 per direct labor hour per direct labor hour per direct labor hour per direct labor hour Buff Company also incurs fixed overhead cost. The amounts of fixed overhead are already provided in the budget below. Use the information to complete the Manufacturing Overhead Budget. Complete 'Direct Labor Budget' first before you start this budget! Buff Company Manufacturing Overhead Budget For the year ending December 31, 2022 Quarter Quarter 1 Quarter 2 Quarter 3 Quarter 4 Year Variable Costs: Indirect Materials ( $1.5/hour) Indirect Labor ( $1.3/hour) Utilities ( $0.2/hour) Maintenance ( $0.3/hour) Total Variable Costs $0 Fixed Costs: Supervisory Salaries $5,730 $5,730 $5,730 $5,730 $22,920 Depreciation $3,438 $3,438 $3,438 $3,438 $13,752 Property Taxes and Insurance $2,292 $2,292 $2,292 $2,292 $9,168 Maintenance $4,584 $4,584 $4,584 $4,584 $18,336 Total Fixed Costs $16,044 $16,044 $16,044 $16,044 $64,176 Total Manufacturing Overhead $0 Direct Labor Hours Predetermined MOH allocation rate* This predetermined MOH rate is a traditional MOH rate - using the yearly amounts, compute the budgeted overhead rate per direct labor hour. **

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts