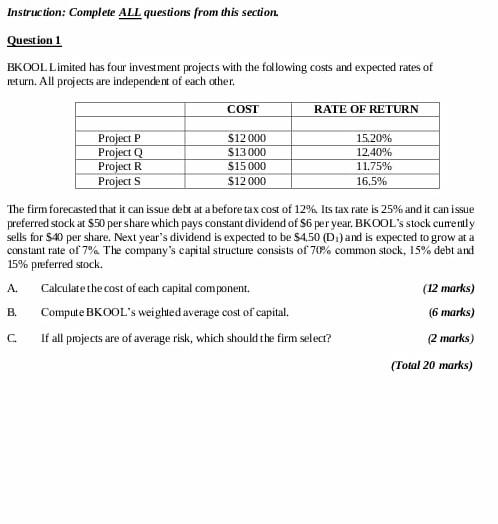

Question: Instruction: Complete ALL questions from this section Question 1 BKOOL Limited has four investment projects with the following costs and expected rates of return. All

Instruction: Complete ALL questions from this section Question 1 BKOOL Limited has four investment projects with the following costs and expected rates of return. All projects are independent of each other. RATE OF RETURN COST 15.20% $12000 S13000 Project P Project Q Project R Projects 12.40% 11.75% S15 000 $12000 16,5% The firm forecasted that it can issue debt at a before tax cost of 12%. Its tax rate is 25% and it can issue preferred stock at $50 per share which pays constant dividend of S6 per year. BKOOL's stock currently sells for $40 per share. Next year's dividend is expected to be 54.50 (D.) and is expected to grow at a constant rate of 7% The company's capital structure consists of 70% common stock, 15% debt and 15% preferred stock. A Calculate the cost of each capital component. (12 marks) B Compute BKOOL's weighted average cost of capital. (6 marks) C c If all projects are of average risk, which should the firm select? (2 marks) (Total 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts