Question: Instruction: please show complete solution and explain how you derived with your computation. Tele Manufacturing Company uses process costing in the manufacture of a single

Instruction: please show complete solution and explain how you derived with your computation.

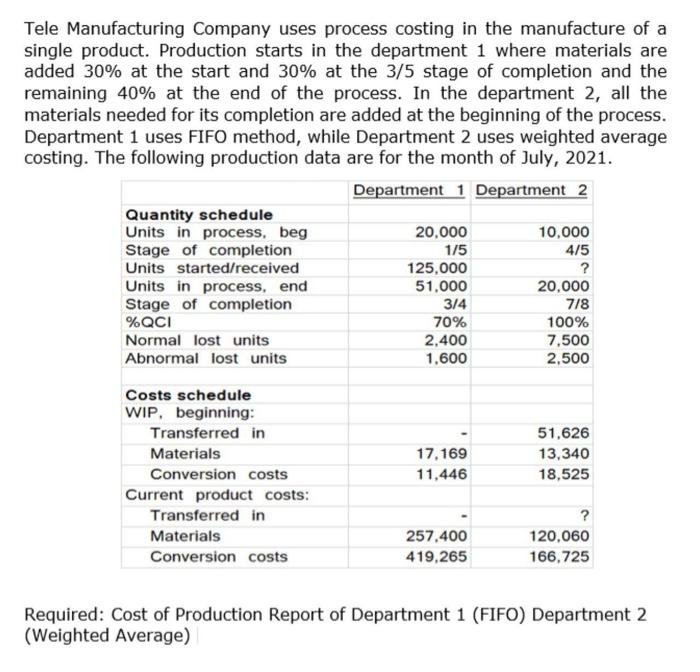

Tele Manufacturing Company uses process costing in the manufacture of a single product. Production starts in the department 1 where materials are added 30% at the start and 30% at the 3/5 stage of completion and the remaining 40% at the end of the process. In the department 2, all the materials needed for its completion are added at the beginning of the process. Department 1 uses FIFO method, while Department 2 uses weighted average costing. The following production data are for the month of July, 2021. Department 1 Department 2 Quantity schedule Units in process. beg 20,000 10,000 Stage of completion 1/5 4/5 Units started/received 125,000 ? Units in process, end 51,000 20,000 Stage of completion 3/4 7/8 %QCI 70% 100% Normal lost units 2,400 7.500 Abnormal lost units 1,600 2,500 Costs schedule WIP, beginning: Transferred in Materials Conversion costs Current product costs: Transferred in Materials Conversion costs 17,169 11,446 51,626 13,340 18,525 257,400 419,265 ? 120,060 166,725 Required: Cost of Production Report of Department 1 (FIFO) Department 2 (Weighted Average) Tele Manufacturing Company uses process costing in the manufacture of a single product. Production starts in the department 1 where materials are added 30% at the start and 30% at the 3/5 stage of completion and the remaining 40% at the end of the process. In the department 2, all the materials needed for its completion are added at the beginning of the process. Department 1 uses FIFO method, while Department 2 uses weighted average costing. The following production data are for the month of July, 2021. Department 1 Department 2 Quantity schedule Units in process. beg 20,000 10,000 Stage of completion 1/5 4/5 Units started/received 125,000 ? Units in process, end 51,000 20,000 Stage of completion 3/4 7/8 %QCI 70% 100% Normal lost units 2,400 7.500 Abnormal lost units 1,600 2,500 Costs schedule WIP, beginning: Transferred in Materials Conversion costs Current product costs: Transferred in Materials Conversion costs 17,169 11,446 51,626 13,340 18,525 257,400 419,265 ? 120,060 166,725 Required: Cost of Production Report of Department 1 (FIFO) Department 2 (Weighted Average)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts