Question: Instruction: Read carefully each of the given problems. Solve each requirement manually or using an excel. If you use excel, provide a short description of

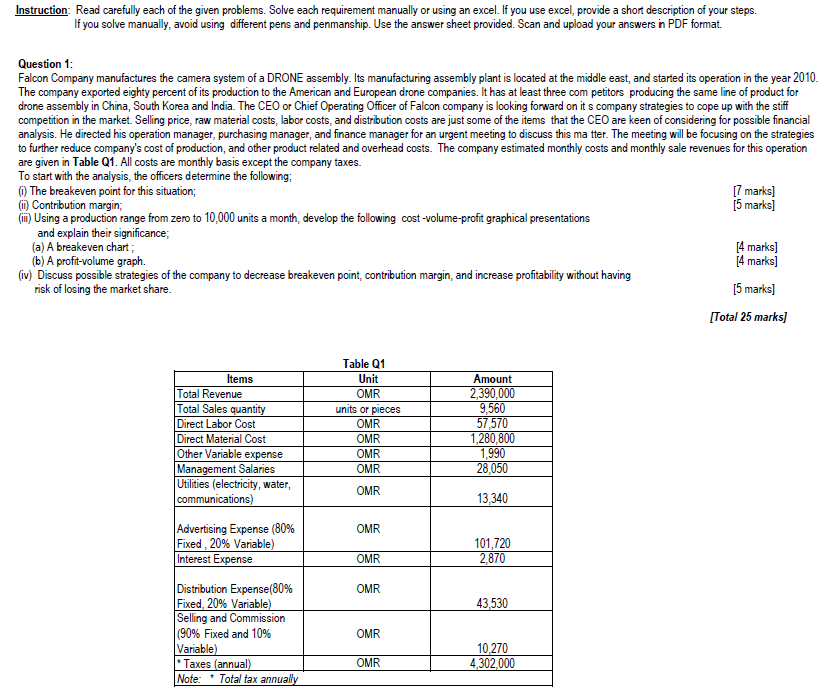

Instruction: Read carefully each of the given problems. Solve each requirement manually or using an excel. If you use excel, provide a short description of your steps. If you solve manually, avoid using different pens and penmanship. Use the answer sheet provided. Scan and upload your answers in PDF format. Question 1: Falcon Company manufactures the camera system of a DRONE assembly. Its manufacturing assembly plant is located at the middle east, and started its operation in the year 2010 The company exported eighty percent of its production to the American and European drone companies. It has at least three com petitors producing the same line of product for drone assembly in China, South Korea and India. The CEO or Chief Operating Officer of Falcon company is looking forward on its company strategies to cope up with the stiff competition in the market. Selling price, raw material costs, labor costs, and distribution costs are just some of the items that the CEO are keen of considering for possible financial analysis. He directed his operation manager, purchasing manager, and finance manager for an urgent meeting to discuss this matter. The meeting will be focusing on the strategies to further reduce company's cost of production, and other product related and overhead costs. The company estimated monthly costs and monthly sale revenues for this operation are given in Table Q1. All costs are monthly basis except the company taxes. To start with the analysis, the officers determine the following: The breakeven point for this situation; [7 marks] m Contribution margin [5 marks] Using a production range from zero to 10,000 units a month, develop the following cost-volume-profit graphical presentations and explain their significance; (a) A breakeven chart; [4 marks) (b) A profit-volume graph. [4 marks] (iv) Discuss possible strategies of the company to decrease breakeven point, contribution margin, and increase profitability without having risk of losing the market share. [5 marks) [Total 25 marks] Table 01 Unit OMR units or pieces OMR OMR OMR OMR Amount 2,390,000 9,560 57,570 1,280,800 1,990 28,050 OMR 13,340 Items Total Revenue Total Sales quantity Direct Labor Cost Direct Material Cost Other Variable expense Management Salaries Utilities (electricity, water, communications) Advertising Expense (80% Fixed , 20% Variable) Interest Expense Distribution Expense(80% Fixed, 20% Variable) Selling and Commission (90% Fixed and 10% Variable) * Taxes (annual) Note: Total tax annually OMR 101,720 2,870 OMR OMR 43,530 OMR 10270 4,302,000 OMR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts