Question: Instruction: Solve the following case on a separate sheet. Neatly show your solutions and for each requirement. Cloud Break Consulting has the following information

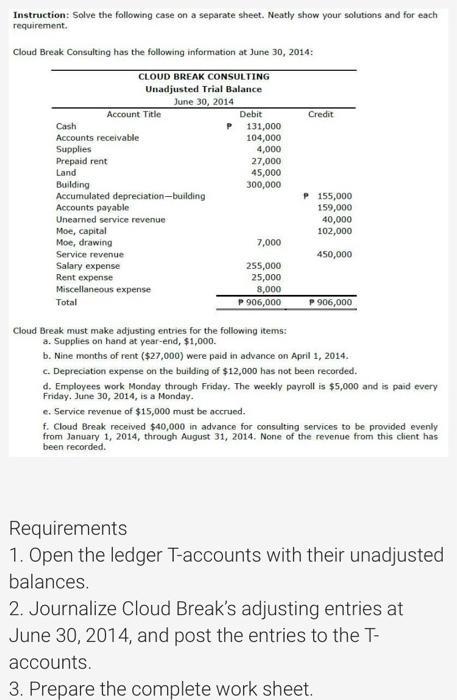

Instruction: Solve the following case on a separate sheet. Neatly show your solutions and for each requirement. Cloud Break Consulting has the following information at June 30, 2014: CLOUD BREAK CONSULTING Unadjusted Trial Balance June 30, 2014 Account Title Cash Accounts receivable Supplies Prepaid rent Land Building Accumulated depreciation-building Accounts payable Unearned service revenue Moe, capital Moe, drawing Service revenue Salary expense Rent expense Miscellaneous expense Total P Debit 131,000 104,000 4,000 27,000 45,000 300,000 7,000 255,000 25,000 8,000 P 906,000 Cloud Break must make adjusting entries for the following items: a. Supplies on hand at year-end, $1,000. Credit P 155,000 159,000 40,000 102,000 450,000 P 906,000 b. Nine months of rent ($27,000) were paid in advance on April 1, 2014. c. Depreciation expense on the building of $12,000 has not been recorded. d. Employees work Monday through Friday. The weekly payroll is $5,000 and is paid every Friday, June 30, 2014, is a Monday. e. Service revenue of $15,000 must be accrued. f. Cloud Break received $40,000 in advance for consulting services to be provided evenly from January 1, 2014, through August 31, 2014. None of the revenue from this client has been recorded. Requirements 1. Open the ledger T-accounts with their unadjusted balances. 2. Journalize Cloud Break's adjusting entries at June 30, 2014, and post the entries to the T- accounts. 3. Prepare the complete work sheet.

Step by Step Solution

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts