Question: Instructions 1 a . Using the absorption costing concept, prepare income statements for May. Income Statement Instructions Big Sky Creations Company Absorption Costing Income Statement

Instructions a Using the absorption costing concept, prepare income statements for May.

Income Statement Instructions

Big Sky Creations Company

Absorption Costing Income Statement b Using the absorption costing concept, prepare income statements for June.

Income Statement Instructions

Big Sky Creations Company

Absorption Costing Income Statement a Using the variable costing concept, prepare income statements for May.

Income Statement Instructions

Big Sky Creations Company

Variable Costing Income Statementb Using the variable costing concept, prepare income statements for June.

Income Statement Instructions

Big Sky Creations Company

Variable Costing Income Statement

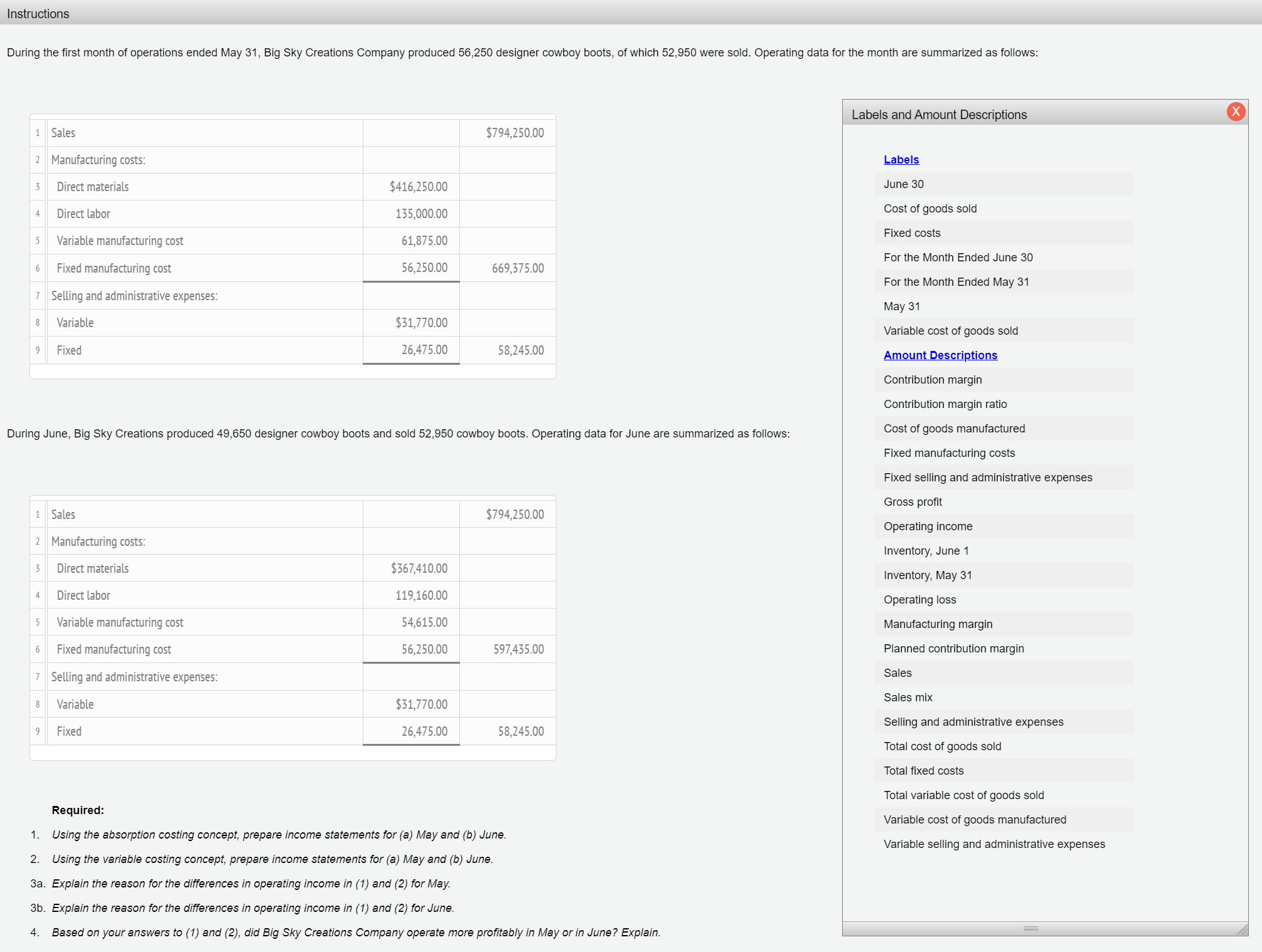

During the first month of operations ended May Big Sky Creations Company produced designer cowboy boots, of which were sold.

Required:

Using the absorption costing concept, prepare income statements for a May and b June.

Using the variable costing concept, prepare income statements for a May and b June.

a Explain the reason for the differences in operating income in and for May.

b Explain the reason for the differences in operating income in and for June.

Based on your answers to and did Big Sky Creations Company operate more profitably in May or in June? Explain.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock