Question: Instructions: (1) Do not show the calculation process. Show your final answers only. (2) Use six decimal places for your calculations and show your answers

Instructions: (1) Do not show the calculation process. Show your final answers only. (2) Use six decimal places for your calculations and show your answers to four decimal places. If you need to show your answers as a percent, take four decimal places from your calculation, converting them into a percent. For example, if your calculation results in 0.456789, show 45.68%, not 46%. To set your Texas Instrument BA II PLUS calculator at 6 decimal places, press [2ND] FORMAT 6 [ENTER]. Please follow the instructions for homework assignments on the syllabus.

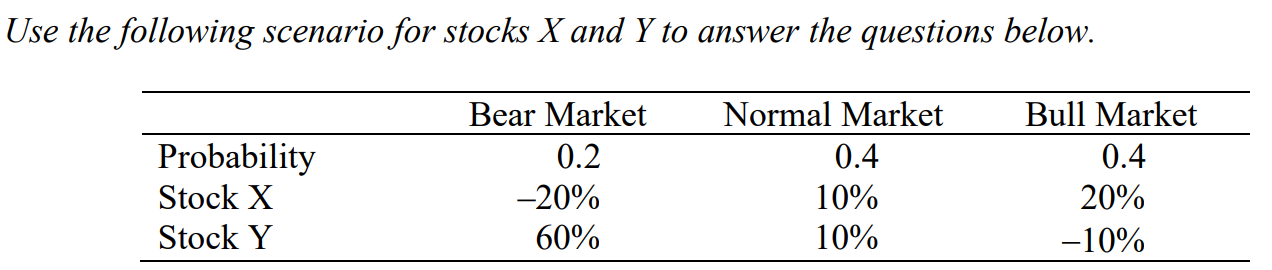

Use the following scenario for stocks X and Y to answer the questions below.

Additional information for your computational convenience:

Variance of returns on stock X = 0.0216

Variance of returns on stock Y = 0.0656

Covariance between returns on stocks X and Y = 0.0376

Questions

(1) What is the expected return for stock X?

(2) What is the standard deviation of the returns on stock Y?

(3) What is the coefficient of variation (CV) for stock X?

(4) What is the coefficient of variation (CV) for stock Y?

(5) Which stock is riskier based on the CVs? Why? Justify your answer.

(6) Compute the correlation coefficient between the returns on stocks X and Y.

(7) Identify the direction of interrelationship based on the correlation coefficient.

A. Positive

B. Negative

C. No relationship

D. You cannot tell the direction of interrelationship by the correlation coefficient.

(8) Based on the correlation coefficient, how strongly are the returns on the two stocks related?

A. Very strongly positive

B. Very weakly positive

C. Very weakly negative

D. Almost perfectly negatively correlated E. You cannot tell the strength of interrelationship by the correlation coefficient.

(9) Assume that of your $10,000 portfolio, you invest $6,000 in stock X and $4,000 in stock Y. What is the expected rate of return on your portfolio?

(10)What is the standard deviation of returns on your portfolio?

Use the following scenario for stocks X and Y to answer the questions below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts