Question: Instructions 1) Read the attached case, Financial Statement Analysis for Small Business, A Resource Guide. Focus on how the author uses the ratios to

![The Average Age of Payables [(Average Payable + Net Purchases) x 365] 2016 2015 2014 2013 2012 Long-Term](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2022/07/62c55382057e1_1657099307182.jpg)

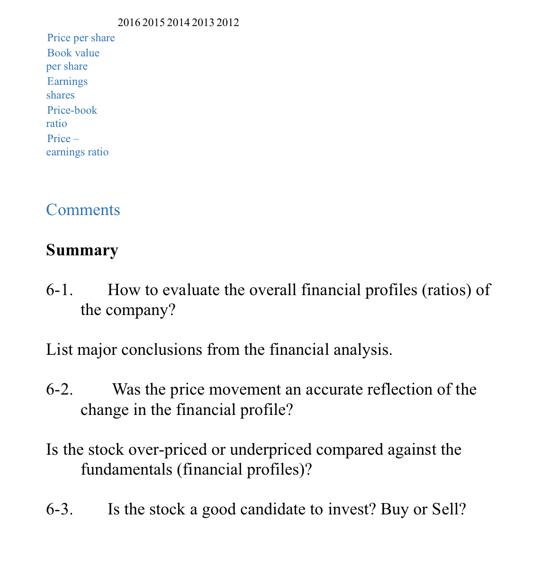

Instructions 1) Read the attached case, "Financial Statement Analysis for Small Business, A Resource Guide." Focus on how the author uses the ratios to interpret the business performance. 2) Select a public listed company with less than $1 billion market cap. You can get a list of stocks from web sources, such as http://www.nasdaq.com/reference/stock- screener.aspx. 3) Collect at least 3 years of financial information from Morningstar.com. Morningstar.com generally will provide 5-year history if it is available. Some ratios need to be calculated. 4) Using the suggested framework below and answer each of the listed questions. Questions Study the financials from the perspectives of different groups: owners, managers, short-term creditors, long-term creditors, and market. For each question, include the related financial ratios and explain the changes over time. Quite often, for fundamental analysis, we need to include comparison against peers or benchmarks. However, due to the limitation of time and resources, it is not required in this assignment. Introduction Owners 1-1. How well is the company doing as an investment? Return on Equity or Investment: ROE Short description of the company background 2016 2015 2014 2013 2012 Comments: ?? 1-2. How well has management employed the company's assets? Return on Asset: ?? 1-3. 2016 2015 2014 2013 2012 List of the sources for the change of Return on equity using DuPont Identity. ROE = (Net profit margin) * (Total asset turnover) * (Equity multiplier) Explain how the three components contributed to the change of return on equity. Net profit margin Total asset turnover Equity multiplier Return on equity 2016 2015 2014 2013 2012 1-4. Comment the track records of free cash flow over the recent years? Using Morningstar.com cash flow statement Free cash flow = Operating cash flow - Capital expenditure Managers 2-1. Are profits high enough, given the level of sales? Net profit margin 2016 2015 2014 2013 2012 2-2. How well are the company's assets being employed to generate sales revenue? The Asset Turnover ratio [Sales Average Total Assets] 2016 2015 2014 2013 2012 2-3. Are receivables coming in too slowly? The Average Collection Period [(Average A/R + Annual Credit Sales) x 365] 2016 2015 2014 2013 2012 2-4. Is too much cash tied up in inventories? The Inventory Turnover [Cost of Goods Sold Expense + Average Inventory] 2-5. What is the breakeven profit? VC Variable cost = cogs = CFC = (Admin + marketing + other operating expense) + (interest expense) R = Revenue SR = Survival revenue = CFC/(1-VC/R) R VC CFC SR Ratio of R/SR 2016 2015 2014 2013 2012 Comments Short-Term Creditors 3-1. Does this customer have sufficient cash or other liquid assets to cover its short-term obligations? The Current Ratio [Current Assets Current Liabilities] The Quick Ratio [Cash + Marketable Securities + A/R + Current Liabilities] 2016 2015 2014 2013 2012 3-2. How quickly does the prospective credit customer pay its bills? The Average Age of Payables [(Average Payable + Net Purchases) x 365] 2016 2015 2014 2013 2012 Long-Term Creditors 4-1. As a potential or present long-term borrower, Debt-to-Equity (D/E) [Total Debt Total Equity] 2016 2015 2014 2013 2012 4-2. Are earnings and cash flow sufficient to cover interest payments and provide for some principal repayment? The Times Interest Earned (TIE) [Income + (Interest + Taxes) + Interest Expense] The Cash Flow to Total Liabilities [Operating Cash Flow Total Liabilities] 2016 2015 2014 2013 2012 Market 5-1. How the financial performance is priced by the financial markets? Price-book ratio = price per share/ book value per share Price-earnings ratios = price per share/ earnings per share Price per share Book value per share Earnings shares Price-book ratio Price- earnings ratio 2016 2015 2014 2013 2012 Comments Summary 6-1. How to evaluate the overall financial profiles (ratios) of the company? List major conclusions from the financial analysis. 6-2. Was the price movement an accurate reflection of the change in the financial profile? Is the stock over-priced or underpriced compared against the fundamentals (financial profiles)? Is the stock a good candidate to invest? Buy or Sell? 6-3.

Step by Step Solution

3.34 Rating (145 Votes )

There are 3 Steps involved in it

Introduction The events surrounding the killing of George Floyd in 2020 ignited widespread protests and discussions about systemic racism and discrimination particularly within law enforcement In resp... View full answer

Get step-by-step solutions from verified subject matter experts