Question: Instructions: 1) use the information in Part A to complete the Payroll Register Table in Part B. Remember to use formulas when there is a

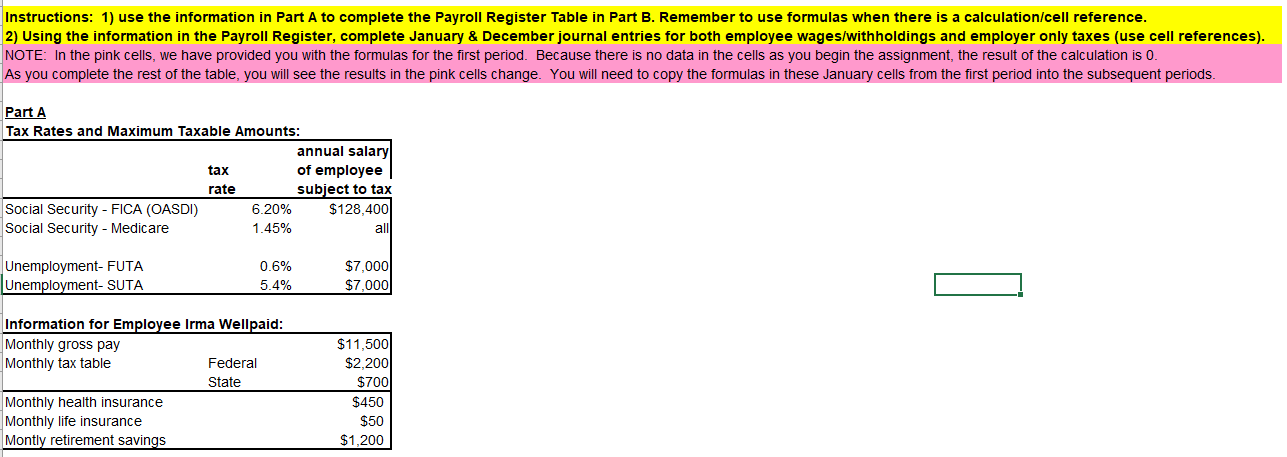

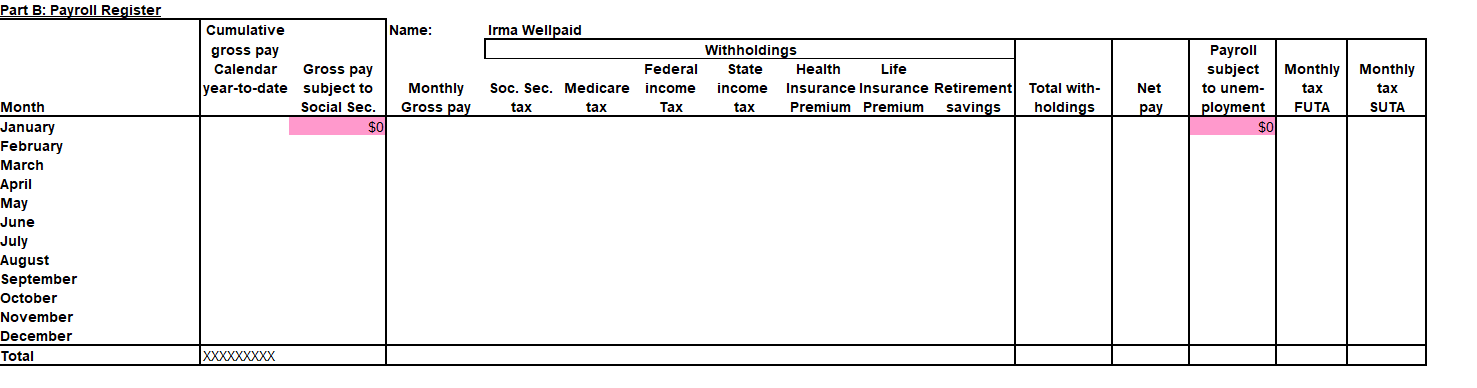

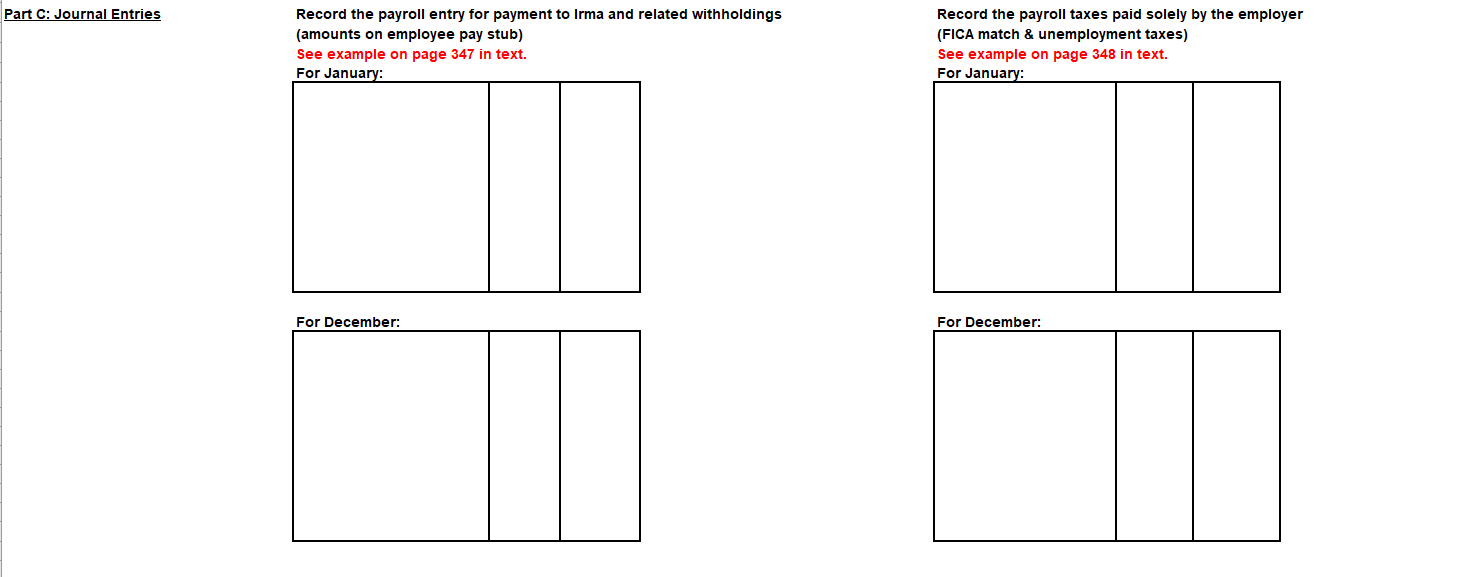

Instructions: 1) use the information in Part A to complete the Payroll Register Table in Part B. Remember to use formulas when there is a calculation/cell reference. 2) Using the information in the Payroll Register, complete January & December journal entries for both employee wages/withholdings and employer only taxes (use cell references). NOTE: In the pink cells, we have provided you with the formulas for the first period. Because there is no data in the cells as you begin the assignment, the result of the calculation is 0. As you complete the rest of the table, you will see the results in the pink cells change. You will need to copy the formulas in these January cells from the first period into the subsequent periods. Part A Tax Rates and Maximum Taxable Amounts: annual salary tax of employee rate subject to tax Social Security - FICA (OASDI) 6.20% $128,400 Social Security - Medicare 1.45% all Unemployment-FUTA Unemployment- SUTA 0.6% 5.4% $7,000 $7,000 Information for Employee Irma Wellpaid: Monthly gross pay Monthly tax table Federal State Monthly health insurance Monthly life insurance Montly retirement savings $11,500 $2,200 $700 $450 $50 $1,200 Part B: Payroll Register Irma Wellpaid Cumulative Name: gross pay Calendar Gross pay year-to-date subject to Monthly Social Sec. Gross pay $0 Withholdings Federal State Health Life income income Insurance Insurance Retirement Tax tax Premium Premium savings Soc. Sec. Medicare tax tax Total with- holdings Net pay Payroll subject to unem- ployment $0 Monthly tax FUTA Monthly tax SUTA Month January February March April May June July August September October November December Total XXXXXXXXX Part C: Journal Entries Record the payroll entry for payment to Irma and related withholdings (amounts on employee pay stub) See example on page 347 in text. For January: Record the payroll taxes paid solely by the employer (FICA match & unemployment taxes) See example on page 348 in text. For January: For December: For December: Instructions: 1) use the information in Part A to complete the Payroll Register Table in Part B. Remember to use formulas when there is a calculation/cell reference. 2) Using the information in the Payroll Register, complete January & December journal entries for both employee wages/withholdings and employer only taxes (use cell references). NOTE: In the pink cells, we have provided you with the formulas for the first period. Because there is no data in the cells as you begin the assignment, the result of the calculation is 0. As you complete the rest of the table, you will see the results in the pink cells change. You will need to copy the formulas in these January cells from the first period into the subsequent periods. Part A Tax Rates and Maximum Taxable Amounts: annual salary tax of employee rate subject to tax Social Security - FICA (OASDI) 6.20% $128,400 Social Security - Medicare 1.45% all Unemployment-FUTA Unemployment- SUTA 0.6% 5.4% $7,000 $7,000 Information for Employee Irma Wellpaid: Monthly gross pay Monthly tax table Federal State Monthly health insurance Monthly life insurance Montly retirement savings $11,500 $2,200 $700 $450 $50 $1,200 Part B: Payroll Register Irma Wellpaid Cumulative Name: gross pay Calendar Gross pay year-to-date subject to Monthly Social Sec. Gross pay $0 Withholdings Federal State Health Life income income Insurance Insurance Retirement Tax tax Premium Premium savings Soc. Sec. Medicare tax tax Total with- holdings Net pay Payroll subject to unem- ployment $0 Monthly tax FUTA Monthly tax SUTA Month January February March April May June July August September October November December Total XXXXXXXXX Part C: Journal Entries Record the payroll entry for payment to Irma and related withholdings (amounts on employee pay stub) See example on page 347 in text. For January: Record the payroll taxes paid solely by the employer (FICA match & unemployment taxes) See example on page 348 in text. For January: For December: For December

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts