Question: INSTRUCTIONS 1. Use the templates given in the course on Blackboard to prepare the journal, ledger, trial balance and the financial statements. 2. The descriptive

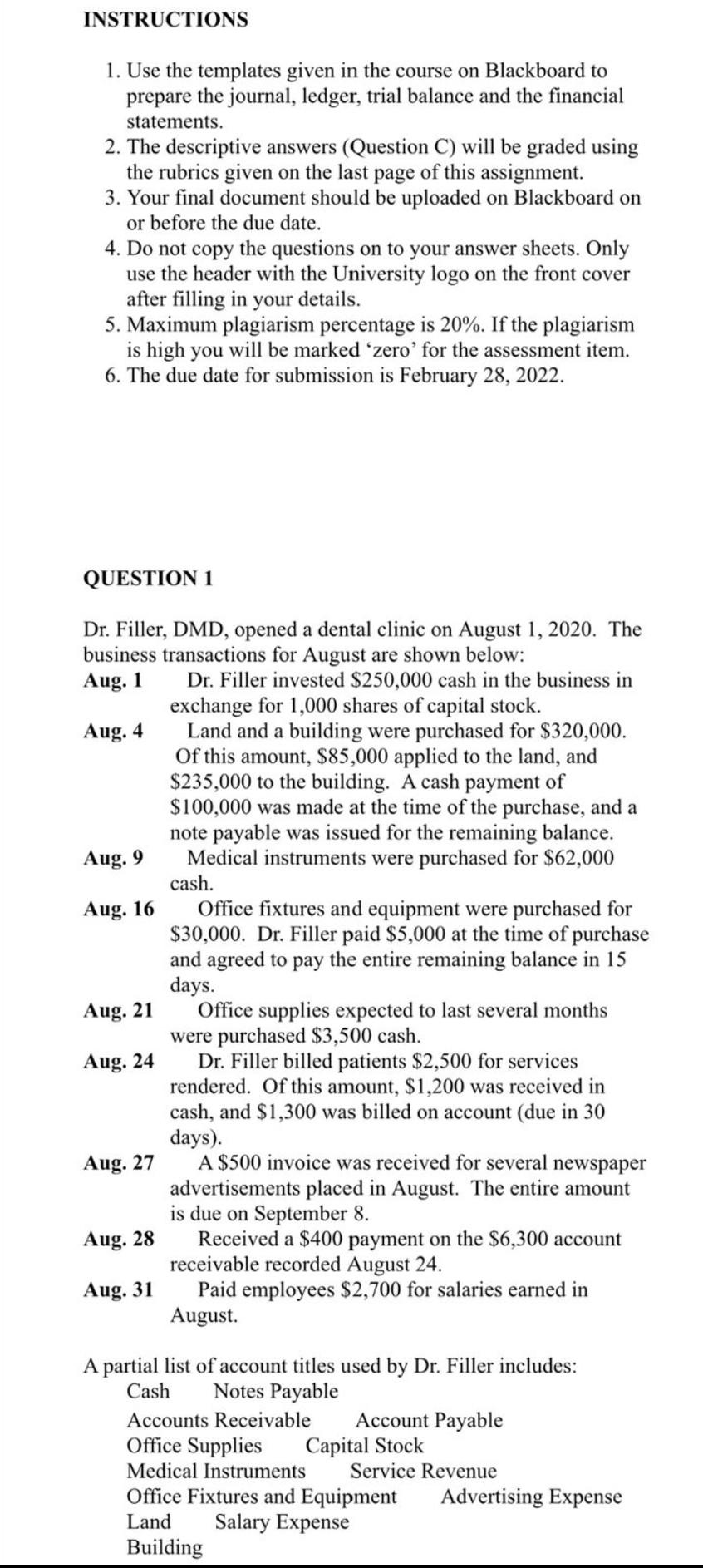

INSTRUCTIONS 1. Use the templates given in the course on Blackboard to prepare the journal, ledger, trial balance and the financial statements. 2. The descriptive answers (Question C) will be graded using the rubrics given on the last page of this assignment. 3. Your final document should be uploaded on Blackboard on or before the due date. 4. Do not copy the questions on to your answer sheets. Only use the header with the University logo on the front cover after filling in your details. 5. Maximum plagiarism percentage is 20%. If the plagiarism is high you will be marked 'zero' for the assessment item. 6. The due date for submission is February 28, 2022. QUESTION 1 Aug. 9 Dr. Filler, DMD, opened a dental clinic on August 1, 2020. The business transactions for August are shown below: Aug. 1 Dr. Filler invested $250,000 cash in the business in exchange for 1,000 shares of capital stock. Aug. 4 Land and a building were purchased for $320,000. Of this amount, $85,000 applied to the land, and $235,000 to the building. A cash payment of $100,000 was made at the time of the purchase, and a note payable was issued for the remaining balance. Medical instruments were purchased for $62,000 cash. Aug. 16 Office fixtures and equipment were purchased for $30,000. Dr. Filler paid $5,000 at the time of purchase and agreed to pay the entire remaining balance in 15 days. Office supplies expected to last several months were purchased $3,500 cash. Aug. 24 Dr. Filler billed patients $2,500 for services rendered. Of this amount, $1,200 was received in cash, and $1,300 was billed on account (due in 30 days). Aug. 27 A $500 invoice was received for several newspaper advertisements placed in August. The entire amount is due on September 8. Aug. 28 Received a $400 payment on the $6,300 account receivable recorded August 24. Aug. 31 Paid employees $2,700 for salaries earned in August Aug. 21 A partial list of account titles used by Dr. Filler includes: Cash Notes Payable Accounts Receivable Account Payable Office Supplies Capital Stock Medical Instruments Service Revenue Office Fixtures and Equipment Advertising Expense Land Salary Expense Building INSTRUCTIONS 1. Use the templates given in the course on Blackboard to prepare the journal, ledger, trial balance and the financial statements. 2. The descriptive answers (Question C) will be graded using the rubrics given on the last page of this assignment. 3. Your final document should be uploaded on Blackboard on or before the due date. 4. Do not copy the questions on to your answer sheets. Only use the header with the University logo on the front cover after filling in your details. 5. Maximum plagiarism percentage is 20%. If the plagiarism is high you will be marked 'zero' for the assessment item. 6. The due date for submission is February 28, 2022. QUESTION 1 Aug. 9 Dr. Filler, DMD, opened a dental clinic on August 1, 2020. The business transactions for August are shown below: Aug. 1 Dr. Filler invested $250,000 cash in the business in exchange for 1,000 shares of capital stock. Aug. 4 Land and a building were purchased for $320,000. Of this amount, $85,000 applied to the land, and $235,000 to the building. A cash payment of $100,000 was made at the time of the purchase, and a note payable was issued for the remaining balance. Medical instruments were purchased for $62,000 cash. Aug. 16 Office fixtures and equipment were purchased for $30,000. Dr. Filler paid $5,000 at the time of purchase and agreed to pay the entire remaining balance in 15 days. Office supplies expected to last several months were purchased $3,500 cash. Aug. 24 Dr. Filler billed patients $2,500 for services rendered. Of this amount, $1,200 was received in cash, and $1,300 was billed on account (due in 30 days). Aug. 27 A $500 invoice was received for several newspaper advertisements placed in August. The entire amount is due on September 8. Aug. 28 Received a $400 payment on the $6,300 account receivable recorded August 24. Aug. 31 Paid employees $2,700 for salaries earned in August Aug. 21 A partial list of account titles used by Dr. Filler includes: Cash Notes Payable Accounts Receivable Account Payable Office Supplies Capital Stock Medical Instruments Service Revenue Office Fixtures and Equipment Advertising Expense Land Salary Expense Building

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts