Question: Instructions: 7. Show any and all work. When asked for an explanation, explain what you do and why (no explanation, no credi 9. This homework

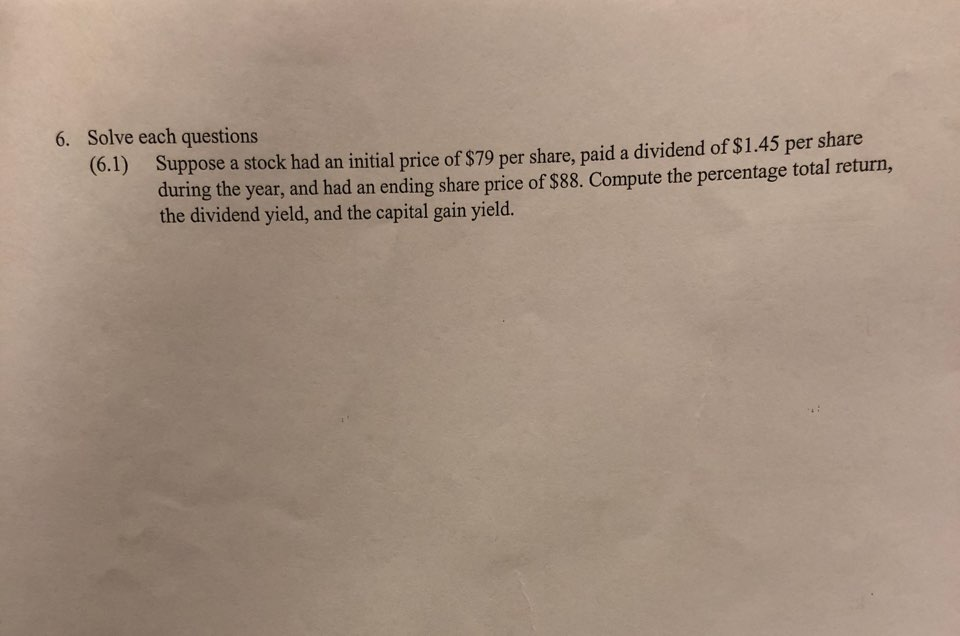

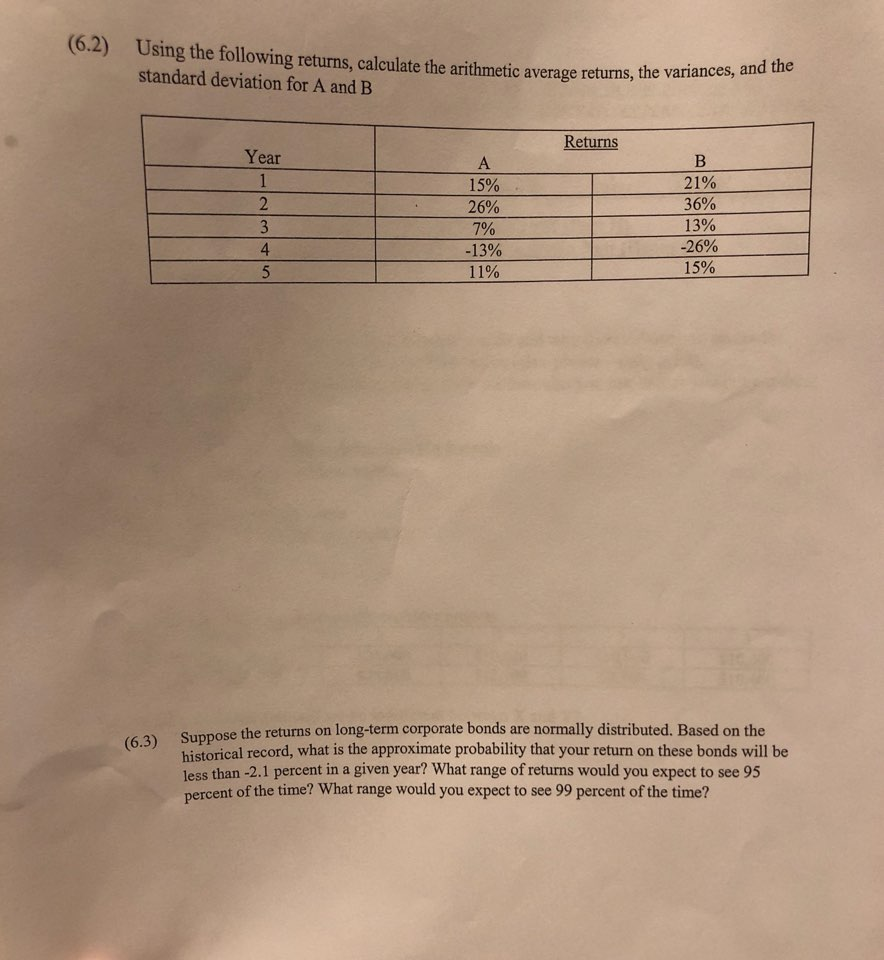

Instructions: 7. Show any and all work. When asked for an explanation, explain what you do and why (no explanation, no credi 9. This homework should be nicely handwritten (no cursive please-only print) 10. Remember to explain all your steps and to show all formulas you use before you put numbers into the equations. First, write the formula Second, substitute the numbers into the formula Third, say what is left to compute Fourth, compute 11. Each question worth the same 12. Please print double-sided and staple it. Solve each questions (6.1) Suppose a stock had an initial price of S79 per share, paid a dividend of $1.45 per share 6. during the year, and had an ending share price of $88. Compute the percentage total return, the dividend yield, and the capital gain yield (6.2) Using the following returns, calculate the arithmetic average returns,the variances, an and the standard deviation for A and B Returns Year 2 4 21% 36% 13% -26% 15% 15% 2690 7% -13% 11% Sunpose the returns on long-term corporate bonds are normally distributed. Based on the historical record, what is the approximate probability that your return on these bonds will be less than -2.1 percent in a given year? What range of returns would you expect to see 95 percent of the time? What range would you expect to see 99 percent of the time? (6.3)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts