Question: INSTRUCTIONS: a) COMPUTE Return on assets Ratio, Profit margin ratio, Quick ratio, Current ratio, and Debt to total assets ratio. b) USING YOUR CALCULATIONS FROM

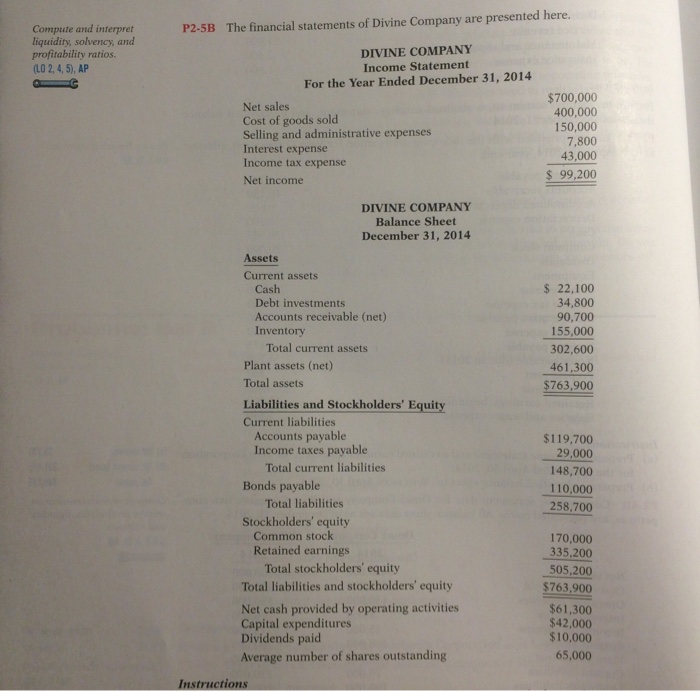

INSTRUCTIONS: a) COMPUTE Return on assets Ratio, Profit margin ratio, Quick ratio, Current ratio, and Debt to total assets ratio. b) USING YOUR CALCULATIONS FROM PART (a) DISCUSS CHANGES FROM 2013 IN LIQUIDITY, SOLVENCY, AND PROFITABILITY.

INSTRUCTIONS: a) COMPUTE Return on assets Ratio, Profit margin ratio, Quick ratio, Current ratio, and Debt to total assets ratio. b) USING YOUR CALCULATIONS FROM PART (a) DISCUSS CHANGES FROM 2013 IN LIQUIDITY, SOLVENCY, AND PROFITABILITY. Compute and interpret liquidity, solvency, and profitability ratios. (LO 2, 4,5), AP P.s The iancdal sasyare presented here DIVINE COMPANY Income Statement For the Year Ended December 31, 2014 Net sales Cost of goods sold Selling and administrative expenses Interest expense Income tax expense Net income $700,000 400,000 150,000 7,800 43,000 $ 99,200 DIVINE COMPANY Balance Sheet December 31, 2014 Assets Current assets s 22,100 34,800 90,700 155,000 302,600 461,300 $763,900 Cash Debt investments Accounts receivable (net) Inventory Total current assets Plant assets (net) Total assets Liabilities and Stockholders' Equity Current liabilities Accounts payable $119,700 29,000 148,700 110,000 258,700 Income taxes payable Total current liabilities Bonds payable Total liabilities Stockholders' equity Common stock 170,000 335,200 505,200 $763,900 Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Net cash provided by operating activities Capital expenditures Dividends paid Average number of shares outstanding $61,300 $42,000 $10,000 65,000 Instructions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts