Question: Instructions (a) Prepare a schedule comparing depreciation for financial reporting and tax purposes. (b) Determine the deferred tax (asset) or liability at the end of

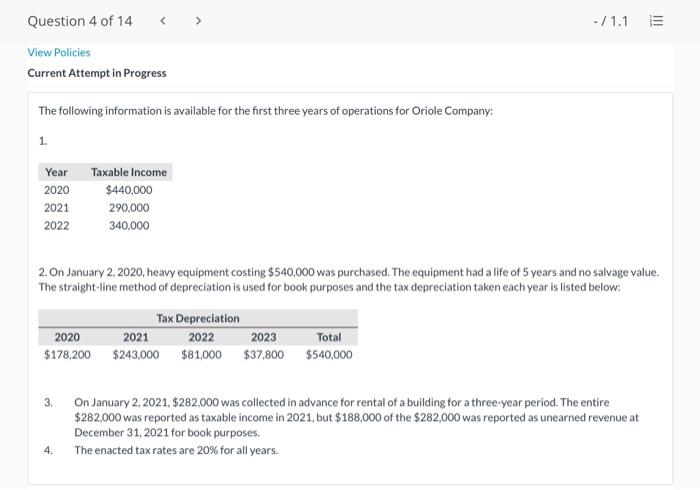

Question 4 of 14 - /1.1 5 View Policies Current Attempt in Progress The following information is available for the first three years of operations for Oriole Company: 1. Year 2020 2021 2022 Taxable income $440,000 290,000 340,000 2. on January 2, 2020, heavy equipment costing $540,000 was purchased. The equipment had a life of 5 years and no salvage value. The straight-line method of depreciation is used for book purposes and the tax depreciation taken each year is listed below: 2020 $178,200 Tax Depreciation 2021 2022 2023 Total $243,000 $81,000 $37,800 $540,000 3. On January 2, 2021, $282,000 was collected in advance for rental of a building for a three-year period. The entire $282,000 was reported as taxable income in 2021, but $188,000 of the $282,000 was reported as unearned revenue at December 31, 2021 for book purposes. The enacted tax rates are 20% for all years. 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts