Question: Instructions a . Prepare an income statement for the year ended December 3 1 , 2 0 2 4 , that includes amounts for gross

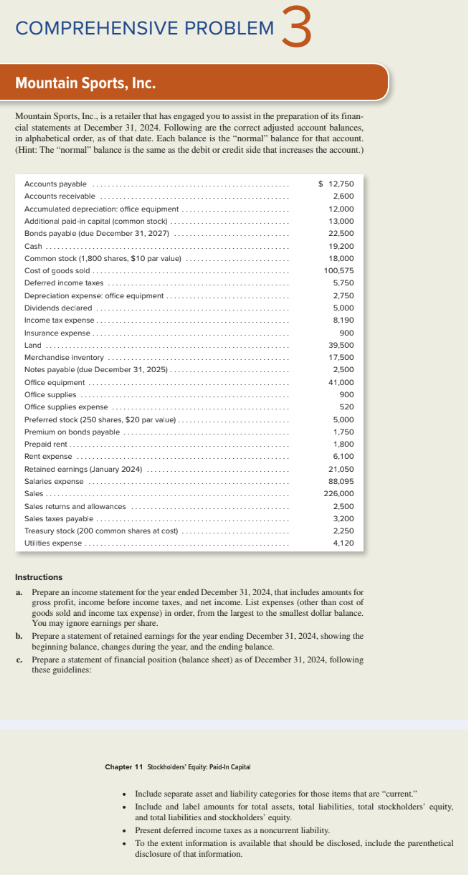

Instructions a Prepare an income statement for the year ended December that includes amounts for gross profit, income before income taxes, and net income. List expenses other than cost of goods sold and income tax expense in order, from the largest to the smallest dollar balance. You may ignore earnings per share. b Prepare a statement of retained earnings for the year ending December showing the beginning balance, changes during the year, and the ending balance. c Prepare a statement of financial position balance sheet as of December following these guidelines: Include separate asset and liability categories for those items that are current Include and label amounts for total assets, total liabilities, total stockholders equity, and total liabilities and stockholders equity. Present deferred income taxes as a noncurrent liability. To the extent information is available that should be disclosed, include the parenthetical disclosure of that information.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock