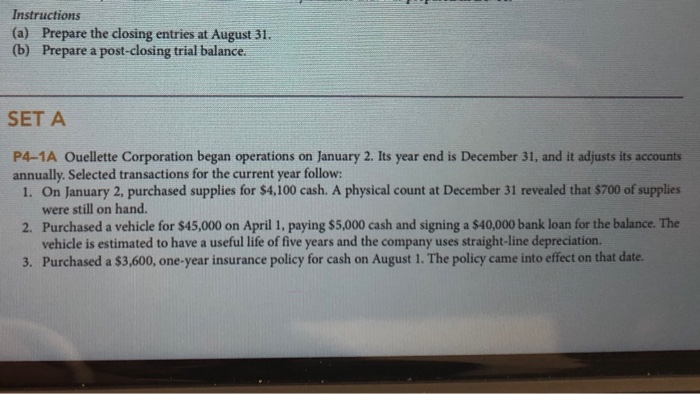

Question: Instructions (a) Prepare the closing entries at August 31. (b) Prepare a post-closing trial balance. SET A P4-1A Ouellette Corporation began operations on January 2.

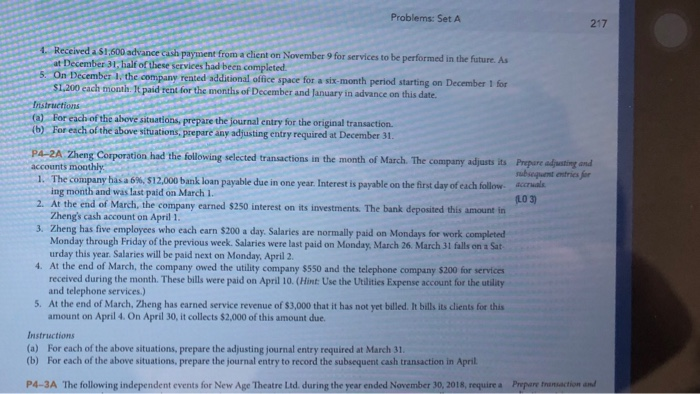

Instructions (a) Prepare the closing entries at August 31. (b) Prepare a post-closing trial balance. SET A P4-1A Ouellette Corporation began operations on January 2. Its year end is December 31, and it adjusts its accounts annually. Selected transactions for the current year follow: 1. On January 2, purchased supplies for $4,100 cash. A physical count at December 31 revealed that $700 of supplies were still on hand. 2. Purchased a vehicle for $45,000 on April 1, paying $5,000 cash and signing a $40,000 bank loan for the balance. The vehicle is estimated to have a useful life of five years and the company uses straight-line depreciation. 3. Purchased a $3,600, one-year insurance policy for cash on August 1. The policy came into effect on that date Problems: Set A Received a 51 500 advance cash payment from a client on November 9 for services to be performed in the future. As at December 31, half of these services had been completed 5. On December 1, the company rented additional office space for a six-month period starting on December 1 for 51,200 each month. It paid tent for the months of December and January in advance on this date. Instructions () For each of the above situations, prepare the journal entry for the original transaction (b) For each of the above situations, prepare any adjusting entry required at December 31 and trics for P4-21 Zheng Corporation had the following selected transactions in the month of March. The company adjusts its Prepared accounts moothly b e 1. The company has a 6% 512,000 bank loan payable due in one year. Interest is payable on the first day of each follow. ing month and was last paid on March 1. LO 3) 2. At the end of March, the company earned $250 interest on its investments. The bank deposited this amount in Zheng's cash account on April 1. 3. Zheng has five employees who each earn $200 a day. Salaries are normally paid on Mondays for work completed Monday through Friday of the previous week. Salaries were last paid on Monday, March 26. March 3 falls on Sat urday this year. Salaries will be paid next on Monday, April 2. 4. At the end of March, the company owed the utility company $550 and the telephone company $200 for services received during the month. These bills were paid on April 10. (Hint: Use the Utilities Expense account for the way and telephone services.) 5. At the end of March, Zheng has earned service revenue of $3,000 that it has not yet billed. It bills its clients for this amount on April 4. On April 30, it collects $2,000 of this amount due. Instructions () For each of the above situations, prepare the adjusting journal entry required at March 31 (b) For each of the above situations, prepare the journal entry to record the subsequent cash transaction in April PA-JA The following independent events for New Age Theatre Lid during the year ended November 30, 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts