Question: (a) Prepare the closing entries (b) Post to Retained Earnings and No. 350 Income Summary accounts. (Use the three-column form.) (c) Prepare a post-closing

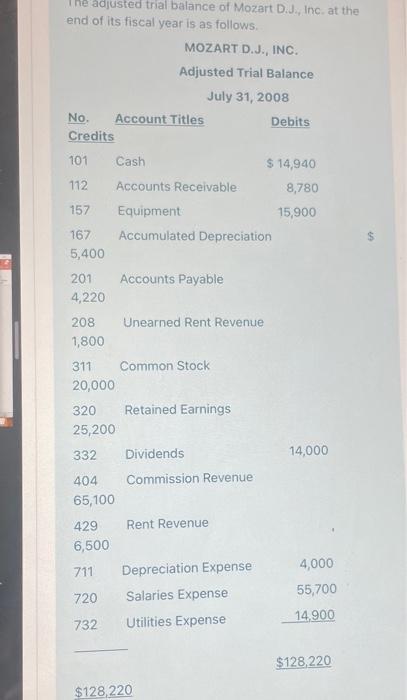

(a) Prepare the closing entries (b) Post to Retained Earnings and No. 350 Income Summary accounts. (Use the three-column form.) (c) Prepare a post-closing trial balance at July 31. (d) Prepare an income statement and a retained earnings statement for the year ended July 31, 2008. There were no issuances of stock during the year. (e) Prepare a classified balance sheet at July 31. he adjusted trial balance of Mozart D.J., Inc. at the end of its fiscal year is as follows. MOZART D.J., INC. Adjusted Trial Balance July 31, 2008 No. Account Titles Credits 101 112 157 167 5,400 201 4,220 208 1,800 311 20,000 429 6,500 711 720 732 Cash Accounts Receivable Equipment Accumulated Depreciation Accounts Payable Unearned Rent Revenue Common Stock 320 Retained Earnings 25,200 332 404 65,100 Dividends Commission Revenue Rent Revenue Depreciation Expense Salaries Expense Utilities Expense Debits $128,220 $ 14,940 8,780 15,900 14,000 4,000 55,700 14,900 $128,220

Step by Step Solution

3.30 Rating (159 Votes )

There are 3 Steps involved in it

a Closing entries 1 Close all revenue accounts to Income Summary Debit Commission Revenue 65100 Debi... View full answer

Get step-by-step solutions from verified subject matter experts