Question: INSTRUCTIONS: (a) Using the data above, compute pension expense for the year 2019 by preparing a pension worksheet. (b) Prepare the journal entry for pension

INSTRUCTIONS:

- (a) Using the data above, compute pension expense for the year 2019 by preparing a pension worksheet.

- (b) Prepare the journal entry for pension expenses for 2019.

- (c) Compute the net gains or losses to be amortized for 2019.

- (d) Prepare the journal entry for pension expense for 2019 assuming that the prior service cost was amended on 1/1/2019 for an additional $300,000.

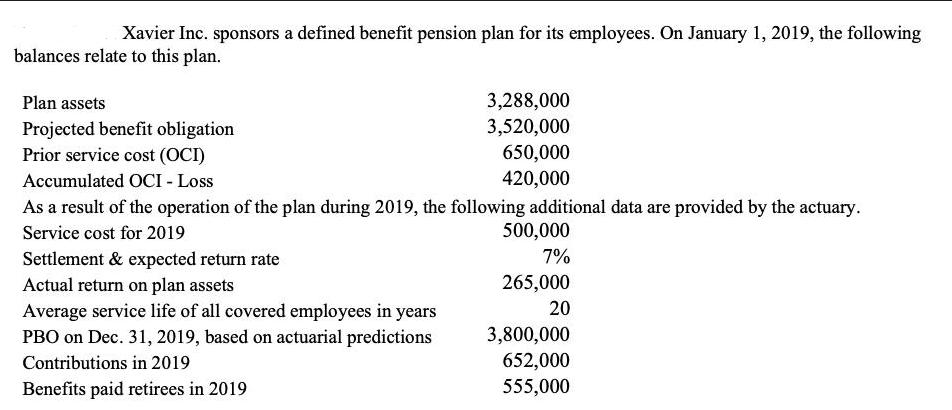

Xavier Inc. sponsors a defined benefit pension plan for its employees. On January 1, 2019, the following balances relate to this plan. Plan assets Projected benefit obligation Prior service cost (OCI) Accumulated OCI - Loss 3,288,000 3,520,000 650,000 420,000 As a result of the operation of the plan during 2019, the following additional data are provided by the actuary. Service cost for 2019 Settlement & expected return rate Actual return on plan assets Average service life of all covered employees in years PBO on Dec. 31, 2019, based on actuarial predictions Contributions in 2019 Benefits paid retirees in 2019 500,000 7% 265,000 20 3,800,000 652,000 555,000

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

a Compute pension expense for the year 2019 by preparing a pension worksheet First calculate the co... View full answer

Get step-by-step solutions from verified subject matter experts