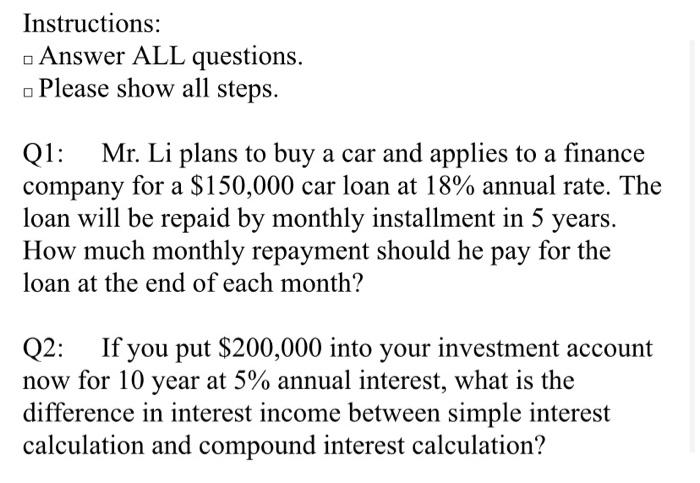

Question: Instructions: Answer ALL questions. Please show all steps. Q1: Mr. Li plans to buy a car and applies to a finance company for a $150,000

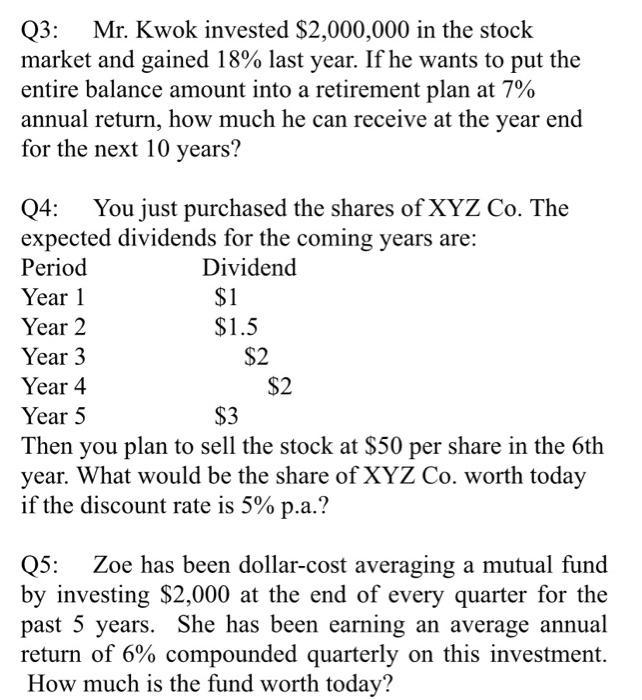

Instructions: Answer ALL questions. Please show all steps. Q1: Mr. Li plans to buy a car and applies to a finance company for a $150,000 car loan at 18% annual rate. The loan will be repaid by monthly installment in 5 years. How much monthly repayment should he pay for the loan at the end of each month? Q2: If you put $200,000 into your investment account now for 10 year at 5% annual interest, what is the difference in interest income between simple interest calculation and compound interest calculation? Q3: Mr. Kwok invested $2,000,000 in the stock market and gained 18% last year. If he wants to put the entire balance amount into a retirement plan at 7% annual return, how much he can receive at the year end for the next 10 years? a Q4: You just purchased the shares of XYZ Co. The expected dividends for the coming years are: Period Dividend Year 1 $1 Year 2 $1.5 Year 3 $2 Year 4 $2 Year 5 $3 Then you plan to sell the stock at $50 per share in the 6th year. What would be the share of XYZ Co. worth today if the discount rate is 5% p.a.? Q5: Zoe has been dollar-cost averaging a mutual fund by investing $2,000 at the end of every quarter for the past 5 years. She has been earning an average annual return of 6% compounded quarterly on this investment. How much is the fund worth today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts