Question: INSTRUCTIONS Answer question one and any other question Question 1 a) On 1 January 2005, Gentle Limited purchased a freehold land and building for GHC240,000

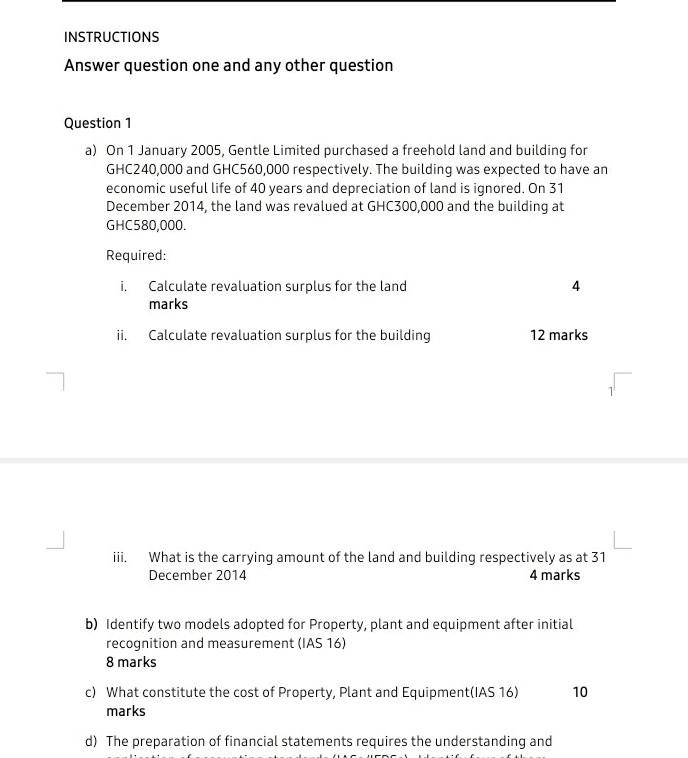

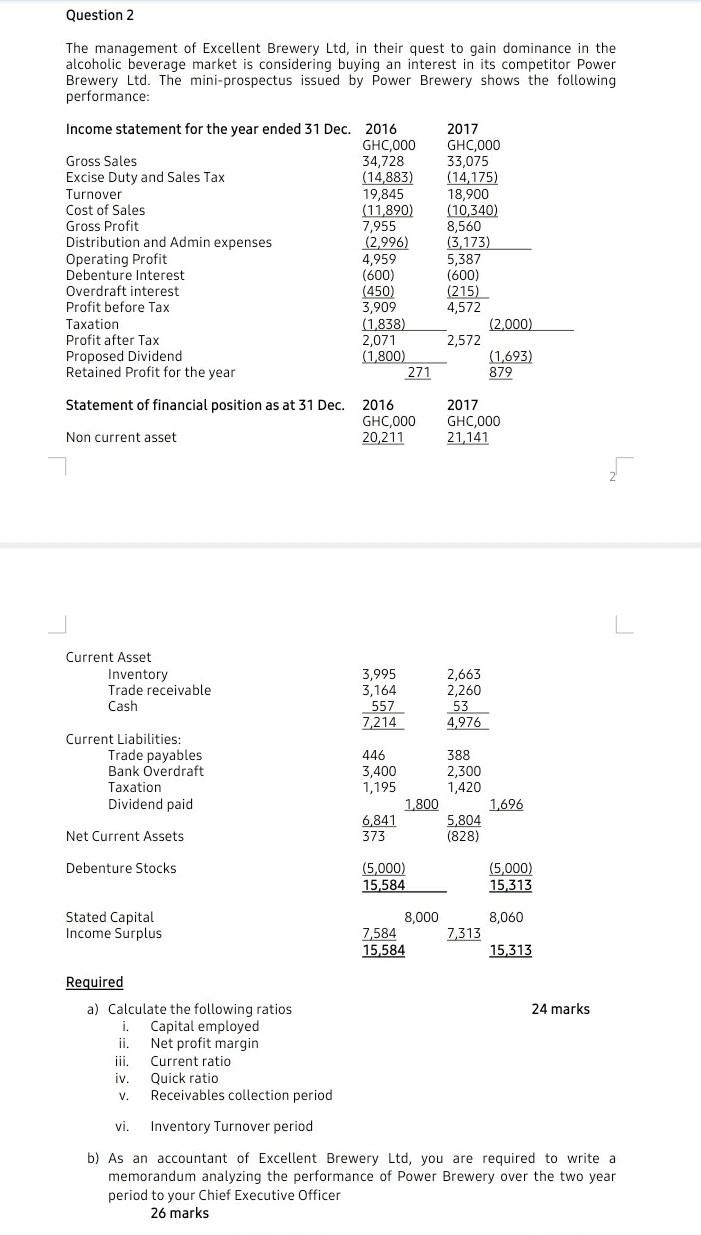

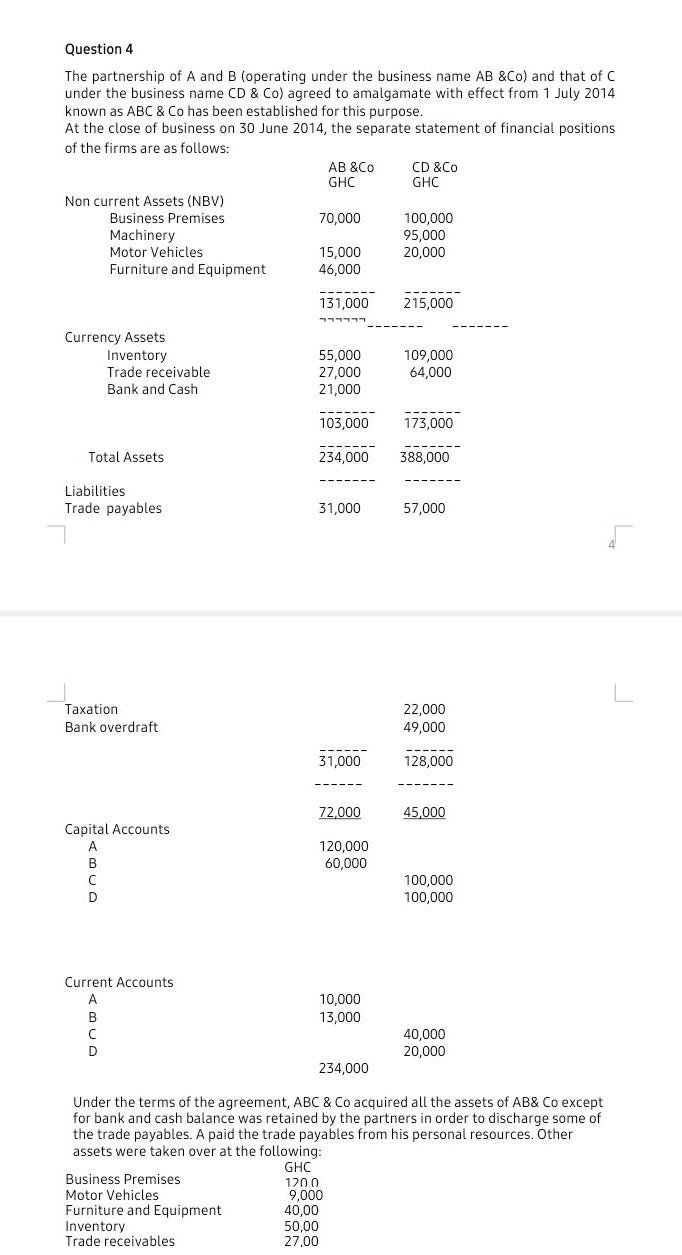

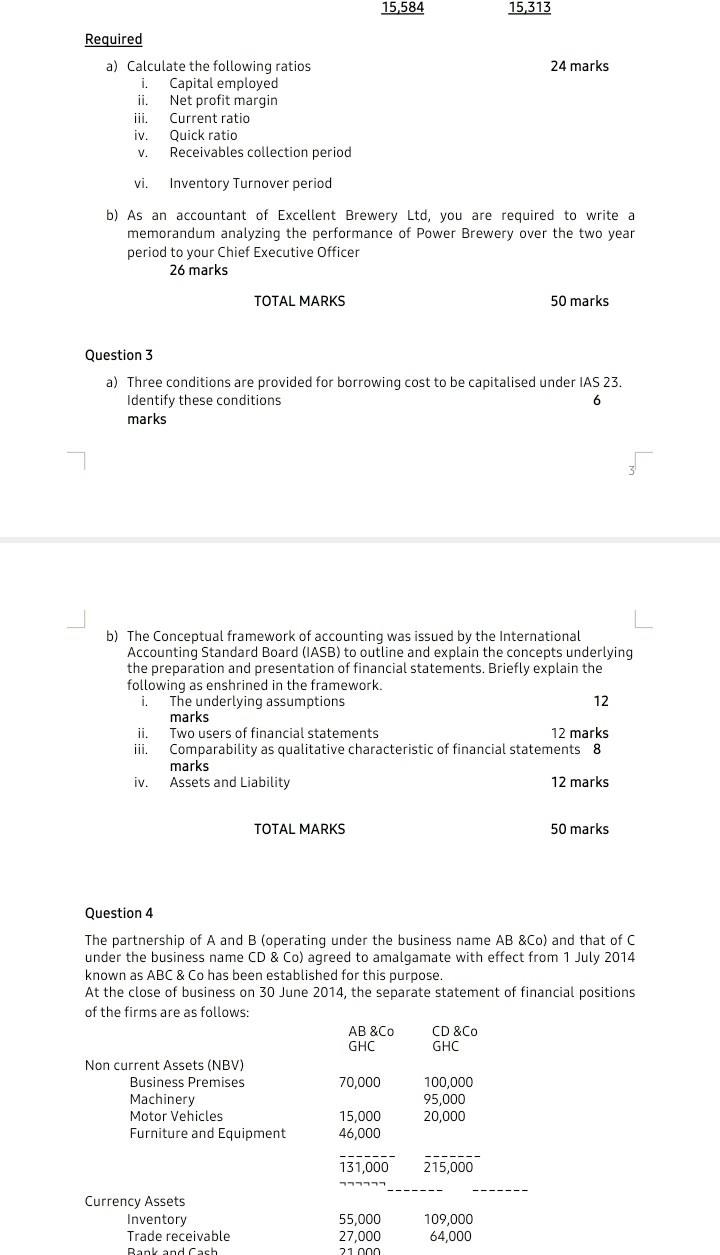

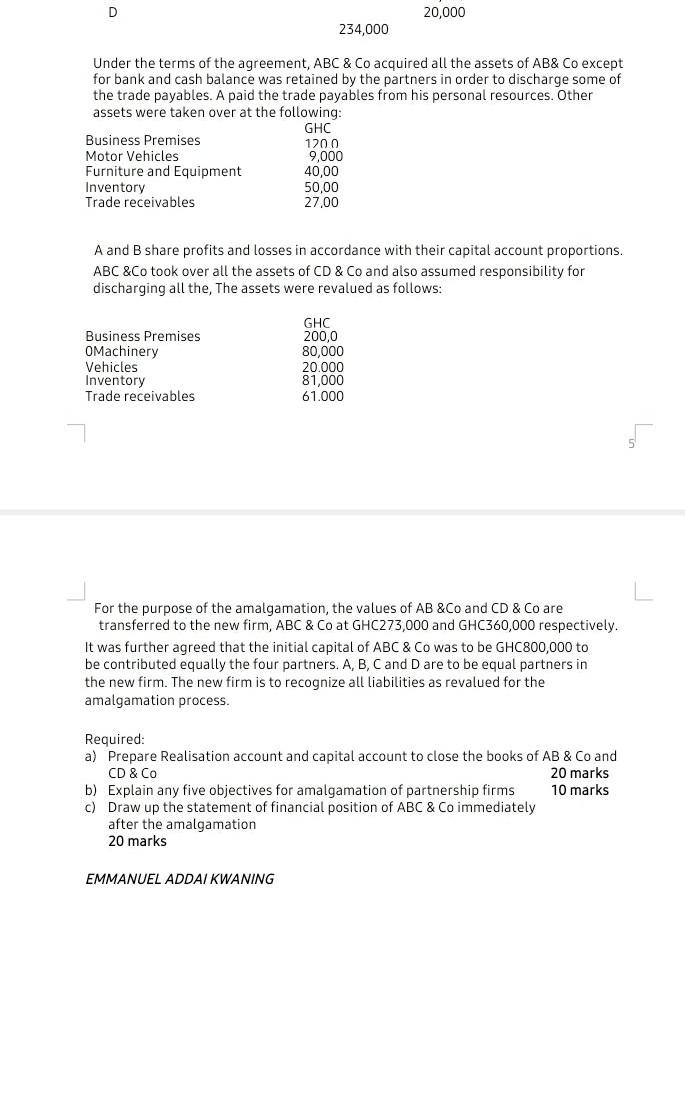

INSTRUCTIONS Answer question one and any other question Question 1 a) On 1 January 2005, Gentle Limited purchased a freehold land and building for GHC240,000 and GHC560,000 respectively. The building was expected to have an economic useful life of 40 years and depreciation of land is ignored. On 31 December 2014, the land was revalued at GHC300,000 and the building at GHC580,000 Required: i. Calculate revaluation surplus for the land marks ii. Calculate revaluation surplus for the building 12 marks 4 What is the carrying amount of the land and building respectively as at 31 December 2014 4 marks b) Identify two models adopted for Property, plant and equipment after initial recognition and measurement (IAS 16) 8 marks c) What constitute the cost of Property, Plant and Equipment(IAS 16) 10 marks d) The preparation of financial statements requires the understanding and Question 2 The management of Excellent Brewery Ltd, in their quest to gain dominance in the alcoholic beverage market is considering buying an interest in its competitor Power Brewery Ltd. The mini-prospectus issued by Power Brewery shows the following performance: 2017 GHC,000 33,075 (14,175) 19,845 18,900 (10,340) 8,560 (2996) Income statement for the year ended 31 Dec. 2016 GHC,000 Gross Sales 34,728 Excise Duty and Sales Tax (14,883) Turnover Cost of Sales (11,890) Gross Profit 7,955 Distribution and Admin expenses Operating Profit 4,959 Debenture Interest (600) Overdraft interest (450) . before Tax 3,909 Taxation (1.838) Profit after Tax 2,071 Proposed Dividend (1 800) Retained Profit for the year 271 (3,173) Profit ber 5,387 (600) (215) 4,572 (2.000) 2,572 (1,693) 879 Statement of financial position as at 31 Dec. 2016 GHC,000 Non current asset 20,211 2017 GHC,000 21,141 Current Asset Inventory Trade receivable Cash 3,995 3,164 557 7,214 2,663 2,260 53 4,976 Current Liabilities: Trade payables Bank Overdraft Taxation Dividend paid 446 388 3,400 2,300 1,195 1,420 1,800 1,696 6,841 5,804 373 (828) Net Current Assets Debenture Stocks (5,000) 15,584 (5,000) 15,313 8,060 Stated Capital Income Surplus 8,000 7,584 15,584 7,313 15,313 24 marks Required a) Calculate the following ratios i. Capital employed ii. Net profit margin Current ratio iv. Quick ratio V. Receivables collection period vi. Inventory Turnover period b) As an accountant of Excellent Brewery Ltd, you required to write a memorandum analyzing the performance of Power Brewery over the two year period to your Chief Executive Officer 26 marks Question 4 The partnership of A and B (operating under the business name AB &Co) and that of C under the business name CD & Co) agreed to amalgamate with effect from 1 July 2014 known as ABC & Co has been established for this purpose. At the close of business on 30 June 2014, the separate statement of financial positions of the firms are as follows: AB &Co CD &Co GHC GHC Non current Assets (NBV) Business Premises 70,000 100,000 Machinery 95,000 Motor Vehicles 15,000 20,000 Furniture and Equipment 46,000 131,000 215,000 Currency Assets Inventory Trade receivable Bank and Cash 55,000 27,000 21,000 109,000 64,000 103,000 173,000 Total Assets 234,000 388,000 Liabilities Trade payables 31,000 57,000 Taxation Bank overdraft 22,000 49,000 31,000 128,000 72.000 45,000 Capital Accounts A B D 120,000 60,000 100,000 100,000 Current Accounts A B C D 10,000 13,000 40,000 20,000 234,000 Under the terms of the agreement, ABC & Co acquired all the assets of AB& Co except for bank and cash balance was retained by the partners in order to discharge some of the trade payables. A paid the trade payables from his personal resources. Other assets were taken over at the following: GHC Business Premises 1200 Motor Vehicles 9,000 Furniture and Equipment 40,00 Inventory 50,00 Trade receivables 27,00 15,584 15,313 Required 24 marks a) Calculate the following ratios Capital employed ii. Net profit margin iii. Current ratio iv. Quick ratio V. Receivables collection period vi. Inventory Turnover period b) As an accountant of Excellent Brewery Ltd, you are required to write a memorandum analyzing the performance of Power Brewery over the two year period to your Chief Executive Officer 26 marks TOTAL MARKS 50 marks Question 3 a) Three conditions are provided for borrowing cost to be capitalised under IAS 23. Identify these conditions 6 marks b) The Conceptual framework of accounting was issued by the International Accounting Standard Board (IASB) to outline and explain the concepts underlying the preparation and presentation of financial statements. Briefly explain the following as enshrined in the framework. i. The underlying assumptions 12 marks ii. Two users of financial statements 12 marks Comparability as qualitative characteristic of financial statements 8 marks iv. Assets and Liability 12 marks TOTAL MARKS 50 marks Question 4 The partnership of A and B (operating under the business name AB &Co) and that of C under the business name CD & Co) agreed to amalgamate with effect from 1 July 2014 known as ABC & Co has been established for this purpose. At the close of business on 30 June 2014, the separate statement of financial positions of the firms are as follows: AB &Co CD &Co GHC GHC Non current Assets (NBV) Business Premises 70,000 100,000 Machinery 95,000 Motor Vehicles 15,000 20,000 Furniture and Equipment 46,000 131,000 215,000 Currency Assets Inventory Trade receivable Bank and cash 55,000 27,000 210 109,000 64,000 D 20,000 234,000 Under the terms of the agreement, ABC & Co acquired all the assets of AB& Co except for bank and cash balance was retained by the partners in order to discharge some of the trade payables. A paid the trade payables from his personal resources. Other assets were taken over at the following: GHC Business Premises 1200 Motor Vehicles 9,000 Furniture and Equipment 40,00 Inventory 50,00 Trade receivables 27,00 A and B share profits and losses in accordance with their capital account proportions. ABC &Co took over all the assets of CD & Co and also assumed responsibility for discharging all the, The assets were revalued as follows: Business Premises OMachinery Vehicles Inventory Trade receivables GHC 200,0 80,000 20.000 81.000 61.000 For the purpose of the amalgamation, the values of AB &Co and CD & Co are transferred to the new firm, ABC & Co at GHC273,000 and GHC360,000 respectively. It was further agreed that the initial capital of ABC & Co was to be GHC800,000 to be contributed equally the four partners. A, B, C and D are to be equal partners in the new firm. The new firm is to recognize all liabilities as revalued for the amalgamation process. Required: a) Prepare Realisation account and capital account to close the books of AB & Co and CD & Co 20 marks b) Explain any five objectives for amalgamation of partnership firms 10 marks c) Draw up the statement of financial position of ABC & Co immediately after the amalgamation 20 marks EMMANUEL ADDAI KWANING INSTRUCTIONS Answer question one and any other question Question 1 a) On 1 January 2005, Gentle Limited purchased a freehold land and building for GHC240,000 and GHC560,000 respectively. The building was expected to have an economic useful life of 40 years and depreciation of land is ignored. On 31 December 2014, the land was revalued at GHC300,000 and the building at GHC580,000 Required: i. Calculate revaluation surplus for the land marks ii. Calculate revaluation surplus for the building 12 marks 4 What is the carrying amount of the land and building respectively as at 31 December 2014 4 marks b) Identify two models adopted for Property, plant and equipment after initial recognition and measurement (IAS 16) 8 marks c) What constitute the cost of Property, Plant and Equipment(IAS 16) 10 marks d) The preparation of financial statements requires the understanding and Question 2 The management of Excellent Brewery Ltd, in their quest to gain dominance in the alcoholic beverage market is considering buying an interest in its competitor Power Brewery Ltd. The mini-prospectus issued by Power Brewery shows the following performance: 2017 GHC,000 33,075 (14,175) 19,845 18,900 (10,340) 8,560 (2996) Income statement for the year ended 31 Dec. 2016 GHC,000 Gross Sales 34,728 Excise Duty and Sales Tax (14,883) Turnover Cost of Sales (11,890) Gross Profit 7,955 Distribution and Admin expenses Operating Profit 4,959 Debenture Interest (600) Overdraft interest (450) . before Tax 3,909 Taxation (1.838) Profit after Tax 2,071 Proposed Dividend (1 800) Retained Profit for the year 271 (3,173) Profit ber 5,387 (600) (215) 4,572 (2.000) 2,572 (1,693) 879 Statement of financial position as at 31 Dec. 2016 GHC,000 Non current asset 20,211 2017 GHC,000 21,141 Current Asset Inventory Trade receivable Cash 3,995 3,164 557 7,214 2,663 2,260 53 4,976 Current Liabilities: Trade payables Bank Overdraft Taxation Dividend paid 446 388 3,400 2,300 1,195 1,420 1,800 1,696 6,841 5,804 373 (828) Net Current Assets Debenture Stocks (5,000) 15,584 (5,000) 15,313 8,060 Stated Capital Income Surplus 8,000 7,584 15,584 7,313 15,313 24 marks Required a) Calculate the following ratios i. Capital employed ii. Net profit margin Current ratio iv. Quick ratio V. Receivables collection period vi. Inventory Turnover period b) As an accountant of Excellent Brewery Ltd, you required to write a memorandum analyzing the performance of Power Brewery over the two year period to your Chief Executive Officer 26 marks Question 4 The partnership of A and B (operating under the business name AB &Co) and that of C under the business name CD & Co) agreed to amalgamate with effect from 1 July 2014 known as ABC & Co has been established for this purpose. At the close of business on 30 June 2014, the separate statement of financial positions of the firms are as follows: AB &Co CD &Co GHC GHC Non current Assets (NBV) Business Premises 70,000 100,000 Machinery 95,000 Motor Vehicles 15,000 20,000 Furniture and Equipment 46,000 131,000 215,000 Currency Assets Inventory Trade receivable Bank and Cash 55,000 27,000 21,000 109,000 64,000 103,000 173,000 Total Assets 234,000 388,000 Liabilities Trade payables 31,000 57,000 Taxation Bank overdraft 22,000 49,000 31,000 128,000 72.000 45,000 Capital Accounts A B D 120,000 60,000 100,000 100,000 Current Accounts A B C D 10,000 13,000 40,000 20,000 234,000 Under the terms of the agreement, ABC & Co acquired all the assets of AB& Co except for bank and cash balance was retained by the partners in order to discharge some of the trade payables. A paid the trade payables from his personal resources. Other assets were taken over at the following: GHC Business Premises 1200 Motor Vehicles 9,000 Furniture and Equipment 40,00 Inventory 50,00 Trade receivables 27,00 15,584 15,313 Required 24 marks a) Calculate the following ratios Capital employed ii. Net profit margin iii. Current ratio iv. Quick ratio V. Receivables collection period vi. Inventory Turnover period b) As an accountant of Excellent Brewery Ltd, you are required to write a memorandum analyzing the performance of Power Brewery over the two year period to your Chief Executive Officer 26 marks TOTAL MARKS 50 marks Question 3 a) Three conditions are provided for borrowing cost to be capitalised under IAS 23. Identify these conditions 6 marks b) The Conceptual framework of accounting was issued by the International Accounting Standard Board (IASB) to outline and explain the concepts underlying the preparation and presentation of financial statements. Briefly explain the following as enshrined in the framework. i. The underlying assumptions 12 marks ii. Two users of financial statements 12 marks Comparability as qualitative characteristic of financial statements 8 marks iv. Assets and Liability 12 marks TOTAL MARKS 50 marks Question 4 The partnership of A and B (operating under the business name AB &Co) and that of C under the business name CD & Co) agreed to amalgamate with effect from 1 July 2014 known as ABC & Co has been established for this purpose. At the close of business on 30 June 2014, the separate statement of financial positions of the firms are as follows: AB &Co CD &Co GHC GHC Non current Assets (NBV) Business Premises 70,000 100,000 Machinery 95,000 Motor Vehicles 15,000 20,000 Furniture and Equipment 46,000 131,000 215,000 Currency Assets Inventory Trade receivable Bank and cash 55,000 27,000 210 109,000 64,000 D 20,000 234,000 Under the terms of the agreement, ABC & Co acquired all the assets of AB& Co except for bank and cash balance was retained by the partners in order to discharge some of the trade payables. A paid the trade payables from his personal resources. Other assets were taken over at the following: GHC Business Premises 1200 Motor Vehicles 9,000 Furniture and Equipment 40,00 Inventory 50,00 Trade receivables 27,00 A and B share profits and losses in accordance with their capital account proportions. ABC &Co took over all the assets of CD & Co and also assumed responsibility for discharging all the, The assets were revalued as follows: Business Premises OMachinery Vehicles Inventory Trade receivables GHC 200,0 80,000 20.000 81.000 61.000 For the purpose of the amalgamation, the values of AB &Co and CD & Co are transferred to the new firm, ABC & Co at GHC273,000 and GHC360,000 respectively. It was further agreed that the initial capital of ABC & Co was to be GHC800,000 to be contributed equally the four partners. A, B, C and D are to be equal partners in the new firm. The new firm is to recognize all liabilities as revalued for the amalgamation process. Required: a) Prepare Realisation account and capital account to close the books of AB & Co and CD & Co 20 marks b) Explain any five objectives for amalgamation of partnership firms 10 marks c) Draw up the statement of financial position of ABC & Co immediately after the amalgamation 20 marks EMMANUEL ADDAI KWANING

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts