Question: Instructions: Answers to be submitted electronically (MS Word, Pdf, or an image of your write up on the paper.) Due date May 25 10pm I.

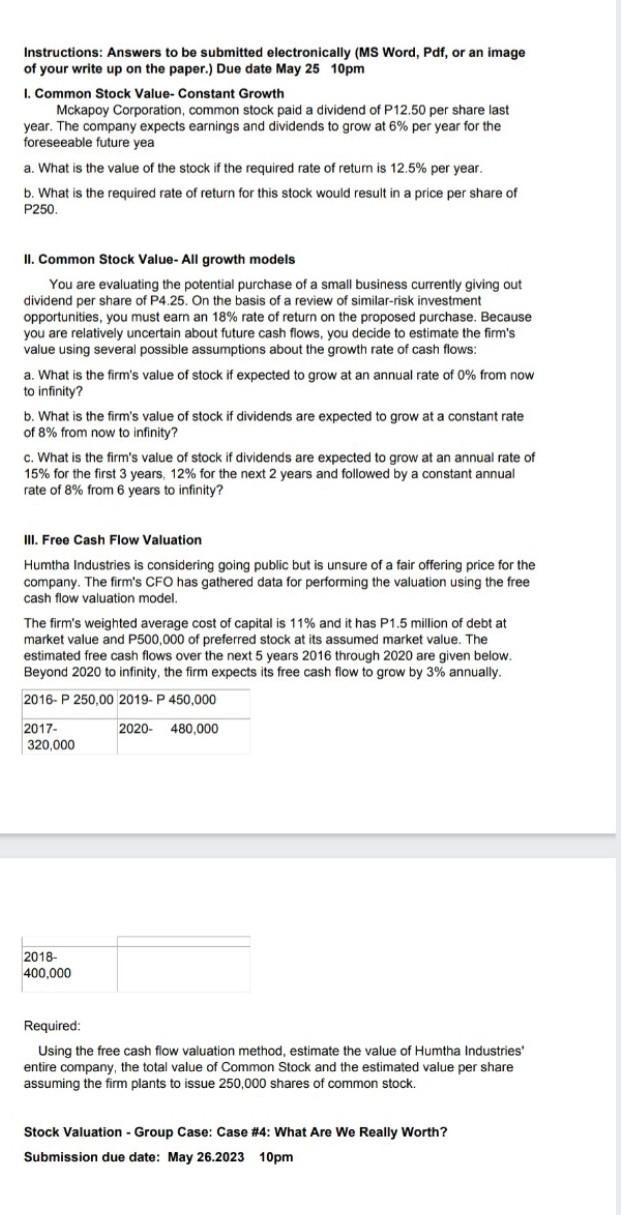

Instructions: Answers to be submitted electronically (MS Word, Pdf, or an image of your write up on the paper.) Due date May 25 10pm I. Common Stock Value- Constant Growth Mckapoy Corporation, common stock paid a dividend of P12.50 per share last year. The company expects earnings and dividends to grow at 6% per year for the foreseeable future yea a. What is the value of the stock if the required rate of retum is 12.5% per year. b. What is the required rate of return for this stock would result in a price per share of P250. II. Common Stock Value- All growth models You are evaluating the potential purchase of a small business currently giving out dividend per share of P4.25. On the basis of a review of similar-risk investment opportunities, you must earn an 18% rate of return on the proposed purchase. Because you are relatively uncertain about future cash flows, you decide to estimate the firm's value using several possible assumptions about the growth rate of cash flows: a. What is the firm's value of stock if expected to grow at an annual rate of 0% from now to infinity? b. What is the firm's value of stock if dividends are expected to grow at a constant rate of 8% from now to infinity? c. What is the firm's value of stock if dividends are expected to grow at an annual rate of 15% for the first 3 years, 12% for the next 2 years and followed by a constant annual rate of 8% from 6 years to infinity? III. Free Cash Flow Valuation Humtha Industries is considering going public but is unsure of a fair offering price for the company. The firm's CFO has gathered data for performing the valuation using the free cash flow valuation model. The firm's weighted average cost of capital is 11% and it has P1.5 million of debt at market value and P500,000 of preferred stock at its assumed market value. The estimated free cash flows over the next 5 years 2016 through 2020 are given below. Beyond 2020 to infinity, the firm expects its free cash flow to grow by 3% annually. Required: Using the free cash flow valuation method, estimate the value of Humtha Industries' entire company, the total value of Common Stock and the estimated value per share assuming the firm plants to issue 250,000 shares of common stock. Stock Valuation - Group Case: Case \#4: What Are We Really Worth? Submission due date: May 26.2023 10pm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts