Question: Instructions: Assignment #4 contains three cases. Please read each case and answer the questions posed in the Required sections. See the course syllabus for additional

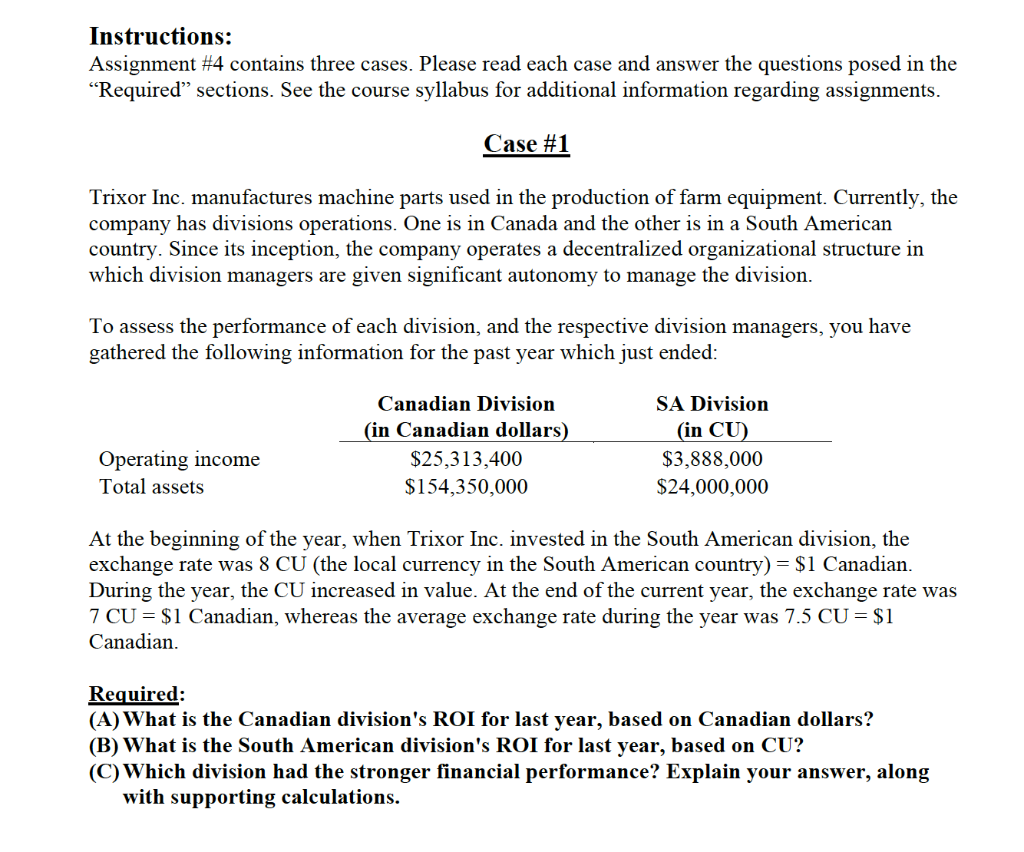

Instructions: Assignment #4 contains three cases. Please read each case and answer the questions posed in the Required sections. See the course syllabus for additional information regarding assignments. Case #1 Trixor Inc. manufactures machine parts used in the production of farm equipment. Currently, the company has divisions operations. One is in Canada and the other is in a South American country. Since its inception, the company operates a decentralized organizational structure in which division managers are given significant autonomy to manage the division. To assess the performance of each division, and the respective division managers, you have gathered the following information for the past year which just ended: Canadian Division (in Canadian dollars) $25,313,400 $154,350,000 SA Division (in CU) $3,888,000 $24,000,000 Operating income Total assets At the beginning of the year, when Trixor Inc. invested in the South American division, the exchange rate was 8 CU (the local currency in the South American country) = $1 Canadian. During the year, the CU increased in value. At the end of the current year, the exchange rate was 7 CU = $1 Canadian, whereas the average exchange rate during the year was 7.5 CU = $1 Canadian. Required: (A) What is the Canadian division's ROI for last year, based on Canadian dollars? (B) What is the South American division's ROI for last year, based on CU? (C)Which division had the stronger financial performance? Explain your answer, along with supporting calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts