Question: Instructions below and material needed thank you! I nventory Methods You have another brilliant idea that you want to propose to your boss. You want

Instructions below and material needed thank you!

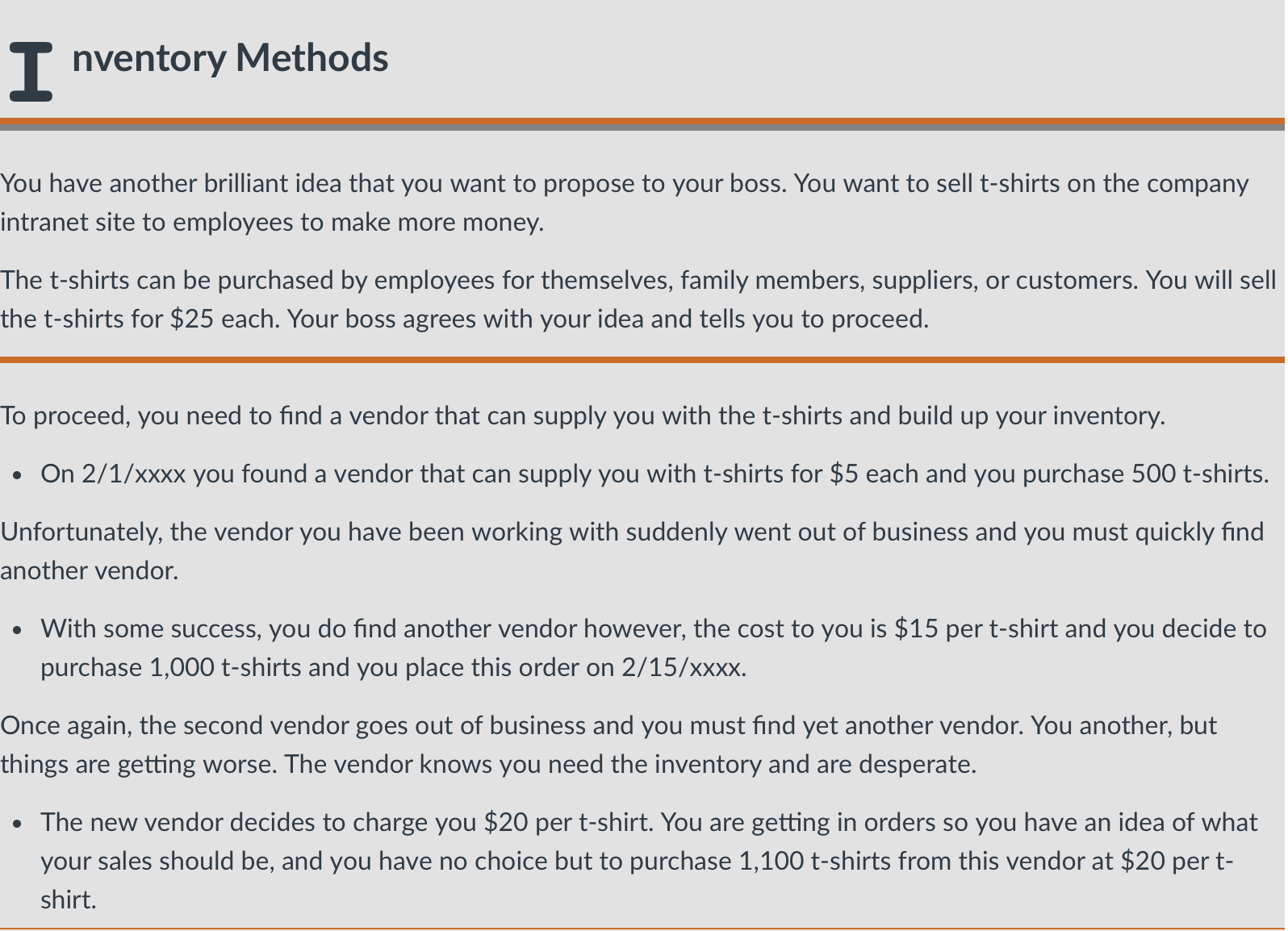

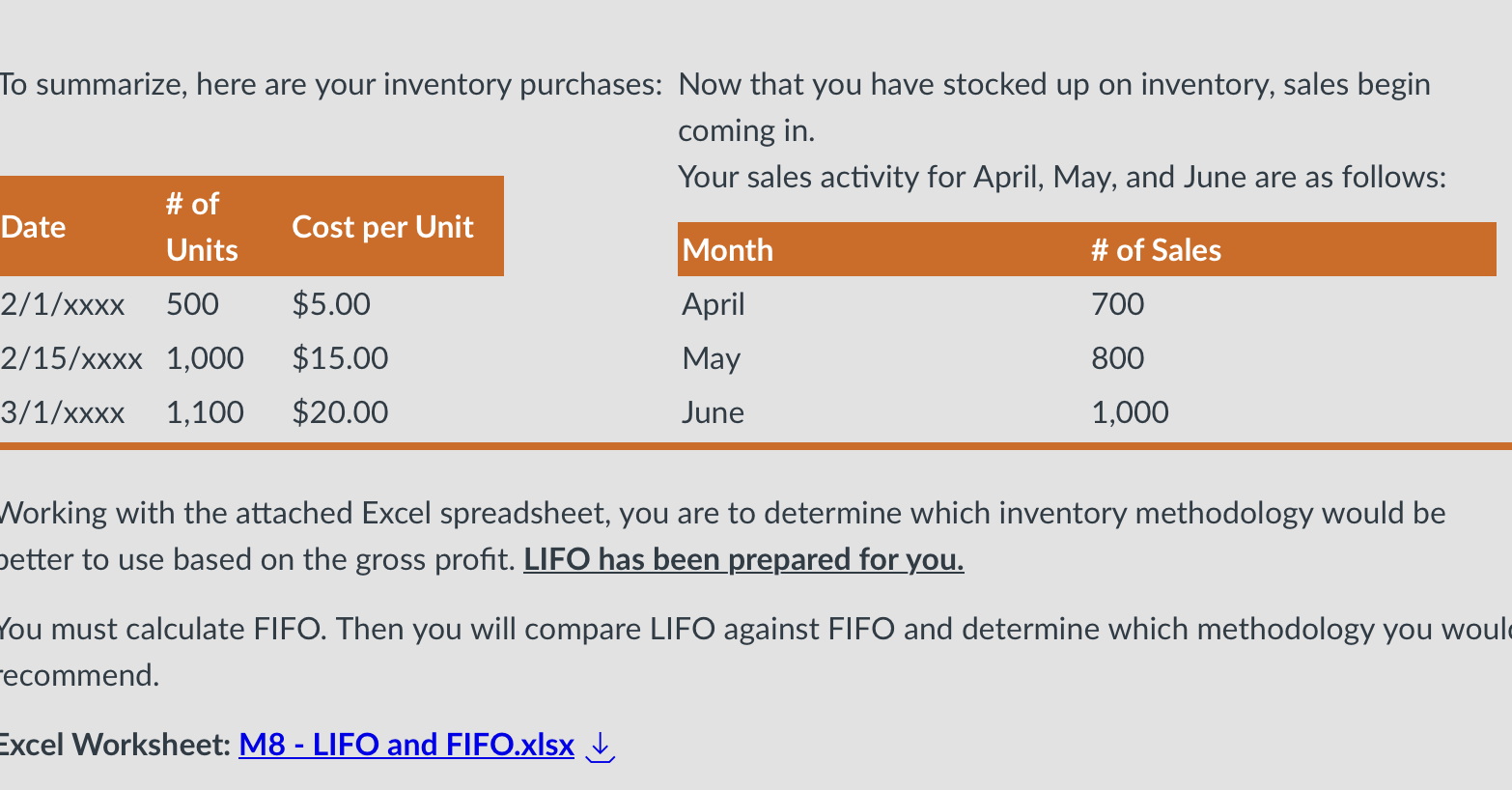

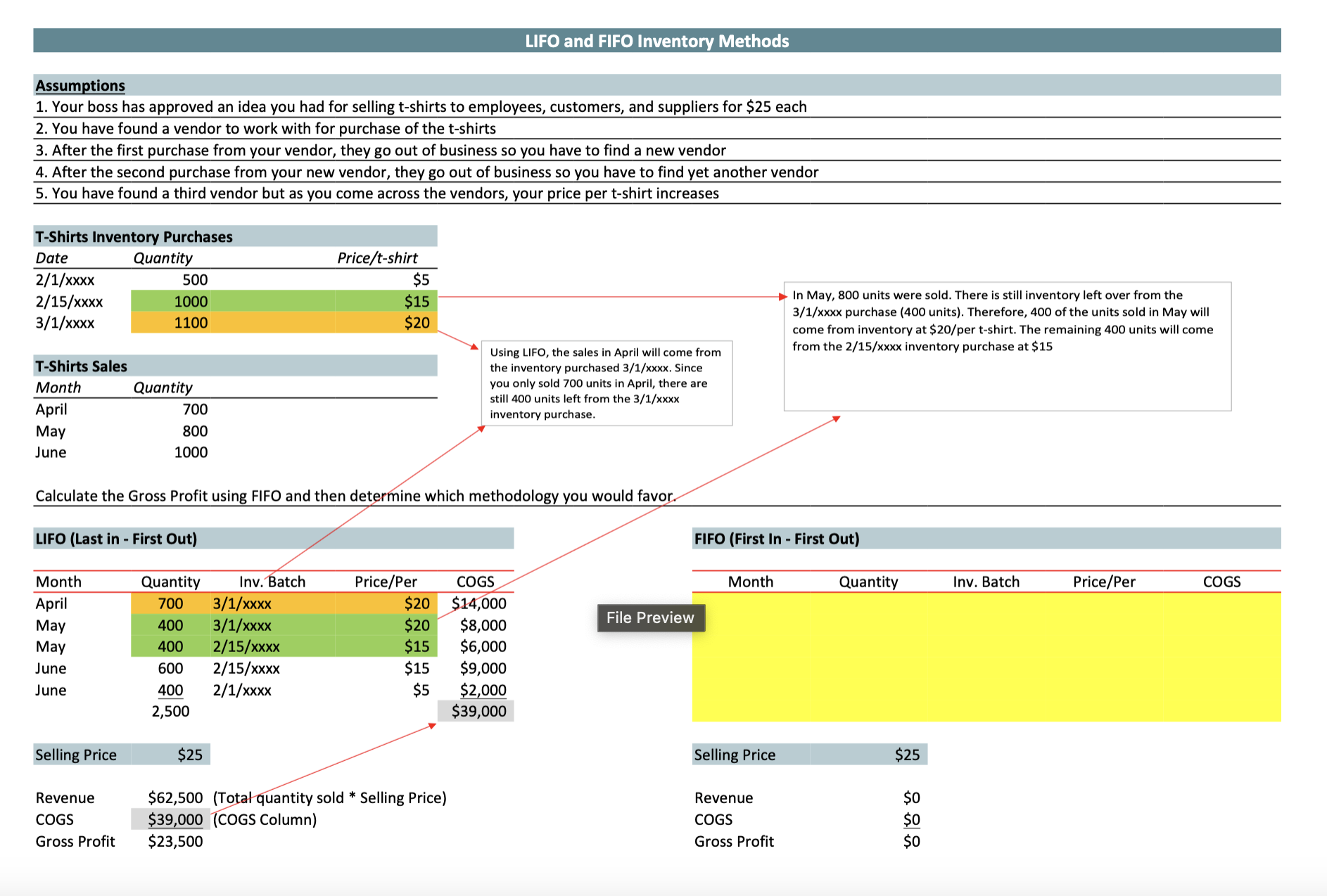

I nventory Methods You have another brilliant idea that you want to propose to your boss. You want to sell t-shirts on the company intranet site to employees to make more money. The t-shirts can be purchased by employees for themselves, family members, suppliers, or customers. You will sell the t-shirts for $25 each. Your boss agrees with your idea and tells you to proceed. To proceed, you need to find a vendor that can supply you with the t-shirts and build up your inventory. e On 2/1/xxxx you found a vendor that can supply you with t-shirts for $5 each and you purchase 500 t-shirts. Unfortunately, the vendor you have been working with suddenly went out of business and you must quickly find another vendor. + With some success, you do find another vendor however, the cost to you is $15 per t-shirt and you decide to purchase 1,000 t-shirts and you place this order on 2/15/xxxx. Once again, the second vendor goes out of business and you must find yet another vendor. You another, but things are getting worse. The vendor knows you need the inventory and are desperate. + The new vendor decides to charge you $20 per t-shirt. You are getting in orders so you have an idea of what your sales should be, and you have no choice but to purchase 1,100 t-shirts from this vendor at $20 per t- shirt. To summarize, here are your inventory purchases: Now that you have stocked up on inventory, sales begin coming in. Your sales activity for April, May, and June are as follows: # of Date Cost per Unit Units Month # of Sales 2/1/xxxx 500 $5.00 April 700 2/15/xxxx 1,000 $15.00 May 800 3/1/xxxx 1,100 $20.00 June 1,000 Working with the attached Excel spreadsheet, you are to determine which inventory methodology would be better to use based on the gross profit. LIFO has been prepared for you. You must calculate FIFO. Then you will compare LIFO against FIFO and determine which methodology you would ecommend. Excel Worksheet: M8 - LIFO and FIFO.xIsx _LIFO and FIFO Inventory Methods Assumptions 1. Your boss has approved an idea you had for selling t-shirts to employees, customers, and suppliers for $25 each 2. You have found a vendor to work with for purchase of the t-shirts 3. After the first purchase from your vendor, they go out of business so you have to find a new vendor 4. After the second purchase from your new vendor, they go out of business so you have to find yet another vendor 5. You have found a third vendor but as you come across the vendors, your price per t-shirt increase T-Shirts Inventory Purchases Date Quantity Price/t-shirt 2/1/XXXX 500 $5 1000 $15 In May, 800 units were sold. There is still inventory left over from the 2/15/xxxx 3/1/xxxx purchase (400 units). Therefore, 400 of the units sold in May will 3/1/xxxx 1100 $20 come from inventory at $20/per t-shirt. The remaining 400 units will come Using LIFO, the sales in April will come from from the 2/15/xxxx inventory purchase at $15 T-Shirts Sales the inventory purchased 3/1/xxxx. Since Month Quantity you only sold 700 units in April, there are still 400 units left from the 3/1/xxxx April 700 inventory purchase. May 300 June 1000 Calculate the Gross Profit using FIFO and then determine which methodology you would favor. LIFO (Last in - First Out) FIFO (First In - First Out) Month Quantity Inv. Batch Price/Per COGS Month Quantity Inv. Batch Price/Per COGS April 700 3/1/xxxx $20 $14,000 File Preview May 400 3/1/xxxx $20 $8,000 May 400 2/15/XXXX $15 $6,000 June 600 2/15/xxxx $15 $9,000 June 400 2/1/xxxx $5 $2,000 2,500 $39,000 Selling Price $25 Selling Price $25 Revenue $62,500 (Total quantity sold * Selling Price) Revenue COGS $39,000 (COGS Column) COGS $0 Gross Profit $23,500 Gross Profit so

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts