Question: *INSTRUCTIONS* Calculate in excel; book has error in problem 2 try to get correct answer on your own. 1. Use the one-period valuation model P

*INSTRUCTIONS*

"Calculate in excel; book has error in problem 2 try to get correct answer on your own."

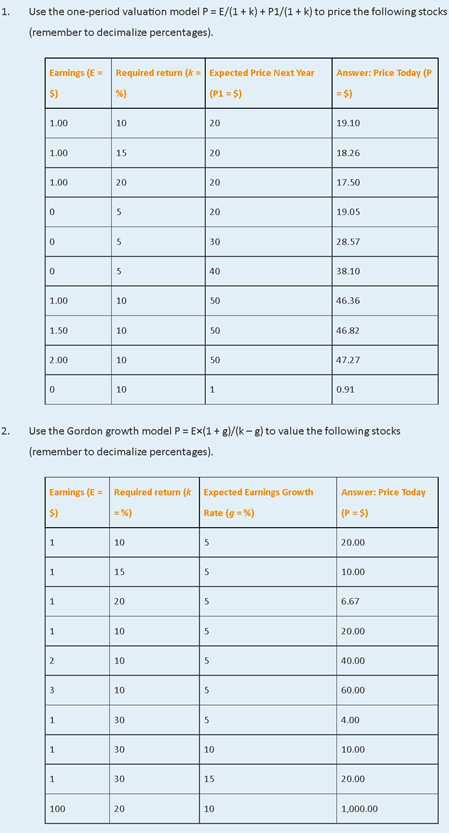

1. Use the one-period valuation model P = E/(1+ k) + P1/(1+ k) to price the following stocks (remember to decimalize percentages). Earnings (E $) Required return (k Expected Price Next Year %) (P1 = $) Answer: Price Today (P = $) 1.00 10 20 19.10 1.00 15 20 18.26 1.00 20 20 17.50 0 5 20 19.05 0 5 30 28.57 0 5 40 38.10 1.00 10 50 46.36 1.50 10 50 46.82 2.00 10 50 47.27 0 10 1 0.91 2. Use the Gordon growth model P = Ex(1+g)/(k - g) to value the following stocks (remember to decimalize percentages). Earnings (E = Required return ( Expected Earnings Growth $) = %) Rate (9 %) Answer: Price Today (P = $) 1 10 5 20.00 1 15 5 10.00 1 20 5 6.67 1 10 5 20.00 2 10 5 40.00 3 10 5 60.00 1 30 5 4.00 1 30 10 10.00 1 30 15 20.00 100 20 10 1,000.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts