Question: - Instructions - Complete the following three tasks relating to Wuycik Co . ' s accounting process at year - end 2 0 2 4

Instructions

Complete the following three tasks relating to Wuycik Cos accounting process at yearend :

a Prepare the journal entries to record the omitted transactions T through T

b Prepare the journal entries to record the omitted adjustments A through A

c Prepare the resulting adjusted trial balance as of December List all the balance sheet accounts and their balances first, followed by all statement of retained earnings accounts and balances; finally list all the income statement accounts and balances. You may need to add accounts to the list based on your work in part a and b

Please observe the following checklist of instructions as you complete this assignment:

Prepare your journal entries and supporting calculations using Excel.

Show how you derived the amounts you present that were not given in the problem.

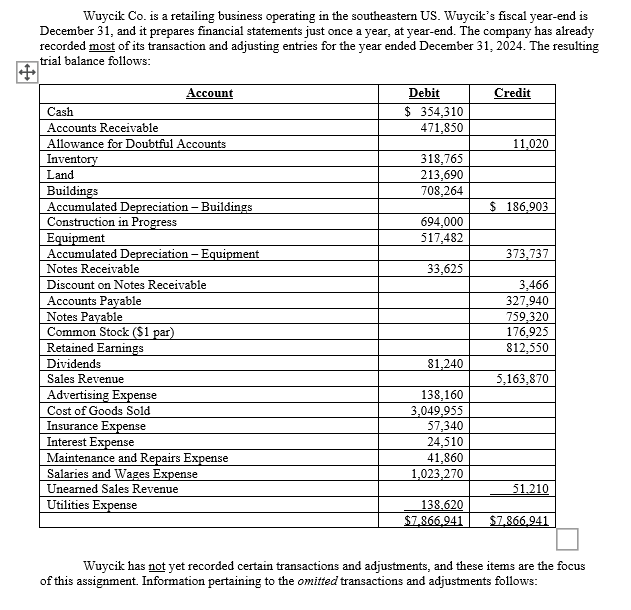

Round all dollar amounts you present in your journal entries to the nearest dollar. Wuycik Co is a retailing business operating in the southeastern US Wuycik's fiscal yearend is December and it prepares financial statements just once a year, at yearend. The company has already recorded most of its transaction and adjusting entries for the year ended December The resulting trial balance follows:

Wuycik has not yet recorded certain transactions and adjustments, and these items are the focus of this assignment. Information pertaining to the omitted transactions and adjustments follows: Omitted Transactions T T:

T On December Wuycik engaged in an exchange of buildings with AAA Co The following information pertains to the building each company owned immediately before the exchange:

In addition, Wuycik received $ cash from AAA. Assume the exchange of buildings has commercial substance.

T On December Wuycik engaged in another exchange of buildings, this one with ZZZ Co The following information pertains to the building each company owned immediately before the exchange:

In addition, Wuycik received $ cash from ZZZ Assume this exchange of buildings lacks commercial substance.

T Wuycik purchased equipment on December The company gave a down payment of $ and signed a year promissory note for the balance due. The note requires Wuycik to make annual payments of $ with the first payment due on December The prevailing market rate of interest for comparable notes is

Omitted Adjustments Al A:

A On January Wuycik received a promissory note from a customer as consideration in an inventory sale transaction. Wuycik recorded the sale, but it has not yet recorded the interest earned on the note during The $ term note requires the customer to pay interest annually each January through The relevant market rate of interest on the issue date was

A Wuycik purchased its buildings in and its equipment in Wuycik uses the straightline depreciation method. For the buildings, the company uses an estimated life of years and no salvage value. For the equipment, it uses an estimated life of years and no salvage value. Note For the depreciation calculations, ignore the new fixed assets Wuycik acquired on December the new buildings and equipment received in T T and T Do consider the old buildings Wuycik gave in T and T though, as the company used these assets for the full year. You should assume that Wuycik computed the depreciation on them for T and T but has not yet recorded the amounts. A The Notes Payable balance of $ results from two loans the company has taken. On May Wuycik took a year, $ loan. The interest on this loan is payable annually, on each April Also, on June Wuycik took a year, $ construction loan see A below The interest on the construction loan is payable on the loan's maturity date, May Note Wuycik already recorded the interest paid on these loans in For this adjustment, consider any accrued interest on the loans at the December reporting date.

A On October Wuycik received $ from a customer as payment in advance for goods to be delivered over the next months. The company recorded the collection in advance into a liability account Unearned Sales Revenue As of December Wuycik has delivered $ of the goods promised to the customer.

A On April Wuycik hired a contractor to construct a new office building. The construction work commenced on June and it is expected to continue through November the estimated completion date. Wuycik made progress payments to the contractor in as follows:

As stated in A above, Wuycik took a year, $ construction loan to help fund the work on this project. The company also has a year, $ loan that is not r

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock