Question: Instructions Comprehensive Problem 1 - 1 A Amonute Tallbear is a single taxpayer ( birthdate May 1 8 , 1 9 9 7 ) living

Instructions

Comprehensive Problem A

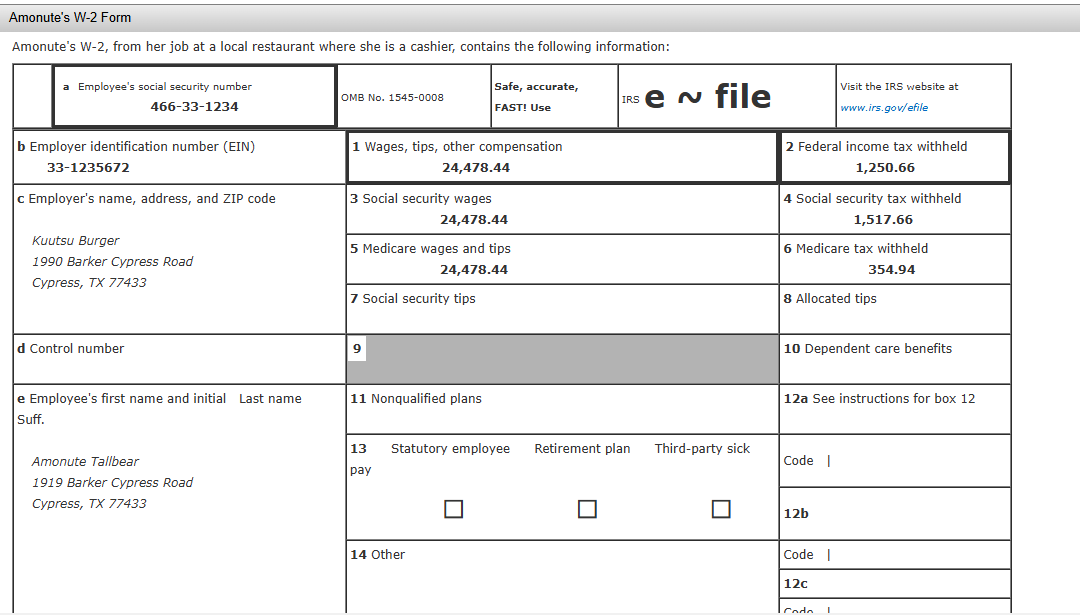

Amonute Tallbear is a single taxpayer birthdate May living at Barker, Cypress Road, Cypress, TX Her Social Security number is For Amonute has no dependents, and received a W from her job at a local restaurant where she is a cashier.

These wages are Amonute's only income for Lastly, Amonute does not own any digital assets.

Required:

Complete Form for Amonute Tallbear for the tax year. If there is an overpayment, she would like a refund.

She wants to donate mathbf$ to the Presidential Election Campaign Fund. The election to donate does not affect tax liability in any way.

Amonute has health care coverage for the full year.

Enter all amounts as positive numbers.

If an amount box requires no entry or the amount is zero, enter

If required, round amounts to the nearest dollar. Amonute's W Form

Amonute's W from her job at a local restaurant where she is a cashier, contains the following information: Form Form Tax Table

Click here to access the tax table for this problem.

The tax table, which is published by the Internal Revenue Service, is used to calculate the tax owed based on a number of variables. To use the tax table, you need to know the taxpayer's taxable income and filing status. Scroll down through the columns for the taxpayer's taxable income the ranges listed are in increments of $ Locate the range that includes the taxpayer's taxable income. Locate the tax figure that corresponds to the taxpayer's filing status.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock