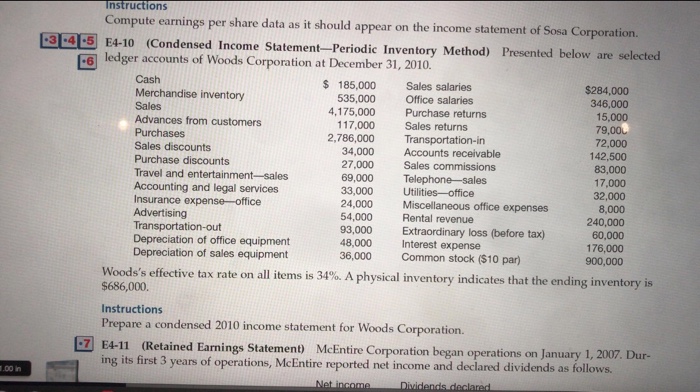

Question: Instructions Compute earnings per share data as it should appear on the income statement of Sosa Corporation. 3 45 E4-10 (Condensed Income Statement-Periodic Inventory Method)

Instructions Compute earnings per share data as it should appear on the income statement of Sosa Corporation. 3 45 E4-10 (Condensed Income Statement-Periodic Inventory Method) Presented below are selected 6 ledger accounts of Woods Corporation at December 31, 2010. Cash Merchandise inventory Sales Advances from customers Purchases Sales discounts Purchase discounts Travel and entertainment-sales Accounting and legal services Insurance expense-office Advertising Transportation-out Depreciation of office equipment Depreciation of sales equipment $ 185,000 Sales salaries Office salaries Purchase returns Sales returns $284,000 535,000 346,000 15,000 79,00 72,000 142,500 83,000 17,000 32,000 8,000 240,000 60,000 176,000 900,000 4.175,000 117,000 2,786,000 Transportation-in 34,000 Accounts receivable 27,000 Sales commissions 69,000 Telephone-sales 33,000 Utilities-office 24,000 Miscellaneous office expenses 54,000 Rental revenue 93,000 Extraordinary loss (before tax) 48,000 Interest expense 36,000 Common stock ($10 par) Woods's effective tax rate on all items is 34%. A physical inventory indicates that the ending inventory $686,000. Instructions Prepare a condensed 2010 income statement for Woods Corporation. 7 E4-11 (Retained Earm ings Statement) McEntire Corporation began operations on January 1, 2007. Dur- ing its first 3 years of operations, McEntire reported net income and declared dividends as follows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts