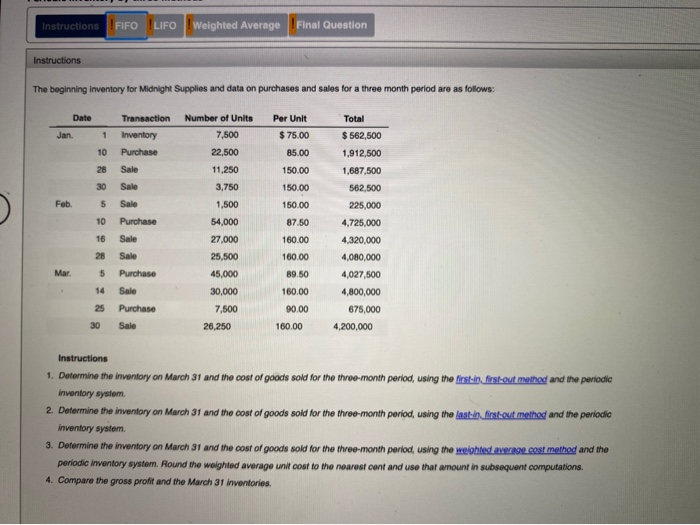

Question: Instructions FIFO LIFO Weighted Average Final Question Instructions The beginning inventory for Midnight Supplies and data on purchases and sales for a three month period

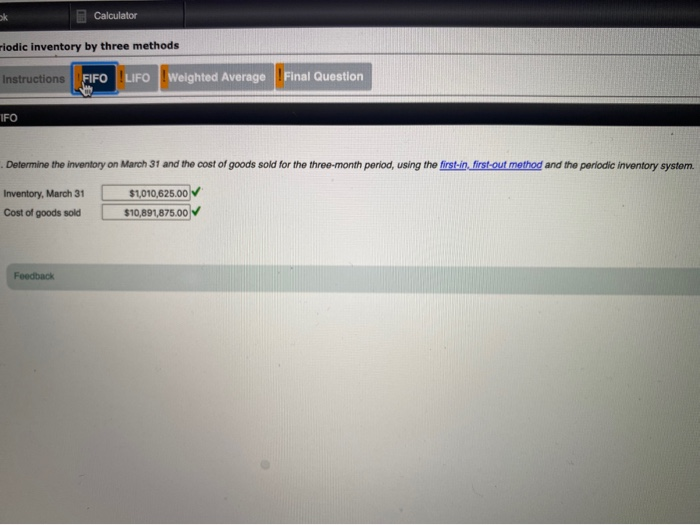

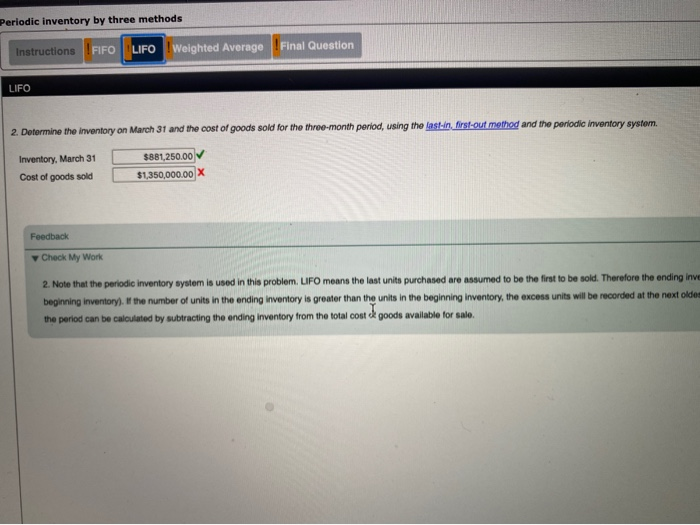

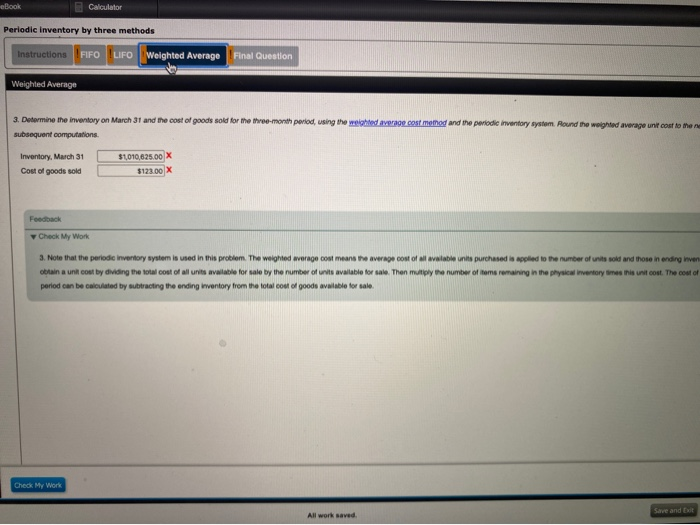

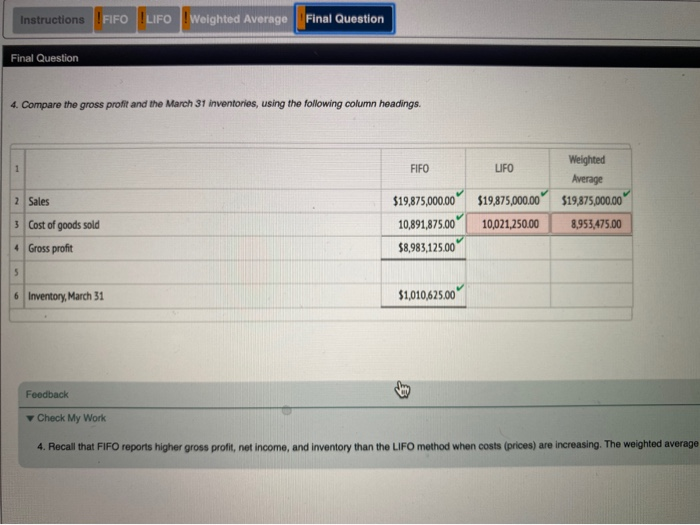

Instructions FIFO LIFO Weighted Average Final Question Instructions The beginning inventory for Midnight Supplies and data on purchases and sales for a three month period are as follows: Total Date Jan 1 10 28 30 5 10 18 28 Transaction Inventory Purchase Sale Sale Sale Purchase Sale Sale Purchase Sale Purchase Sale Number of Units 7,500 22,500 11.250 3,750 1,500 54,000 27,000 25,500 45,000 30,000 7,500 26.250 Per Unit $ 75.00 85.00 150.00 150.00 150.00 87.50 160.00 160.00 89.50 160.00 90.00 160.00 $ 562,500 1,912,500 1,687,500 562,500 225,000 4,725,000 4,320,000 4,080,000 4,027,500 4,800,000 675,000 4,200,000 14 25 30 Instructions 1. Determine the inventory on March 31 and the cost of goods sold for the three month period, using the first in Erst method and the periodic inventory system 2. Determine the inventory on March 31 and the cost of goods sold for the three-month period, using the last first method and the periodic inventory system. 3. Determine the inventory on March 31 and the cost of poods sold for the three-month period using the weighted to me and the periode inventory system. Round the weighted average unit cost to the nearest cent and use that amount in subsequent computations 4. Compare the gross profit and the March 31 inventories. Calculator riodic inventory by three methods Instructions FIFO LIFO Weighted Average Final Question 1FO Determine the inventory on March 31 and the cost of goods sold for the three-month period, using the first-in. first-out method and the periodic inventory system. Inventory, March 31 Cost of goods sold $1,010,625.00 $10,891,875.00 Feedback Periodic inventory by three methods Instructions FIFO LIFO Weighted Average Final Question LIFO 2. Determine the inventory on March 31 and the cost of goods sold for the three-month period, using the last-In, first-out method and the periodic inventory system L Inventory, March 31 Cost of goods sold $881.250,00 $1,350,000.00 X Feedback Check My Work 2. Note that the periodic inventory system is used in this problem. UFO means the last units purchased are assumed to be the first to be sold. Therefore the ending in beginning inventory), the number of units in the ending inventory is greater than the units in the beginning inventory, the excess units will be recorded at the next olde the period can be calculated by subtracting the ending inventory from the total cost d goods available for sale Calculator Periodic Inventory by three methods Instructions FIFO UFO Weighted Average Final Question Weighted Average 3. Determine the inventory on March 31 and the cost of goods sold for the three month period, using the weighted average cost method and the periode inventory system found the weighted average unit cost to the subsequent computations Invertory, March 31 Cost of goods sold 31010.625.00 X 1123.00 X Check My Work O 3. Note that the periodo inventory system is used in this problem. The weighted average cost means the average cost of all available units purchased is applied to the number of its sold and those in ending inver n a un cout by dividing the total cost of all units awatile for sale by the number of units available for sale. Then t he number of tomo ning in the p e rsones .com. The con el period can be called by stracting the ending inwentory from the total cost of goods available for sale Instructions FIFO LIFO Weighted Average Final Question Final Question 4. Compare the gross profit and the March 31 inventories, using the following column headings FIFO LIFO 2 Sales Weighted Average $19,875,000.00 8,953,475.00 $19,875,000.00 10,891,875.00 $8,983,125.00 $19,875,000.00 10,021,250.00 Cost of goods sold Gross profit Inventory, March 31 $1,010,625.00 Feedback Check My Work 4. Recall that FIFO reports higher gross profit, net income, and inventory than the LIFO method when costs (prices) are increasing. The weighted average

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts