Question: Instructions : Final answer must show work and Final answers should be either in dollars or percentage format to 2 decimal places QUESTION 1 Navarro,

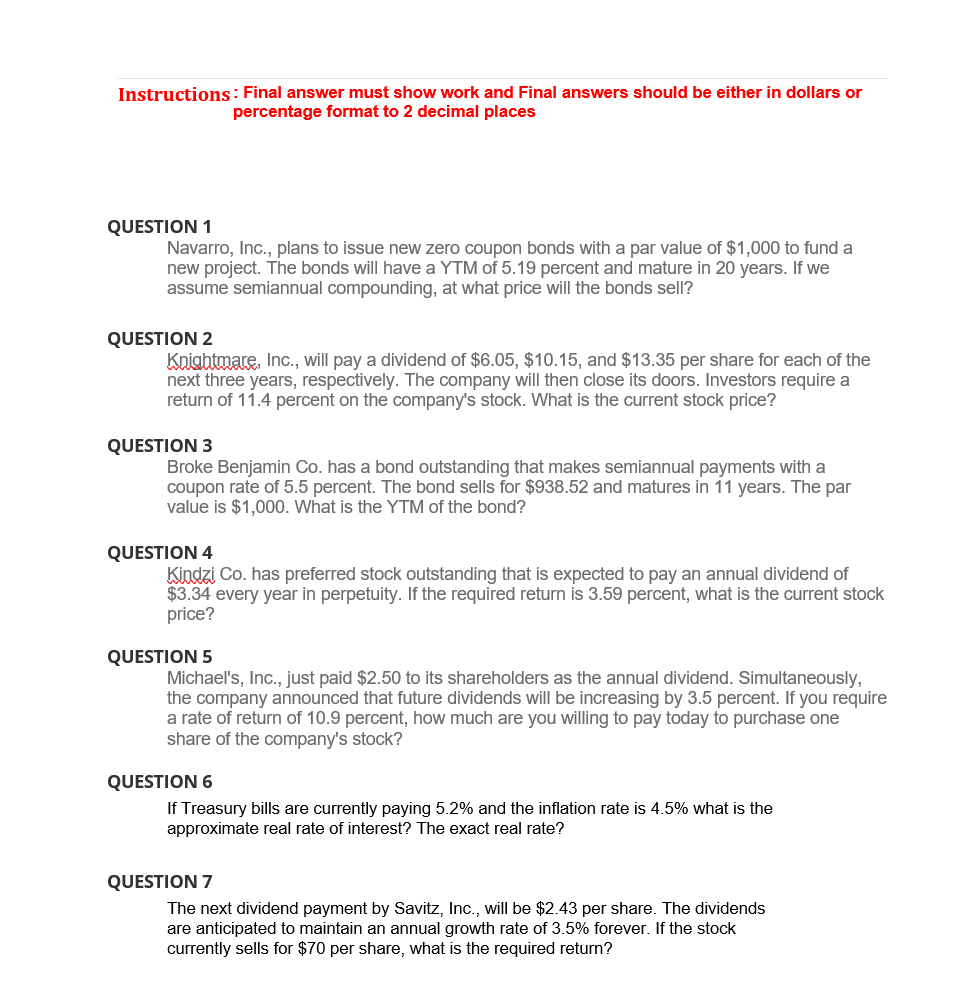

Instructions : Final answer must show work and Final answers should be either in dollars or percentage format to 2 decimal places QUESTION 1 Navarro, Inc., plans to issue new zero coupon bonds with a par value of $1,000 to fund a new project. The bonds will have a YTM of 5.19 percent and mature in 20 years. If we assume semiannual compounding, at what price will the bonds sell? QUESTION 2 Knightmare, Inc., will pay a dividend of $6.05,$10.15, and $13.35 per share for each of the next three years, respectively. The company will then close its doors. Investors require a return of 11.4 percent on the company's stock. What is the current stock price? QUESTION 3 Broke Benjamin Co. has a bond outstanding that makes semiannual payments with a coupon rate of 5.5 percent. The bond sells for $938.52 and matures in 11 years. The par value is $1,000. What is the YTM of the bond? QUESTION 4 Kindzi Co. has preferred stock outstanding that is expected to pay an annual dividend of $3.34 every year in perpetuity. If the required return is 3.59 percent, what is the current stock price? QUESTION 5 Michael's, Inc., just paid $2.50 to its shareholders as the annual dividend. Simultaneously, the company announced that future dividends will be increasing by 3.5 percent. If you require a rate of return of 10.9 percent, how much are you willing to pay today to purchase one share of the company's stock? QUESTION 6 If Treasury bills are currently paying 5.2% and the inflation rate is 4.5% what is the approximate real rate of interest? The exact real rate? QUESTION 7 The next dividend payment by Savitz, Inc., will be $2.43 per share. The dividends are anticipated to maintain an annual growth rate of 3.5% forever. If the stock currently sells for $70 per share, what is the required return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts