Question: Instructions : Find data and complete the project with correct answers. DONOT JUST SHOW HOW TO SOLVE. Consider a portfolio with four stocks Google (

Instructions : Find data and complete the project with correct answers. DONOT JUST SHOW HOW TO SOLVE.

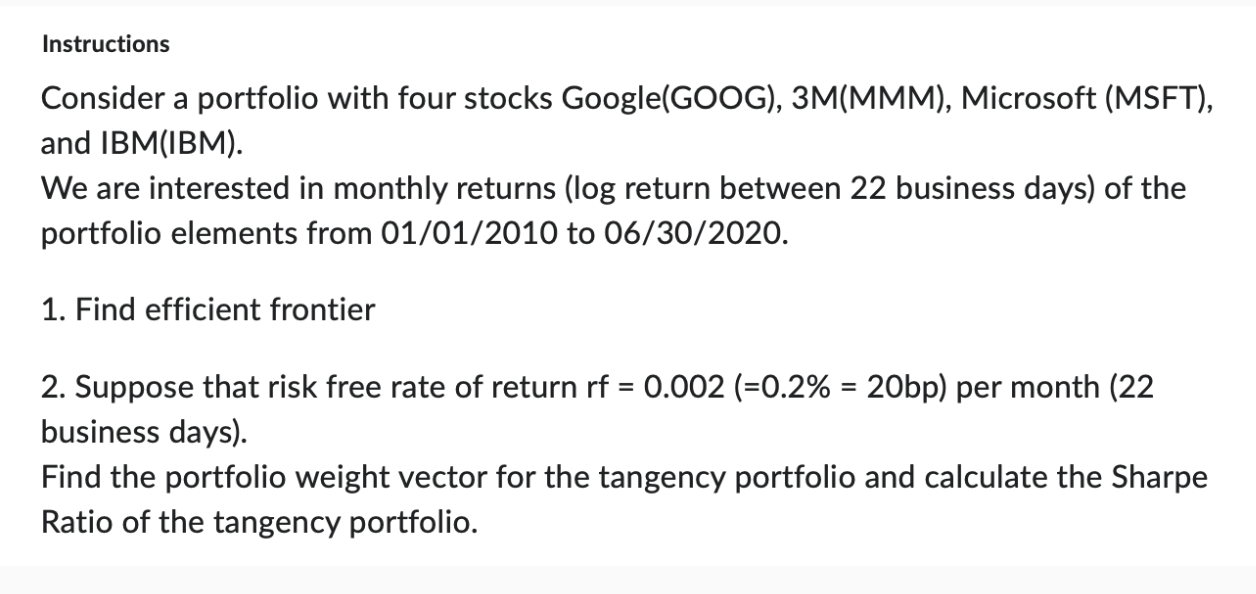

Consider a portfolio with four stocks GoogleGOOGMMMM Microsoft MSFT

and IBMIBM

We are interested in monthly returns log return between business days of the

portfolio elements from to

Find efficient frontier

Suppose that risk free rate of return per month

business days

Find the portfolio weight vector for the tangency portfolio and calculate the Sharpe

Ratio of the tangency portfolio. Find data and complete the project with correct answers. DONOT JUST SHOW HOW TO SOLVE.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock