Question: Instructions for completion Using the information provided below for Ben Lewis, an Australian resident taxpayer, determine the capital gains tax consequences of his share sales

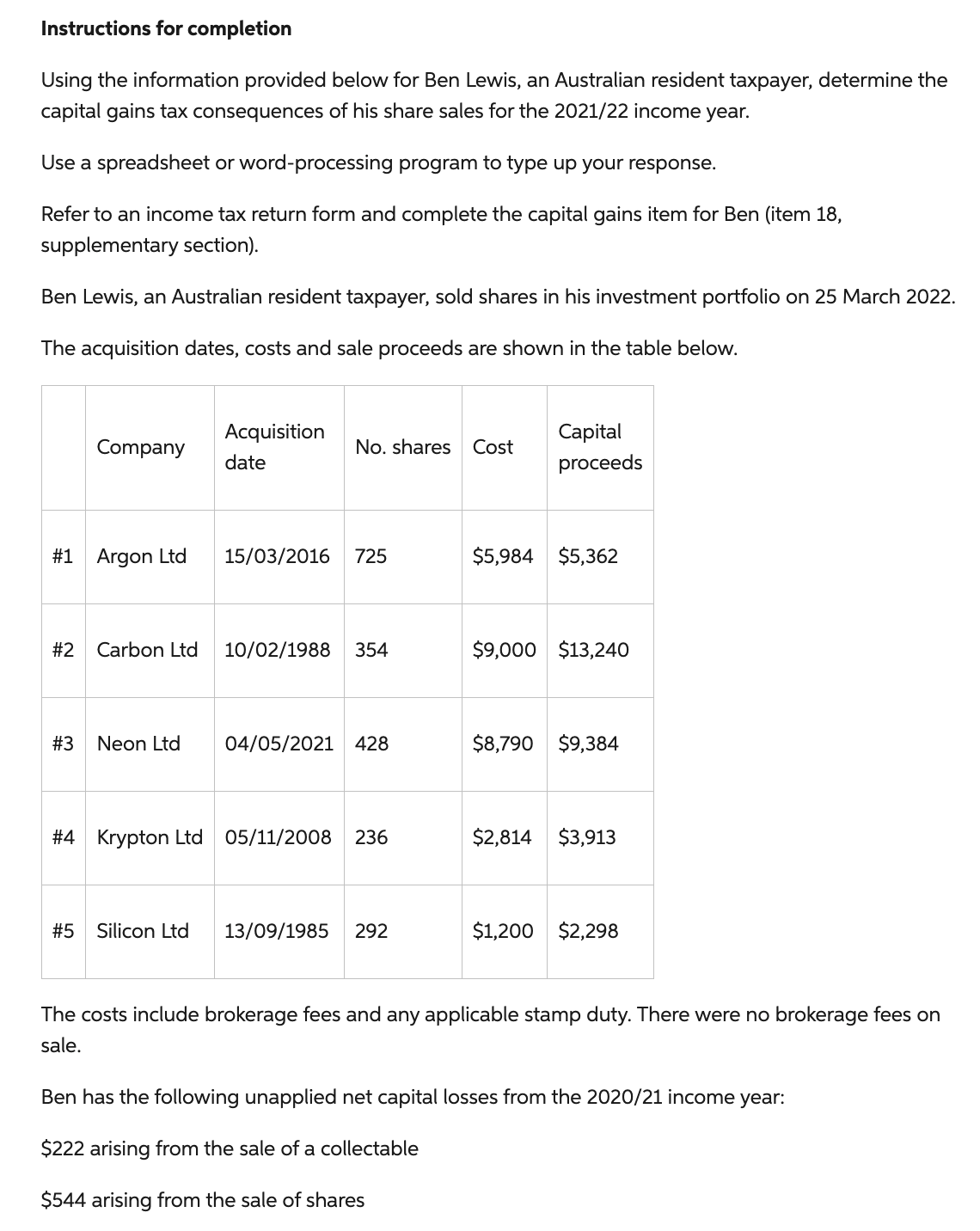

Instructions for completion Using the information provided below for Ben Lewis, an Australian resident taxpayer, determine the capital gains tax consequences of his share sales for the 2021/22 income year. Use a spreadsheet or word-processing program to type up your response. Refer to an income tax return form and complete the capital gains item for Ben (item 18 , supplementary section). Ben Lewis, an Australian resident taxpayer, sold shares in his investment portfolio on 25 March 2022. The acquisition dates, costs and sale proceeds are shown in the table below. The costs include brokerage fees and any applicable stamp duty. There were no brokerage fees on sale. Ben has the following unapplied net capital losses from the 2020/21 income year: $222 arising from the sale of a collectable $544 arising from the sale of shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts