Instructions for DF Hardware.

A. Determine what the sales forecast for your company is based on the information in the case. Show all calculations and identify what the numbers are (e.g. market share is 6.4%, or $XXX,XXX)

B. Ascertain the number of sales reps needed to cover the Ohio territory.

1) Make sure you use the sales figures for OHIO, not the total US, when you do your calculations.

2) All the information needed is contained in the tables and the explanatory material.

3) Show ALL your math and identify each number and its origin.

4) If your calculations tell you that you need a portion of a sales rep (say 8/10), round up to a complete sales person.

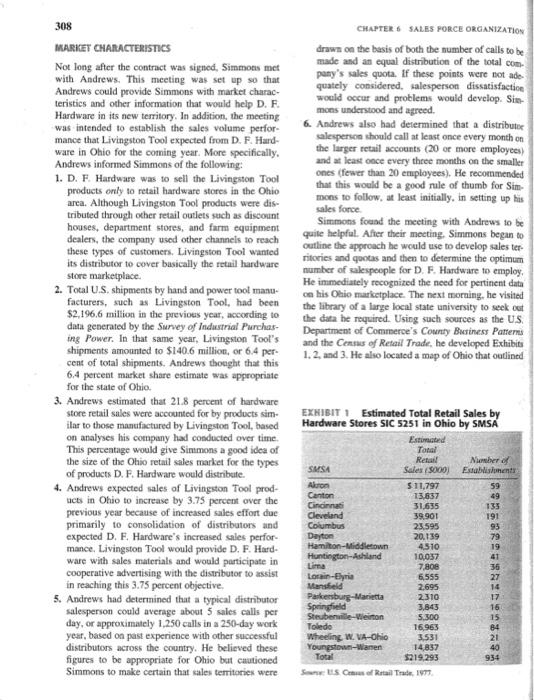

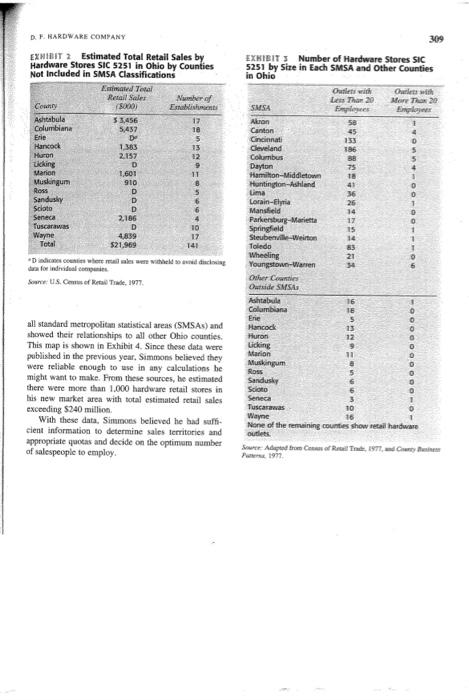

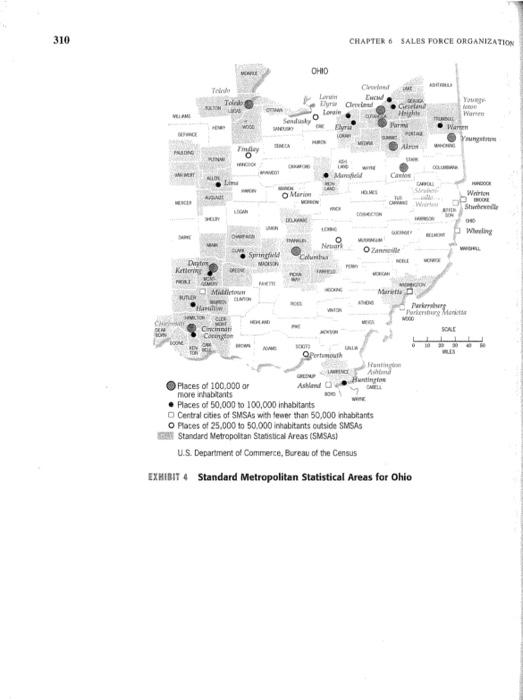

DF HARDWARE COMPANY 307 CASE T-1 D. F. HARDWARE COMPANY he D. F. Hardware Company was a hardware wholesalet/distributor located in Cleveland, ucts for a number of manufacturers, selling primarily to retail hardware stores in the greater Cleveland area. Sales were made by a company salesperson, Ted Tyler, who called on the local retailers. D. F. Hardware Co. trucks later delivered the purchased products to these retailers. Tyler reported to Matt Simmons, the company's General Manager, who also acted in the capacity of D. F. Hardware's sales manager. With only one salesperson, this position did not occupy much of Simmons' time One of D. F. Hardware's most valued suppliers was the Livingston Tool Corporation, a large manufacturer of hand and power tools. Livingston Tool sold its products in many markets, one of which was retail hardware stores such as were sold by D. F. Hardware In this particular market, Livingston Tool used selec- tive distributors, since most of the stores were small and widely distributed. D. F. Hardware had functioned a distributor for Livingston Tool for a number of years in the Cleveland marketplace. The association between the two companies was very amiable; D. E. Hardware valued the Livingston Tool distributorship and its line of high quality products, and Livingston Tool was also pleased with D. F. Hardware's perfor mance in the marketplace. Cecil Andrew, the national sales manager of Livingston Tool, approached Sim- mons with an interesting offer. Livingston Tool was revising its policy on its distributor network. Instead of using several distributors to cover a market area, Liv. ingston Tool was consolidating and attempting to cover the same area with an exclusive distributorship In Ohio, for example, Livingston Tool had been using distributors in Columbus, Toledo, Cincinnati, and Steubenville in addition to D. E Hardware in Cleve land. Andrews wanted to replace the five with a single distributor that would be granted the exclusive right to THE DILEMMA The Livingston Tool offer was an exciting one for Matt Simmons. As was stated. D. F. Hardware had been pleased with the Cleveland area distributorship, and the thought of having this position for all of Ohio really excited Simmons. The Livingston Tool product line was of high quality, profitable, and fast moving, and Sim. mons saw it as a major profit maker for D. F. Hardware. As inviting as the Livingston Tool offer was, Sim. mons knew its acceptance would involve profound change for his company. The new franchise would necessitate an expansion of D. F. Hardware's sales force, with the establishment of sales territories and sales quotas in the entire Ohio market area. Ted Tyler could continue to sell the Cleveland area, but he could not be expected to cover the entire state of Ohio. In addition, Simmons knew that an acceptance of the Liv. ingston Tool offer would involve changes in his com pany's physical distribution network, inventory policy, credit policies, and other such related areas. Simmons found none of these changes formidable enough to warrant the rejection of the Livingston Tool offer. The prospect of having the profitable Livingston Tool franchise for all of Ohio seemed to overshadow any possible obstacles. In addition, he felt that such a move would be the first his company might make in regard to increasing its market penetration and its size. He envisioned that D. F. Hardware would someday be a large regional distributor and that this move was but the forerunner of several similar ones. After weighing all the pros and cons, Simmons Recepted Andrew's offer as Livingston Tool's Ohio exclusive distributor Andrews then informed the other four Ohio distribo- tors in Columbus, Toledo, Cincinnati, and Steubenville) of Livingston Tool's decision and told them that as of June 1. D. F. Hardware would serve as exclusive distributor in the Ohio market area. After signing the contract. Simmons felt that his first task was to develop sales territories and quotas 308 MARKET CHARACTERISTICS Not long after the contract was signed. Simmons met with Andrews. This meeting was set up so that Andrews could provide Simmons with market charac- teristics and other information that would help D. F. Hardware in its new territory. In addition, the meeting was intended to establish the sales volume perfor mance that Livingston Tool expected from D. F Hard- ware in Ohio for the coming year. More specifically, Andrews informed Simmons of the following: 1. D. F Hardware was to sell the Livingston Tool products only to retail hardware stores in the Ohio arca. Although Livingston Tool products were dis- tributed through other retail outlets such as discount houses, department stores, and farm equipment dealers, the company used other channels to reach these types of customers. Livingston Tool wanted its distributor to cover basically the retail hardware store marketplace 2. Total U.S. shipments by hand and power tool manu- facturers, such as Livingston Tool, had been $2.1966 million in the previous year, according to data generated by the Survey of Industrial Purchas- ing Power. In that same year. Livingston Tool's shipments amounted to $140.6 million, or 6.4 per- cent of total shipments. Andrews thought that this 6.4 percent market share estimate was appropriate for the state of Ohio. 3. Andrews estimated that 21.8 percent of hardware store retail sales were accounted for by products sim- ilar to those manufactured by Livingston Tool, hased on analyses his company had conducted over time. This percentage would give Simmons a good idea of the size of the Ohio retail sales market for the types of products D. F. Hardware would distribute. 4. Andrews expected sales of Livingston Tool prod- lucts in Ohio to increase by 3.75 percent over the previous year because of increased sales effort due primarily to consolidation of distributors and expected D, E. Hardware's increased sales perfor- mance. Livingston Tool would provide D. F. Hard- ware with sales materials and would participate in cooperative advertising with the distributor to assist in reaching this 3.75 percent objective 5. Andrews had determined that a typical distributor salesperson could average about 5 sales calls per day, or approximately 1.250 calls in a 250-day work year, based on past experience with other successful distributors across the country. He believed these figures to be appropriate for Ohio but cautioned Simmons to make certain that sales territories were CHAPTER 6 SALES FORCE ORGANIZATION drawn on the basis of both the number of calls to be made and an equal distribution of the total com pany's sales quota. If these points were not ade quately considered salesperson dissatisfactice would occur and problems would develop. Sim mons understood and agreed. 6. Andrews also had determined that a distributor salesperson should call at least once every month on the larger retail accounts (20 or more employees and at least once every three months on the smaller ones (fewer than 20 employees). He recommended that this would be a good rule of thumb for Sim- mons to follow. at least initially, in setting up his sales force Simmons found the meeting with Andrews to be quite helpful. After their meeting. Simmons began to outline the approach he would use to develop sales ter- ritories and quotes and then to determine the optimum number of salespeople for D. F. Hardware to employ, He immediately recognized the need for pertinent data on his Ohio marketplace. The next morning, he visited the library of a large local state university to seek out the data he required. Using such sources as the US Department of Commerce's County Business Patterns and the Census of Retail Trade, he developed Exhibits 1.2 and 3. He also located a map of Ohio that outlined EXHIBIT 1 Estimated Total Retail Sales by Hardware Stores SIC 5251 in Ohio by SMSA Estimated Tonal Retail Number of SMSA Sales (5000) Establishments Akron 511,797 59 Canton 13,837 49 Cincinnati 31.635 135 Cleveland 39.901 191 Columbus 23.595 95 Dayton 20.139 79 Hamilton Middletown 19 Huntington-Ashland 10,037 41 Linna 7,808 36 Lorain-Elyria 6,555 27 Mansfield 2.695 14 Parkersburg-Marietta 2310 17 Springfield 3,843 16 Steubenville-Wirton 5.300 15 Toledo 16.963 84 Wheeling. W. VA-Ohio 3.531 21 Youngstow-Wanen 14837 40 Total $219.293 934 Retail 1977 4310 DE HARDWARE COMPANY 309 EXHIBIT 2 Estimated Total Retail Sales by Hardware Stores SIC 5251 in Ohio by Counties Not Included in SMSA Classifications Emmand Tasal Retail Sales No Country 3000) Emblis Ashtabula 33,456 17 Columbiana 5,457 10 Erie De 5 Hancock 1383 13 Huron 2.157 12 Licking D 9 Marion 1.601 11 Muslingum 910 8 Ross D 5 Sandusly D 6 Scoto D 6 Seneca 2.186 4 Tuscarawas D 10 Wayne 4,839 17 Total $21.969 141 De method das for individual com SS.Cms of The 1977 EXHIBIT) Number of Hardware Stores SIC 5251 by Sire in Each SMSA and Other Counties in Ohio Outlets with | Ourlete with Less Than 20 More Than 20 SMSA Emples Engle Akran 58 Canton 45 Gincinnati 153 Cleveland 186 Columbus 88 Dayton Hamilton Middletown 18 Huntington-Ashland 41 Lima 36 Lorain-Elynia 26 Mansfield 14 Parkersburg-Marietta 12 Springfield 15 Steubenville-Weston 14 Toledo 83 Wheeling 21 Youngstown-Warren Other Counties Outside SMS shtabule 16 Columbiana TE 0 Erie 5 Hancock 13 0 Huron 12 Licking Marion 11 Muskingum Ross 5 Sandusky 6 Soto Seneca Tuscarawas 10 Wayne 16 None of the remaining counties show retail hardware outlets Sauer Alped the Comment Real Time, 1971, Carey 1971 O all standard metropolitan statistical areas (SMSAs) and showed their relationships to all other Ohio counties This map is shown in Exhibit 4. Since these data were published in the previous year. Simmons believed they were reliable enough to use in any calculations be might want to make. From these sources, he estimated there were more than 1.000 hardware retail stores in his new market area with total estimated retail sales exceeding $240 million With these data, Simmons believed he had a cient Information to determine sales territories and appropriate quotes and decide on the optimum number of salespeople to employ. 310 CHAPTER 6 SALES FORCE ORGANIZATION OHID TA C CH El Civil Tolino Ger Sony You Waren Warn Your WOOD Parm IMA AL my 0 M Caw MID Ima Mar W Wir MOR Stre wing One w Na Club Spring MORE D WON Malow Mar NUTE Pierre Prer SOME CH Cincin Conington BOON ING A. Deview0ull A Places of 100,000 or more inhabitants Places of 50,000 to 100,000 inhabitants Central Cities of SMSds with fewer than 50,000 inhabitants O Places of 25,000 do 50.000 inhabitants outside SMSAS G Standard Metropolitan Statistical Areas (SMSAS) U.S. Department of Commerce, Bureau of the Census EXHIBIT 4 Standard Metropolitan Statistical Areas for Ohio DF HARDWARE COMPANY 307 CASE T-1 D. F. HARDWARE COMPANY he D. F. Hardware Company was a hardware wholesalet/distributor located in Cleveland, ucts for a number of manufacturers, selling primarily to retail hardware stores in the greater Cleveland area. Sales were made by a company salesperson, Ted Tyler, who called on the local retailers. D. F. Hardware Co. trucks later delivered the purchased products to these retailers. Tyler reported to Matt Simmons, the company's General Manager, who also acted in the capacity of D. F. Hardware's sales manager. With only one salesperson, this position did not occupy much of Simmons' time One of D. F. Hardware's most valued suppliers was the Livingston Tool Corporation, a large manufacturer of hand and power tools. Livingston Tool sold its products in many markets, one of which was retail hardware stores such as were sold by D. F. Hardware In this particular market, Livingston Tool used selec- tive distributors, since most of the stores were small and widely distributed. D. F. Hardware had functioned a distributor for Livingston Tool for a number of years in the Cleveland marketplace. The association between the two companies was very amiable; D. E. Hardware valued the Livingston Tool distributorship and its line of high quality products, and Livingston Tool was also pleased with D. F. Hardware's perfor mance in the marketplace. Cecil Andrew, the national sales manager of Livingston Tool, approached Sim- mons with an interesting offer. Livingston Tool was revising its policy on its distributor network. Instead of using several distributors to cover a market area, Liv. ingston Tool was consolidating and attempting to cover the same area with an exclusive distributorship In Ohio, for example, Livingston Tool had been using distributors in Columbus, Toledo, Cincinnati, and Steubenville in addition to D. E Hardware in Cleve land. Andrews wanted to replace the five with a single distributor that would be granted the exclusive right to THE DILEMMA The Livingston Tool offer was an exciting one for Matt Simmons. As was stated. D. F. Hardware had been pleased with the Cleveland area distributorship, and the thought of having this position for all of Ohio really excited Simmons. The Livingston Tool product line was of high quality, profitable, and fast moving, and Sim. mons saw it as a major profit maker for D. F. Hardware. As inviting as the Livingston Tool offer was, Sim. mons knew its acceptance would involve profound change for his company. The new franchise would necessitate an expansion of D. F. Hardware's sales force, with the establishment of sales territories and sales quotas in the entire Ohio market area. Ted Tyler could continue to sell the Cleveland area, but he could not be expected to cover the entire state of Ohio. In addition, Simmons knew that an acceptance of the Liv. ingston Tool offer would involve changes in his com pany's physical distribution network, inventory policy, credit policies, and other such related areas. Simmons found none of these changes formidable enough to warrant the rejection of the Livingston Tool offer. The prospect of having the profitable Livingston Tool franchise for all of Ohio seemed to overshadow any possible obstacles. In addition, he felt that such a move would be the first his company might make in regard to increasing its market penetration and its size. He envisioned that D. F. Hardware would someday be a large regional distributor and that this move was but the forerunner of several similar ones. After weighing all the pros and cons, Simmons Recepted Andrew's offer as Livingston Tool's Ohio exclusive distributor Andrews then informed the other four Ohio distribo- tors in Columbus, Toledo, Cincinnati, and Steubenville) of Livingston Tool's decision and told them that as of June 1. D. F. Hardware would serve as exclusive distributor in the Ohio market area. After signing the contract. Simmons felt that his first task was to develop sales territories and quotas 308 MARKET CHARACTERISTICS Not long after the contract was signed. Simmons met with Andrews. This meeting was set up so that Andrews could provide Simmons with market charac- teristics and other information that would help D. F. Hardware in its new territory. In addition, the meeting was intended to establish the sales volume perfor mance that Livingston Tool expected from D. F Hard- ware in Ohio for the coming year. More specifically, Andrews informed Simmons of the following: 1. D. F Hardware was to sell the Livingston Tool products only to retail hardware stores in the Ohio arca. Although Livingston Tool products were dis- tributed through other retail outlets such as discount houses, department stores, and farm equipment dealers, the company used other channels to reach these types of customers. Livingston Tool wanted its distributor to cover basically the retail hardware store marketplace 2. Total U.S. shipments by hand and power tool manu- facturers, such as Livingston Tool, had been $2.1966 million in the previous year, according to data generated by the Survey of Industrial Purchas- ing Power. In that same year. Livingston Tool's shipments amounted to $140.6 million, or 6.4 per- cent of total shipments. Andrews thought that this 6.4 percent market share estimate was appropriate for the state of Ohio. 3. Andrews estimated that 21.8 percent of hardware store retail sales were accounted for by products sim- ilar to those manufactured by Livingston Tool, hased on analyses his company had conducted over time. This percentage would give Simmons a good idea of the size of the Ohio retail sales market for the types of products D. F. Hardware would distribute. 4. Andrews expected sales of Livingston Tool prod- lucts in Ohio to increase by 3.75 percent over the previous year because of increased sales effort due primarily to consolidation of distributors and expected D, E. Hardware's increased sales perfor- mance. Livingston Tool would provide D. F. Hard- ware with sales materials and would participate in cooperative advertising with the distributor to assist in reaching this 3.75 percent objective 5. Andrews had determined that a typical distributor salesperson could average about 5 sales calls per day, or approximately 1.250 calls in a 250-day work year, based on past experience with other successful distributors across the country. He believed these figures to be appropriate for Ohio but cautioned Simmons to make certain that sales territories were CHAPTER 6 SALES FORCE ORGANIZATION drawn on the basis of both the number of calls to be made and an equal distribution of the total com pany's sales quota. If these points were not ade quately considered salesperson dissatisfactice would occur and problems would develop. Sim mons understood and agreed. 6. Andrews also had determined that a distributor salesperson should call at least once every month on the larger retail accounts (20 or more employees and at least once every three months on the smaller ones (fewer than 20 employees). He recommended that this would be a good rule of thumb for Sim- mons to follow. at least initially, in setting up his sales force Simmons found the meeting with Andrews to be quite helpful. After their meeting. Simmons began to outline the approach he would use to develop sales ter- ritories and quotes and then to determine the optimum number of salespeople for D. F. Hardware to employ, He immediately recognized the need for pertinent data on his Ohio marketplace. The next morning, he visited the library of a large local state university to seek out the data he required. Using such sources as the US Department of Commerce's County Business Patterns and the Census of Retail Trade, he developed Exhibits 1.2 and 3. He also located a map of Ohio that outlined EXHIBIT 1 Estimated Total Retail Sales by Hardware Stores SIC 5251 in Ohio by SMSA Estimated Tonal Retail Number of SMSA Sales (5000) Establishments Akron 511,797 59 Canton 13,837 49 Cincinnati 31.635 135 Cleveland 39.901 191 Columbus 23.595 95 Dayton 20.139 79 Hamilton Middletown 19 Huntington-Ashland 10,037 41 Linna 7,808 36 Lorain-Elyria 6,555 27 Mansfield 2.695 14 Parkersburg-Marietta 2310 17 Springfield 3,843 16 Steubenville-Wirton 5.300 15 Toledo 16.963 84 Wheeling. W. VA-Ohio 3.531 21 Youngstow-Wanen 14837 40 Total $219.293 934 Retail 1977 4310 DE HARDWARE COMPANY 309 EXHIBIT 2 Estimated Total Retail Sales by Hardware Stores SIC 5251 in Ohio by Counties Not Included in SMSA Classifications Emmand Tasal Retail Sales No Country 3000) Emblis Ashtabula 33,456 17 Columbiana 5,457 10 Erie De 5 Hancock 1383 13 Huron 2.157 12 Licking D 9 Marion 1.601 11 Muslingum 910 8 Ross D 5 Sandusly D 6 Scoto D 6 Seneca 2.186 4 Tuscarawas D 10 Wayne 4,839 17 Total $21.969 141 De method das for individual com SS.Cms of The 1977 EXHIBIT) Number of Hardware Stores SIC 5251 by Sire in Each SMSA and Other Counties in Ohio Outlets with | Ourlete with Less Than 20 More Than 20 SMSA Emples Engle Akran 58 Canton 45 Gincinnati 153 Cleveland 186 Columbus 88 Dayton Hamilton Middletown 18 Huntington-Ashland 41 Lima 36 Lorain-Elynia 26 Mansfield 14 Parkersburg-Marietta 12 Springfield 15 Steubenville-Weston 14 Toledo 83 Wheeling 21 Youngstown-Warren Other Counties Outside SMS shtabule 16 Columbiana TE 0 Erie 5 Hancock 13 0 Huron 12 Licking Marion 11 Muskingum Ross 5 Sandusky 6 Soto Seneca Tuscarawas 10 Wayne 16 None of the remaining counties show retail hardware outlets Sauer Alped the Comment Real Time, 1971, Carey 1971 O all standard metropolitan statistical areas (SMSAs) and showed their relationships to all other Ohio counties This map is shown in Exhibit 4. Since these data were published in the previous year. Simmons believed they were reliable enough to use in any calculations be might want to make. From these sources, he estimated there were more than 1.000 hardware retail stores in his new market area with total estimated retail sales exceeding $240 million With these data, Simmons believed he had a cient Information to determine sales territories and appropriate quotes and decide on the optimum number of salespeople to employ. 310 CHAPTER 6 SALES FORCE ORGANIZATION OHID TA C CH El Civil Tolino Ger Sony You Waren Warn Your WOOD Parm IMA AL my 0 M Caw MID Ima Mar W Wir MOR Stre wing One w Na Club Spring MORE D WON Malow Mar NUTE Pierre Prer SOME CH Cincin Conington BOON ING A. Deview0ull A Places of 100,000 or more inhabitants Places of 50,000 to 100,000 inhabitants Central Cities of SMSds with fewer than 50,000 inhabitants O Places of 25,000 do 50.000 inhabitants outside SMSAS G Standard Metropolitan Statistical Areas (SMSAS) U.S. Department of Commerce, Bureau of the Census EXHIBIT 4 Standard Metropolitan Statistical Areas for Ohio