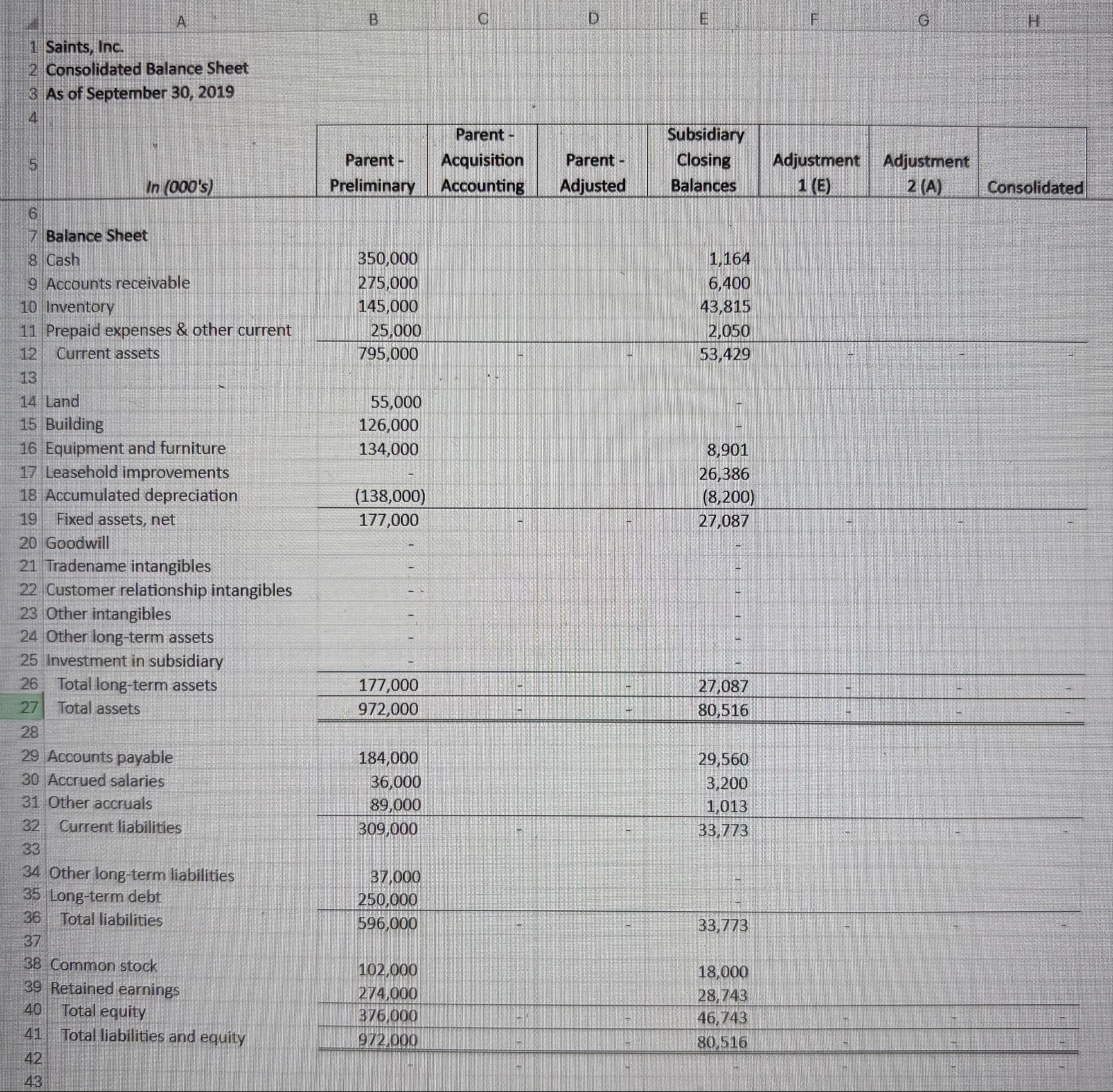

Question: Instructions for tab A . The Parent acquired the Subsidiary on September 3 0 , 2 0 1 9 . This is the initial consolidated

Instructions for tab A

The Parent acquired the Subsidiary on September This is the initial consolidated balance sheet. Note that the purchase was a stock deal and the company is not using pushdown accounting.Complete the following steps to record the purchase on the Parent's books and the related purchase accounting and consolidation adjustments. Use the purchase accounting valuation report for the necessary amounts You will need to complete the formulas in Column D Adjusted Parent and Column H Consolidated Record the Parent's journal entry to reflect the acquisition. Remember this was a stock deal and the Parent uses the equity method of accounting. Refer to Exhibit A Summary of Conclusions in the valuation report. Note that Parent took on debt related to this deal. Show this as debt being added to the Parent's books you do not have to show the debt as being paid off Also, Parent exchanged some stock options with the sellers which will be accounted for as if the Parent had issued its own stock so some of the purchase price will be in equity, the rest in cash Complete the equity elimination entry Entry E in the Adjustment column. This adjustment will not show the purchase accounting fair value adjustments nor will it fully eliminate Investment in Sub Complete the AAP adjustment purchase accounting Entry A in the Adjustment column. Use the valuation report to arrive at the fair values of the acquired assets. There are no fair value adjustments to liabilities. Note the following:A Use the Valuation of Inventory report to determine the fair value adjustment to inventory.B Use the Valuation of Personal Property report to determine the fair value adjustment to Fixed Assets. Split the valuation between Leasehold Improvements the first line in the valuation report and Equipment and Furniture all other lines Make sure the new net book value of the Subsidiary plus this adjustment equals ending fair value of $ per the report.C Use Exhibit A Summary of Conclusions to record the value of the unrecorded intangibles and the value of the value of the lease contracts ignoring Goodwill for now Combine the distribution agreements and product designs into Other Intangibles. The value of the leases should be recorded in Other LT Assets.D Record goodwill per Exhibit A Summary of Conclusions and then complete this adjustment by eliminating the remaining equity method investment balance. Note that because of rounding this may leave you with an unbalanced entry should be a few hundered $ If this is the case, adjust your goodwill amount to balance the entry ie "plug" goodwill This adjustment should not be more than $Tab A is worth points, graded for accuracy of numbers, formulas and calculations. Where possible, amounts on this tab should be referenced back to another tab with a forumla or calculated with a formula. Entering hardcoded numbers should be avoided if possible.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock