Question: Instructions For the items listed below in Chapter 6 , prepare journal entries for the following transactions of Mars Co . : ( a )

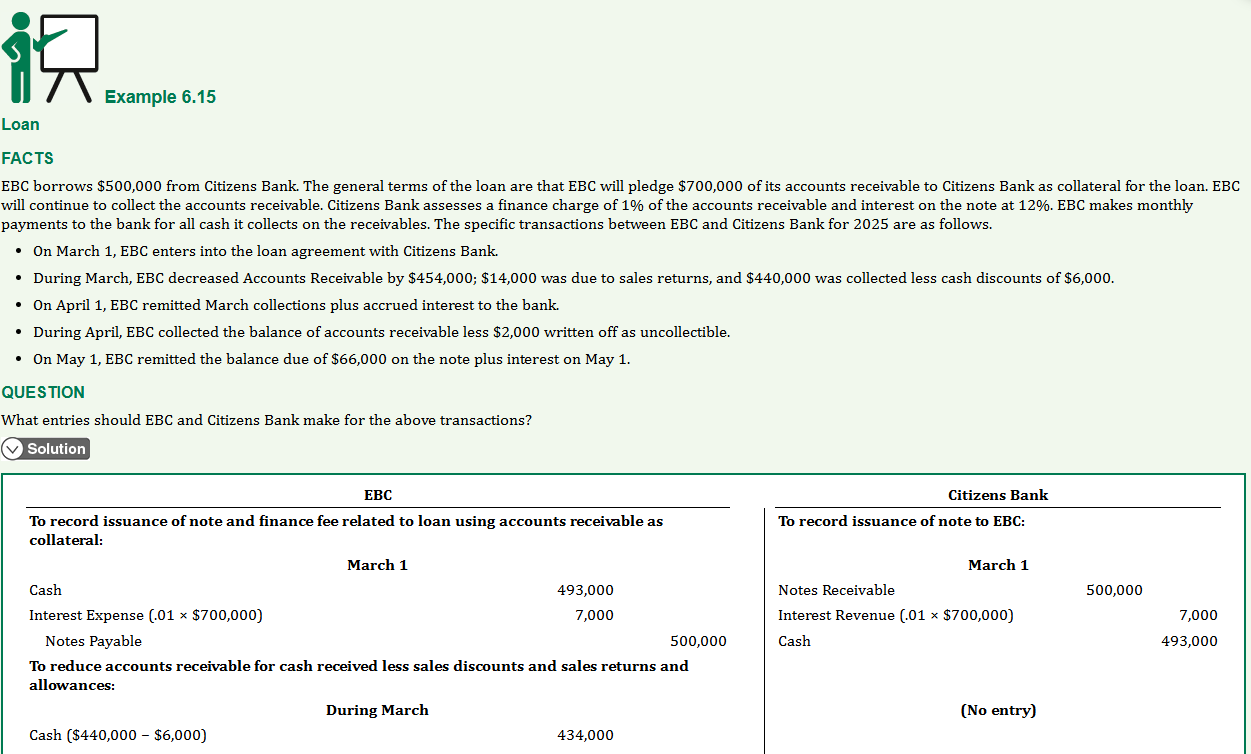

Instructions For the items listed below in Chapter prepare journal entries for the following transactions of Mars Co: a Accounts receivable in the amount of $ were assigned to Utley Finance Co by Mars as security for a loan of $ Utley charged a commission on the accounts; the interest rate on the note is b During the first month, Mars collected $ on assigned accounts after deducting $ of discounts. Mars wrote off a $ assigned account. c Mars paid to Utley the amount collected plus one month's interest on the note. d Explain the differences in accounting for a secured borrowing and a sale of receivables. Hints See textbook EXAMPLE for full reference details. I only provided you a partial snapshot. a Interest Expense $ x b Sales Discounts ; Allowance for Doubtful Accounts c Interest Expense $ x x Loan FACTS EBC borrows $ from Citizens Bank. The general terms of the loan are that EBC will pledge $ of its accounts receivable to Citizens Bank as collateral for the loan. EBC will continue to collect the accounts receivable. Citizens Bank assesses a finance charge of of the accounts receivable and interest on the note at EBC makes monthly payments to the bank for all cash it collects on the receivables. The specific transactions between EBC and Citizens Bank for are as follows. On March EBC enters into the loan agreement with Citizens Bank. During March, EBC decreased Accounts Receivable by $ ; $ was due to sales returns, and $ was collected less cash discounts of $ On April EBC remitted March collections plus accrued interest to the bank. During April, EBC collected the balance of accounts receivable less $ written off as uncollectible. On May EBC remitted the balance due of $ on the note plus interest on May QUESTION What entries should EBC and Citizens Bank make for the above transactions?To record issuance of note and finance fee related to loan using accounts receivable as collateral:To reduce accounts receivable for cash received less sales discounts and sales returns and allowances:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock