Question: Instructions for the Z-score assignment. 1. 2. 3. 4. 5. Calculate the 4 ratios indicated on the handout by finding the balance sheet or income

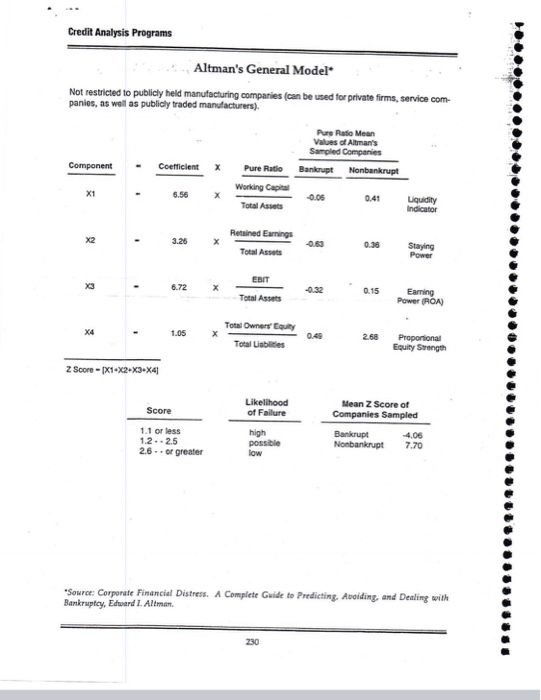

Instructions for the Z-score assignment. 1. 2. 3. 4. 5. Calculate the 4 ratios indicated on the handout by finding the balance sheet or income statement numbers on the annual financial statements you have procured. If you use quarterly financials, you will lose points. Working capital current assets-current liabilities EBIT : earnings before interest and taxes. Operating Income) Multiply each ratio by the coefficient given in the second column. This is a constant Add up each of the 4 components. This is your Z-score. Interpret your score based on the information at the bottom of page 230 of the handout (Likelihood of failure). Write a brief paragraph answering the question, "Were you surprised with the answer you calculated given what you know of the company?" Also, tell me a little bit about this company. What business is it in? You must show all of your math calculations. If I have to do the calculations to check your work, you will lose points. Information must be typed. A copy of the balance sheet and income statement must be attached to receive credit Please highlight the numbers on the financial statements that you use. It makes it much easier to correct. Thank you. 7. 8. 9. 10. Credit Analysis Programs Altman's General Model Not restricted to publicly held manufacturing companies can be used for private firms, service com panies, as well as publicly traded manufacturers). Pure Ratio Mean Values of Altman's Sampled Companies Component Coefficient Pure Ratio Bankrupt Nonbankrupt Working Capital X1 6.56 -0.06 0.41 Liquidity Total Assets Indicator Retained Earnings X2 3.26 0.38 Total Assets Staying Power 3 6.72 0.15 Earning Power (ROA) Total Assets Total Owners Couty Total Liabides X4 1.05 0.49 268 Proportional Equity Strength Z Score - (x1+x2-x3-84 Score Likelihood of Failure 1.1 or less 1.2.2.5 2.6. or greater Mean Z Score of Companies Sampled Bankrupt -4.06 Nonbankrupt 7.70 high possible low Source: Corporate Financial Distress. A Complete Guide to Predicting, Avoiding, and Dealing with Bankruptcy, Edward I. Altman. 230 Instructions for the Z-score assignment. 1. 2. 3. 4. 5. Calculate the 4 ratios indicated on the handout by finding the balance sheet or income statement numbers on the annual financial statements you have procured. If you use quarterly financials, you will lose points. Working capital current assets-current liabilities EBIT : earnings before interest and taxes. Operating Income) Multiply each ratio by the coefficient given in the second column. This is a constant Add up each of the 4 components. This is your Z-score. Interpret your score based on the information at the bottom of page 230 of the handout (Likelihood of failure). Write a brief paragraph answering the question, "Were you surprised with the answer you calculated given what you know of the company?" Also, tell me a little bit about this company. What business is it in? You must show all of your math calculations. If I have to do the calculations to check your work, you will lose points. Information must be typed. A copy of the balance sheet and income statement must be attached to receive credit Please highlight the numbers on the financial statements that you use. It makes it much easier to correct. Thank you. 7. 8. 9. 10. Credit Analysis Programs Altman's General Model Not restricted to publicly held manufacturing companies can be used for private firms, service com panies, as well as publicly traded manufacturers). Pure Ratio Mean Values of Altman's Sampled Companies Component Coefficient Pure Ratio Bankrupt Nonbankrupt Working Capital X1 6.56 -0.06 0.41 Liquidity Total Assets Indicator Retained Earnings X2 3.26 0.38 Total Assets Staying Power 3 6.72 0.15 Earning Power (ROA) Total Assets Total Owners Couty Total Liabides X4 1.05 0.49 268 Proportional Equity Strength Z Score - (x1+x2-x3-84 Score Likelihood of Failure 1.1 or less 1.2.2.5 2.6. or greater Mean Z Score of Companies Sampled Bankrupt -4.06 Nonbankrupt 7.70 high possible low Source: Corporate Financial Distress. A Complete Guide to Predicting, Avoiding, and Dealing with Bankruptcy, Edward I. Altman. 230

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts