Question: Instructions for working all Group 4 Comprehensive Tax Return Problems in the textbook are as follows: Birthdays: If you are using the tax software, make

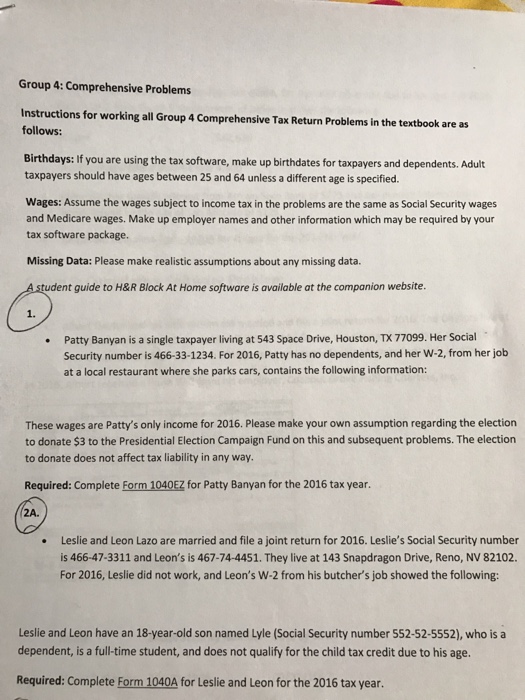

Instructions for working all Group 4 Comprehensive Tax Return Problems in the textbook are as follows: Birthdays: If you are using the tax software, make up birthdates for taxpayers and dependents. Adult taxpayers should have ages between 25 and 64 unless a different age is specified. Wages: Assume the wages subject to income tax in the problems are the same as Social Security wages and Medicare wages. Make up employer names and other information which may be required by your tax software package. Missing Data: Please make realistic assumptions about any missing data. A student guide to H&R Block at Home software is available at the companion website. Patty Banyan is a single taxpayer living at 543 Space Drive, Houston, TX 77099. Her Social Security number is 466-33-1234. For 2016, Patty has no dependents, and her W-2, from her job at a local restaurant where she parks cars, contains the following information: These wages are Patty's only income for 2016. Please make your own assumption regarding the election to donate $3 to the Presidential Election Campaign Fund on this and subsequent problems. The election to donate does not affect tax liability in any way. Required: Complete Form 1040EZ for Patty Banyan for the 2016 tax year. Leslie and Leon Laze are married and file a joint return for 2016. Leslie's Social Security number is 466-47-3311 and Leon's is 467-74-4451. They live at 143 Snapdragon Drive, Reno, NV 82102. For 2016, Leslie did not work, and Leon's W-2 from his butcher's job showed the following: Leslie and Leon have an 18-year-old son named Lyle (Social Security number 552-52-5552), who is a dependent, is a full-time student, and does not qualify for the child tax credit due to his age. Required: Complete Form 1040A for Leslie and Leon for the 2016 tax year. Instructions for working all Group 4 Comprehensive Tax Return Problems in the textbook are as follows: Birthdays: If you are using the tax software, make up birthdates for taxpayers and dependents. Adult taxpayers should have ages between 25 and 64 unless a different age is specified. Wages: Assume the wages subject to income tax in the problems are the same as Social Security wages and Medicare wages. Make up employer names and other information which may be required by your tax software package. Missing Data: Please make realistic assumptions about any missing data. A student guide to H&R Block at Home software is available at the companion website. Patty Banyan is a single taxpayer living at 543 Space Drive, Houston, TX 77099. Her Social Security number is 466-33-1234. For 2016, Patty has no dependents, and her W-2, from her job at a local restaurant where she parks cars, contains the following information: These wages are Patty's only income for 2016. Please make your own assumption regarding the election to donate $3 to the Presidential Election Campaign Fund on this and subsequent problems. The election to donate does not affect tax liability in any way. Required: Complete Form 1040EZ for Patty Banyan for the 2016 tax year. Leslie and Leon Laze are married and file a joint return for 2016. Leslie's Social Security number is 466-47-3311 and Leon's is 467-74-4451. They live at 143 Snapdragon Drive, Reno, NV 82102. For 2016, Leslie did not work, and Leon's W-2 from his butcher's job showed the following: Leslie and Leon have an 18-year-old son named Lyle (Social Security number 552-52-5552), who is a dependent, is a full-time student, and does not qualify for the child tax credit due to his age. Required: Complete Form 1040A for Leslie and Leon for the 2016 tax year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts