Question: Instructions Form 1040 Schedule A Schedule D Form 8949 2019 Tax rate Schedules Follow-up Advice and Letter Instructions Note: This problem is for the 2019

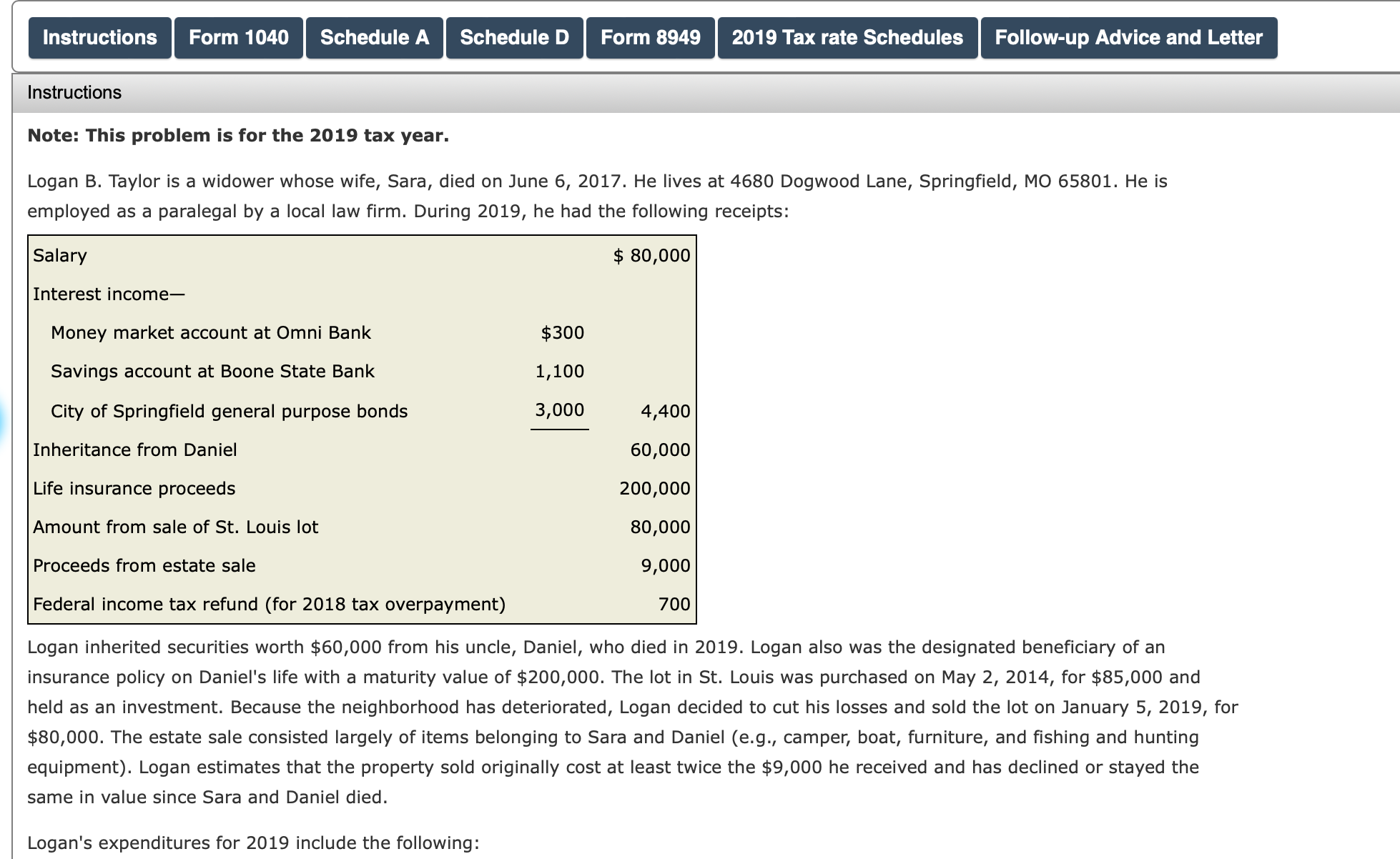

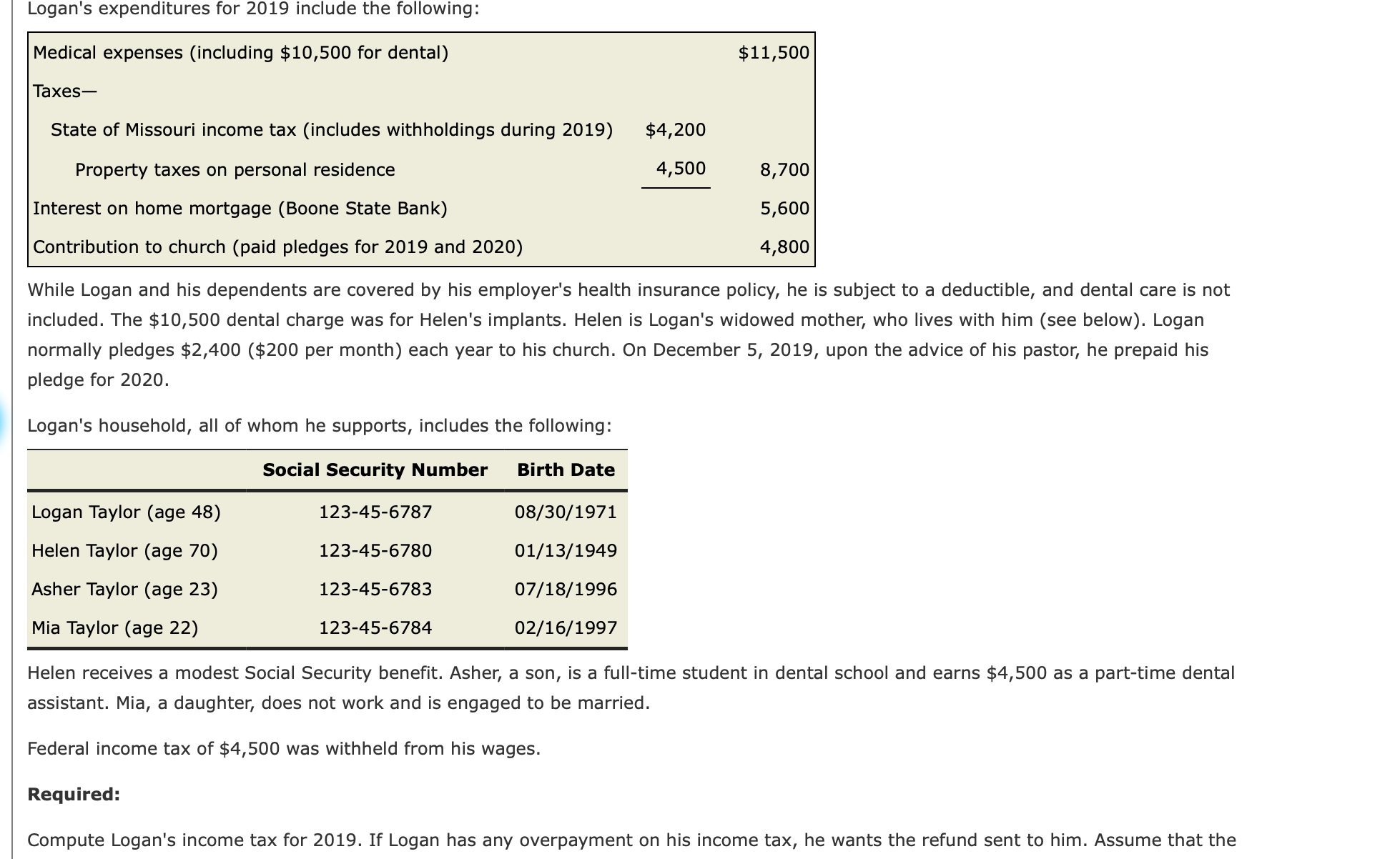

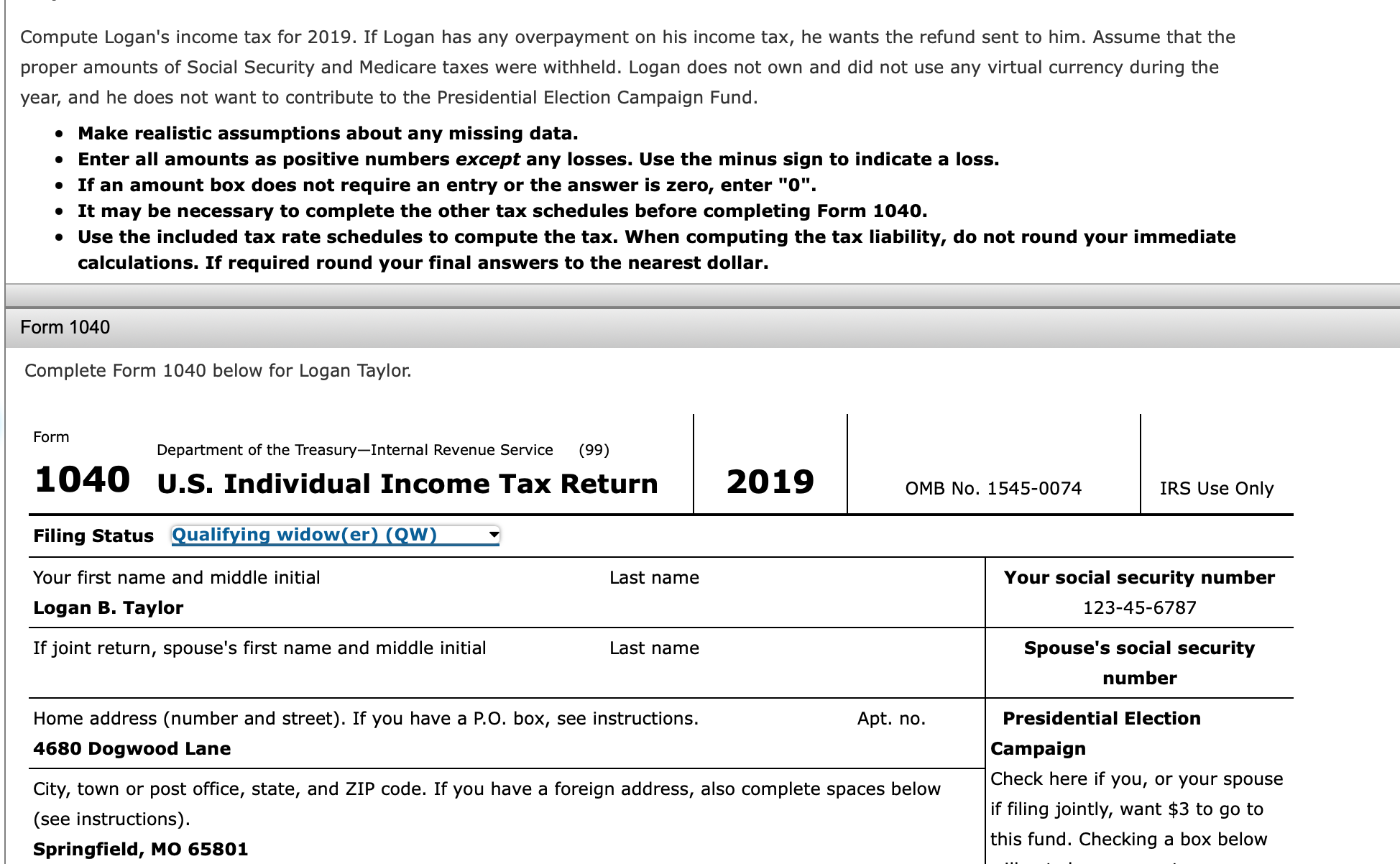

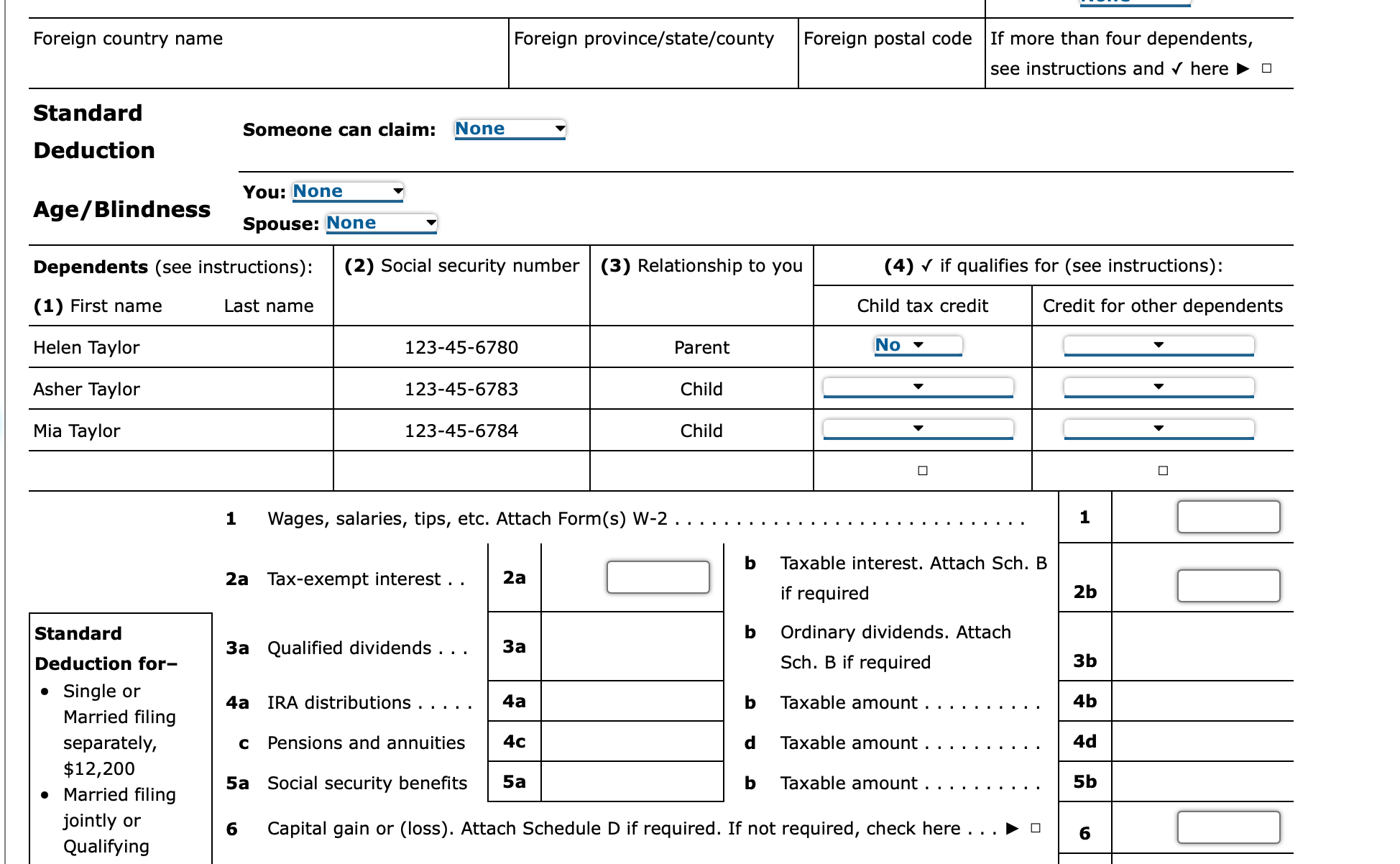

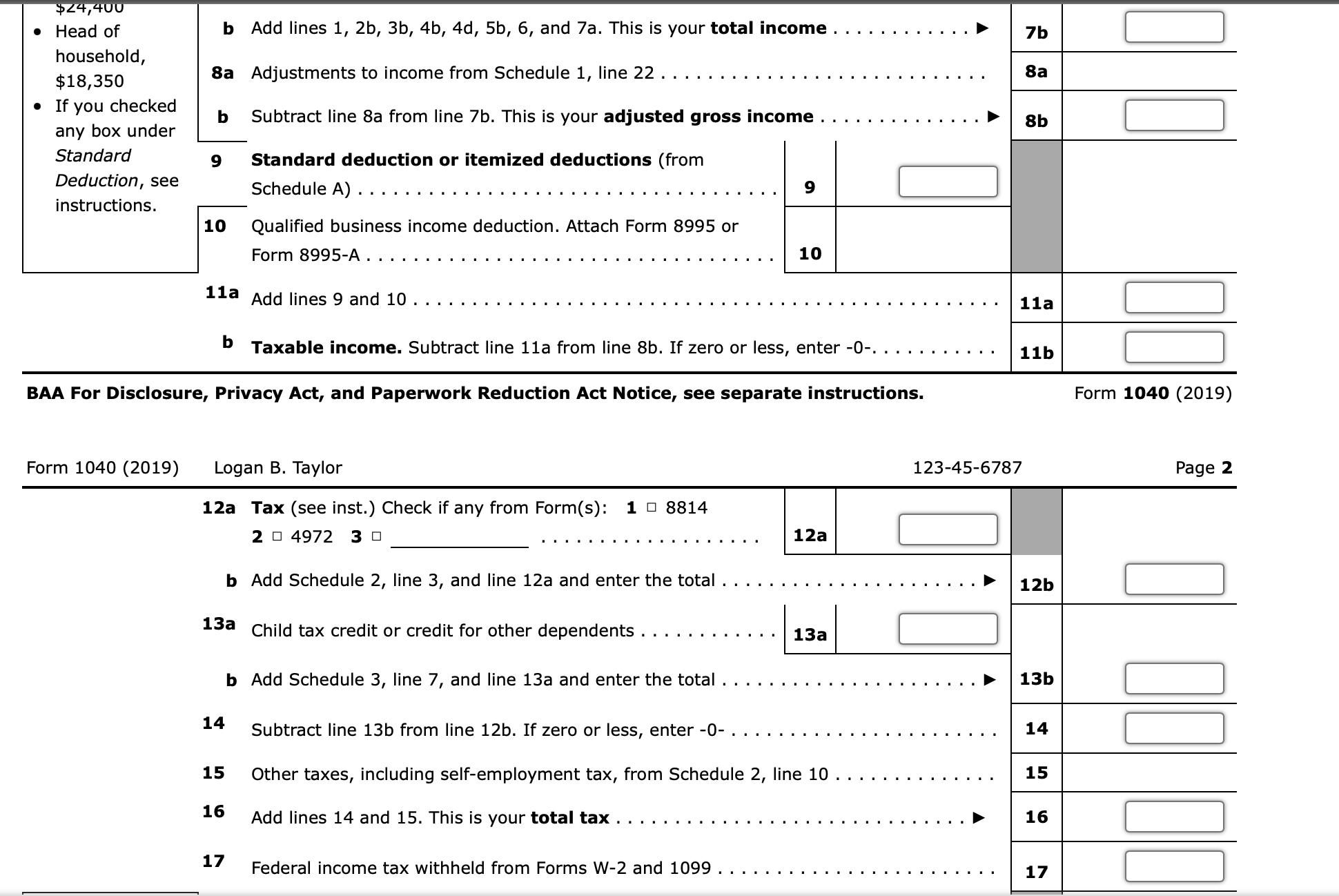

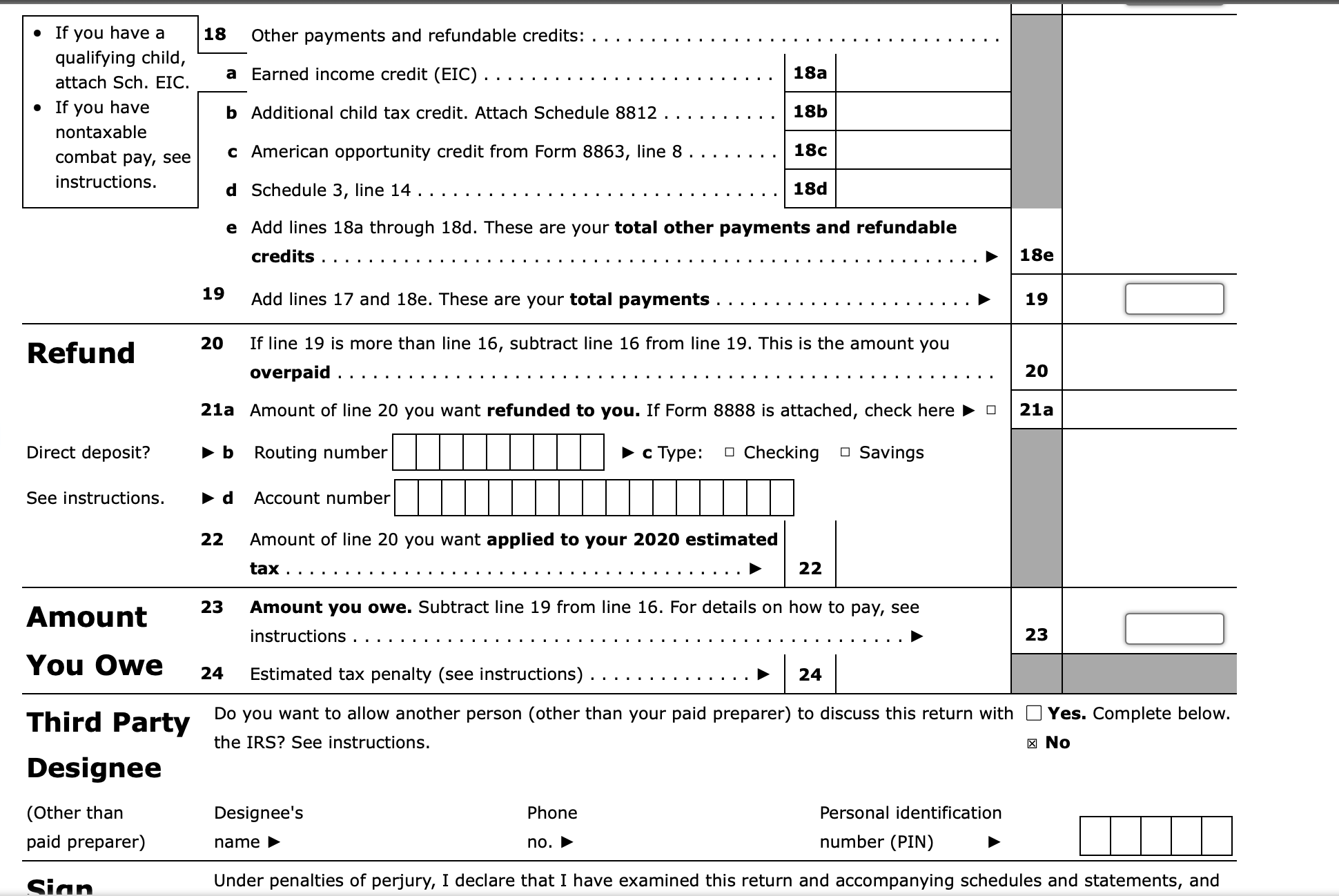

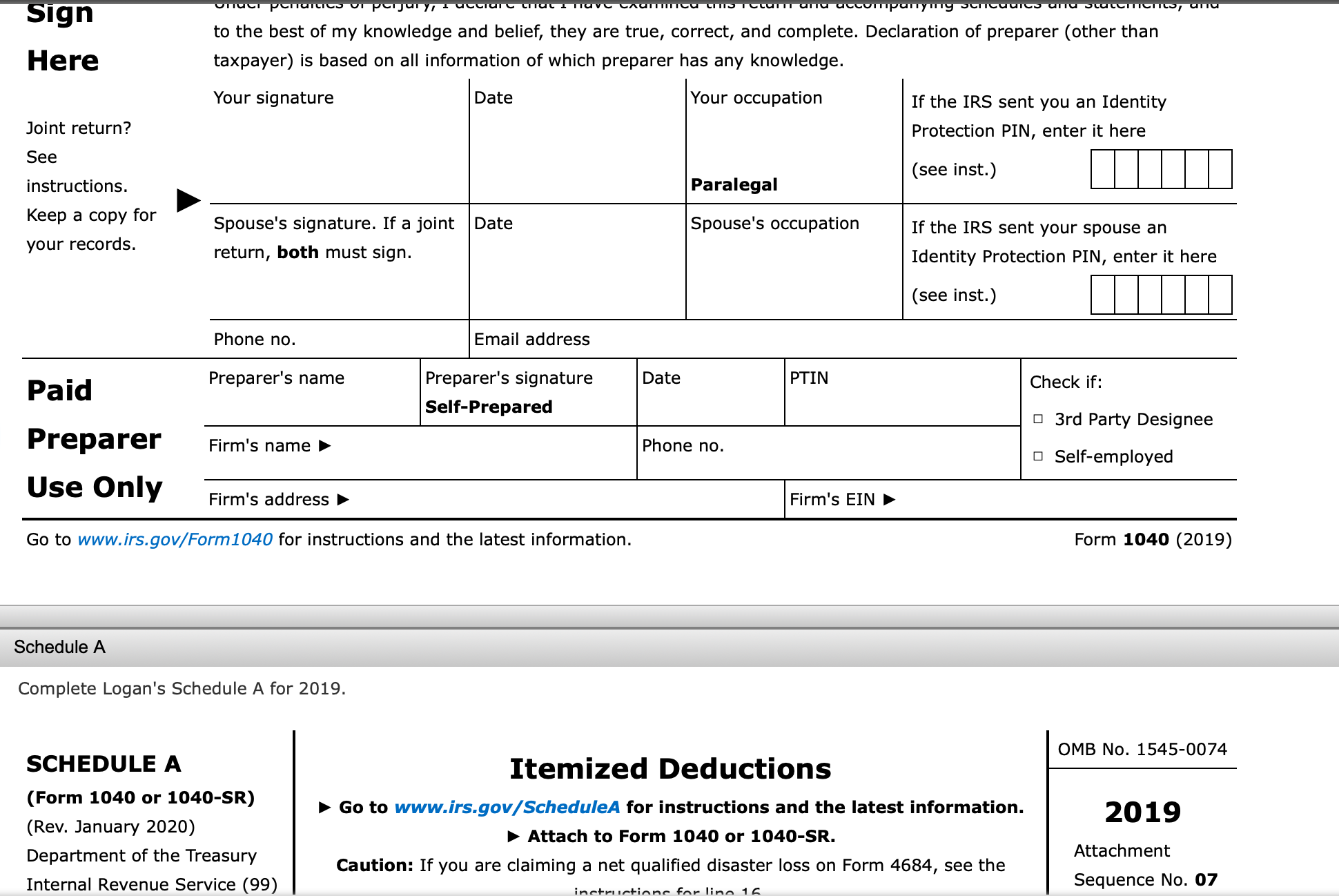

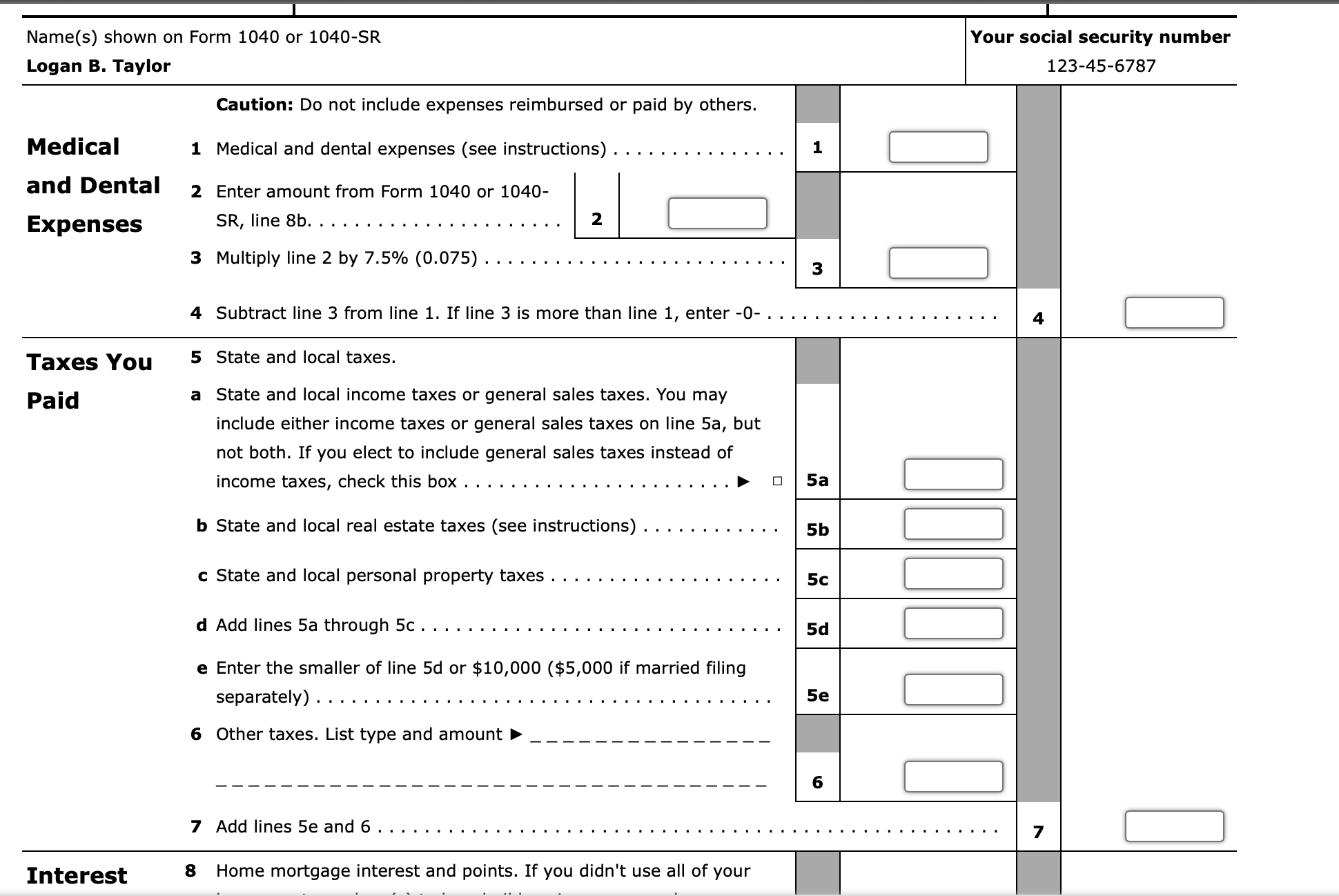

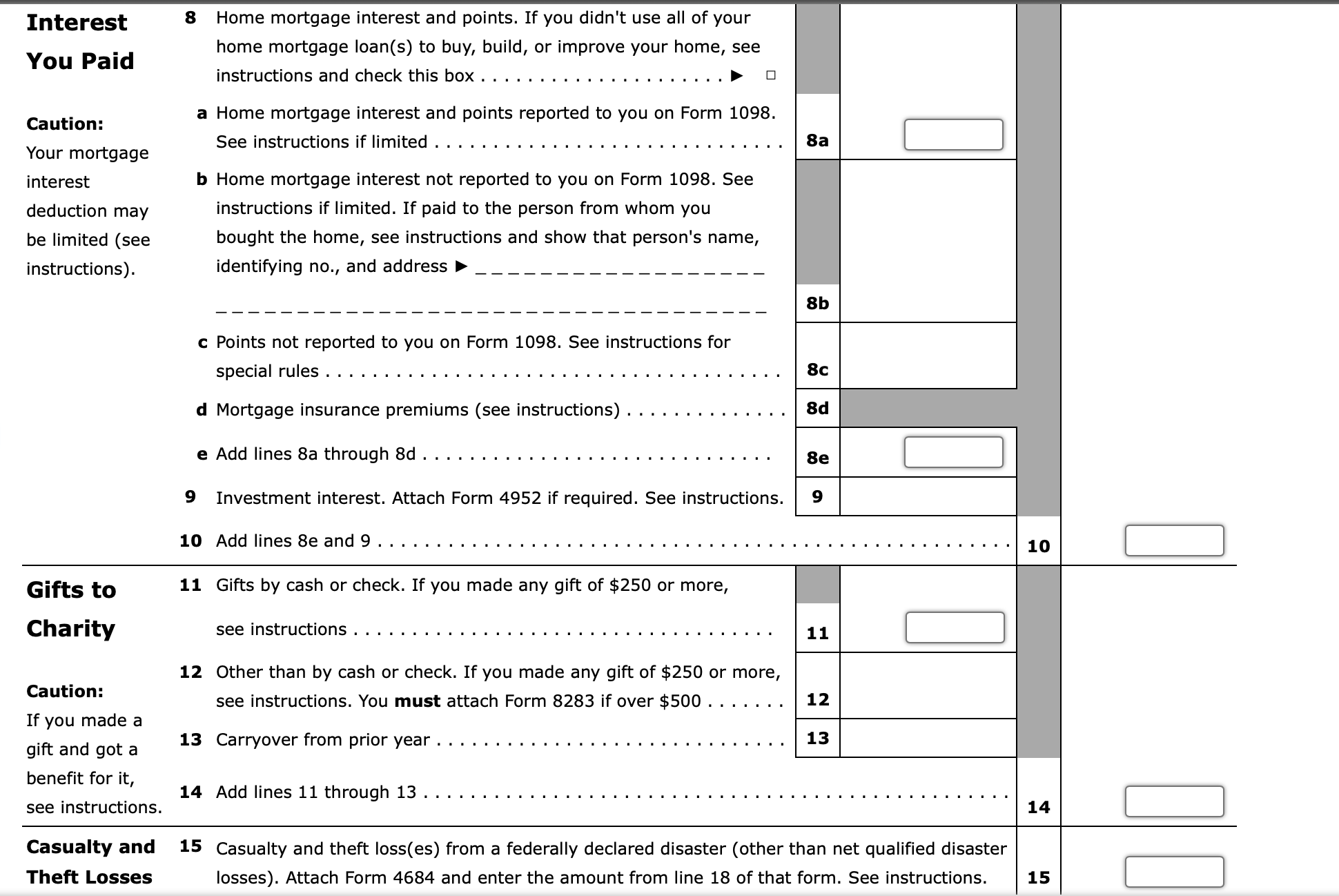

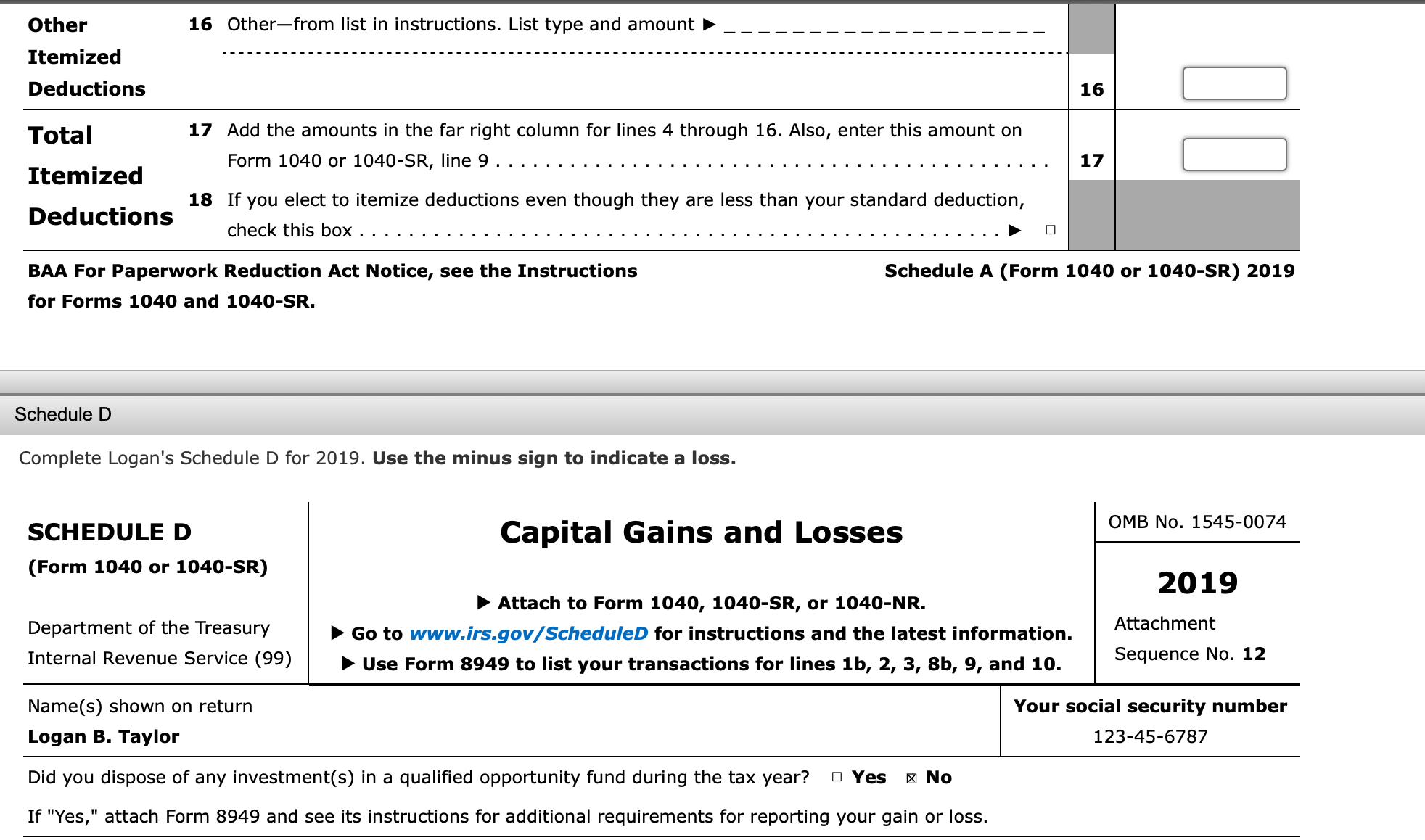

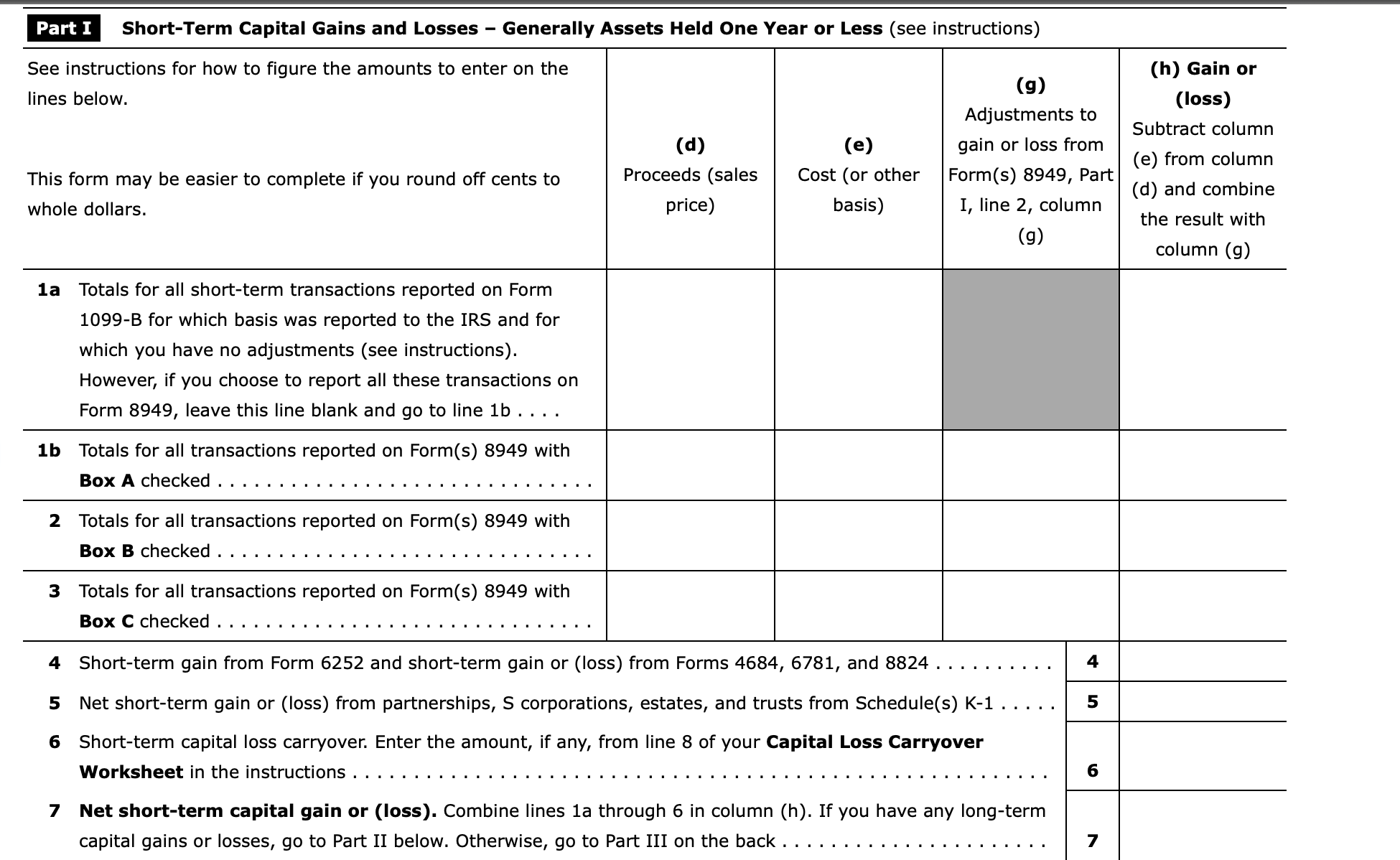

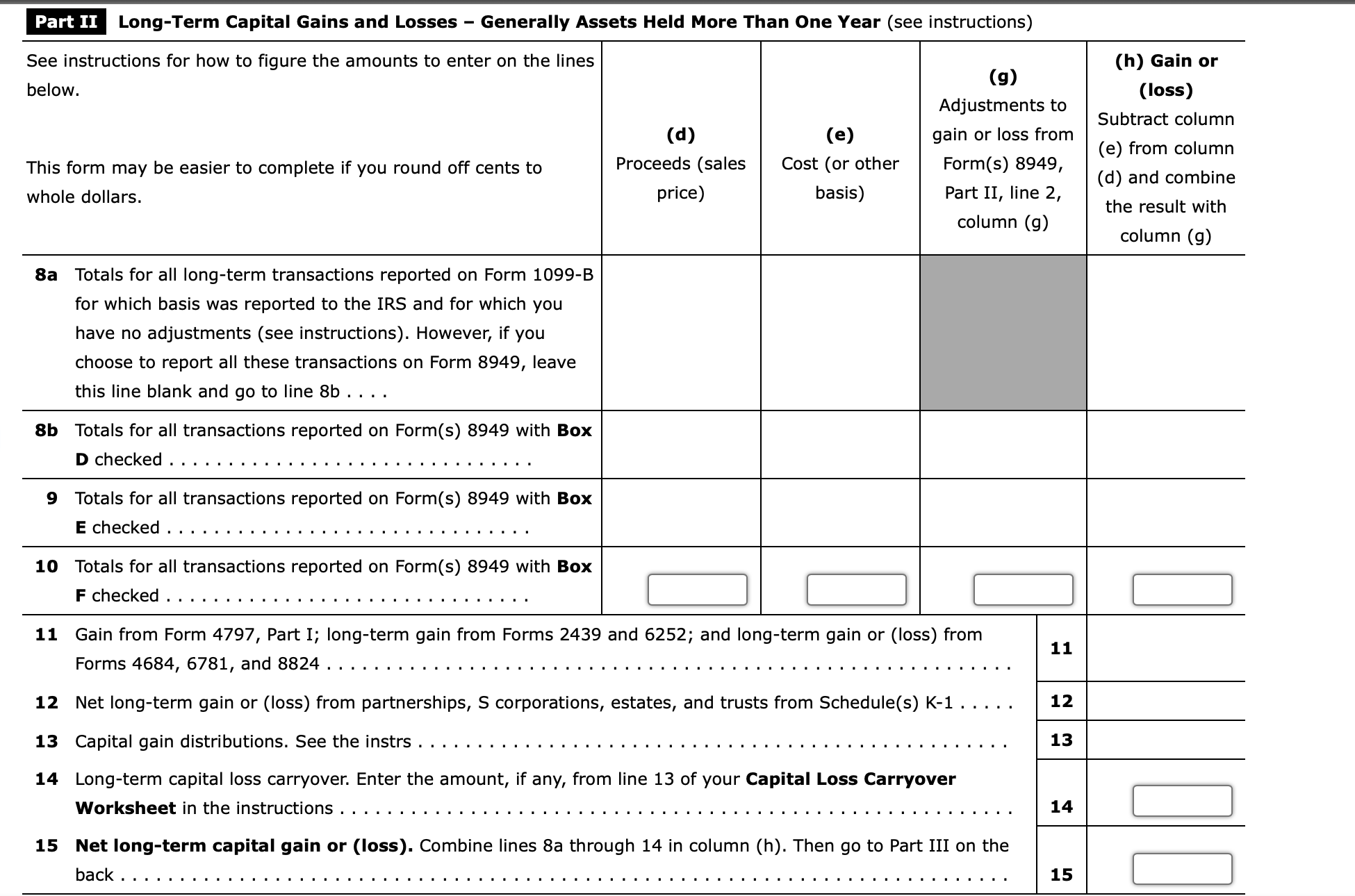

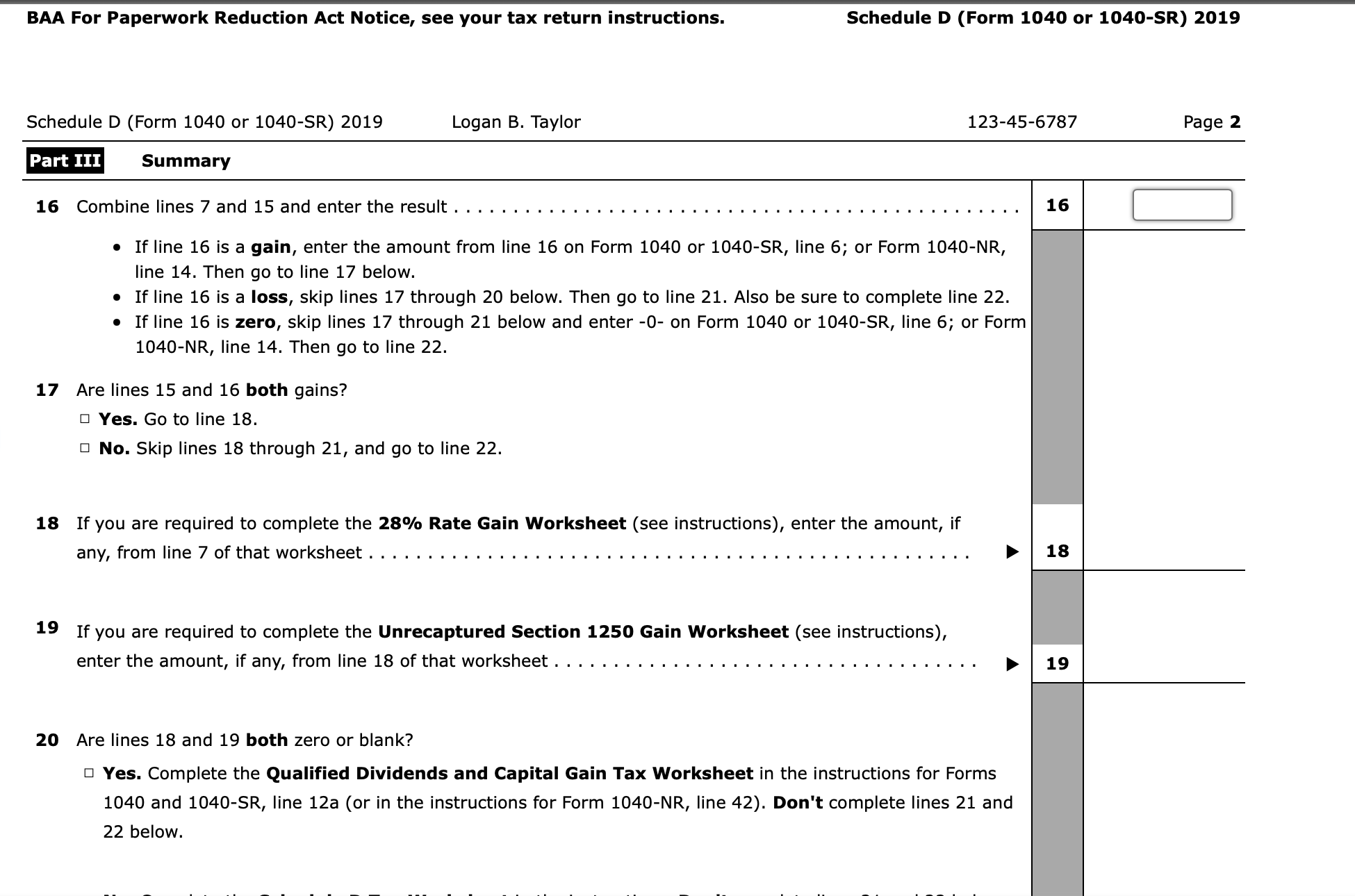

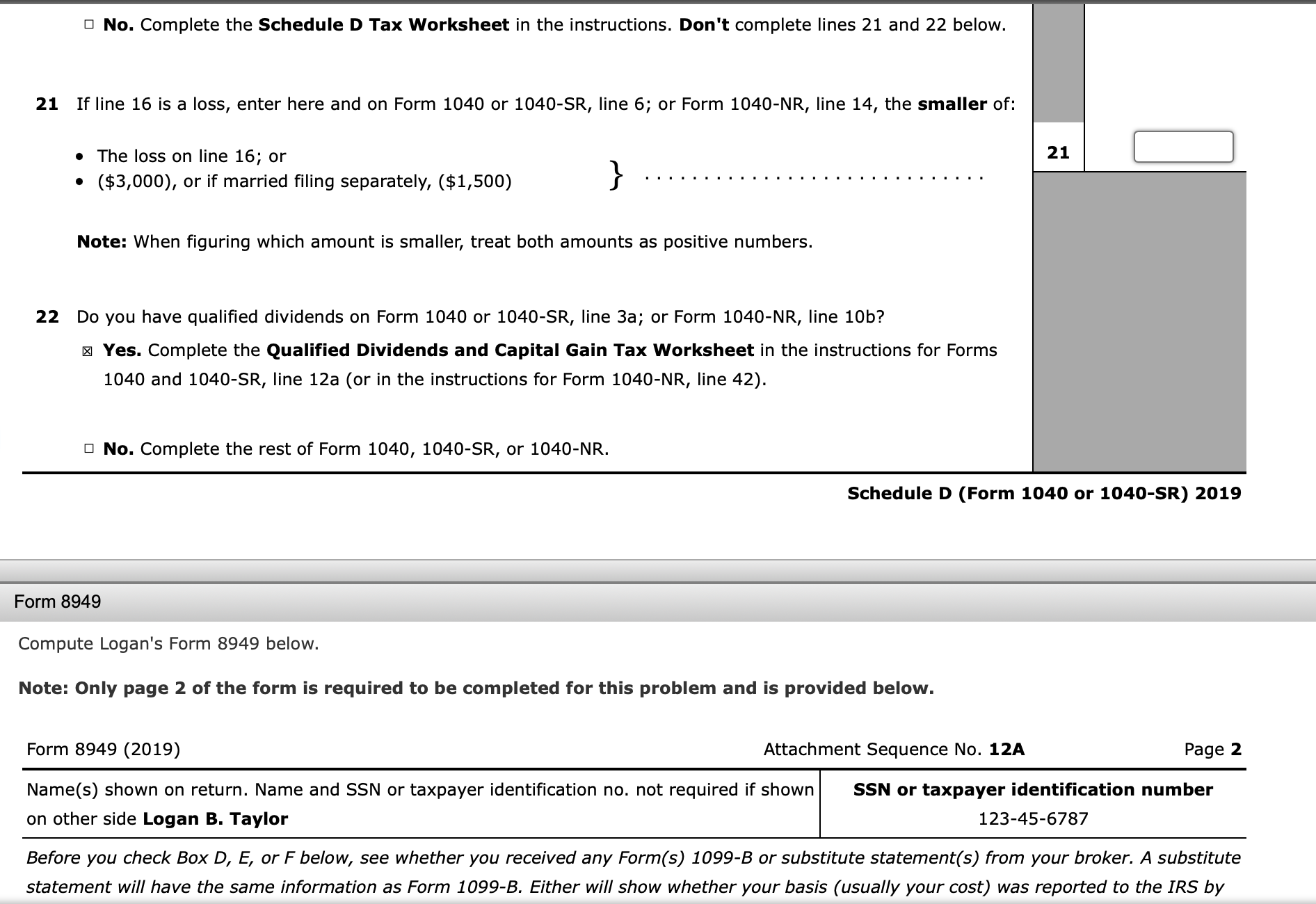

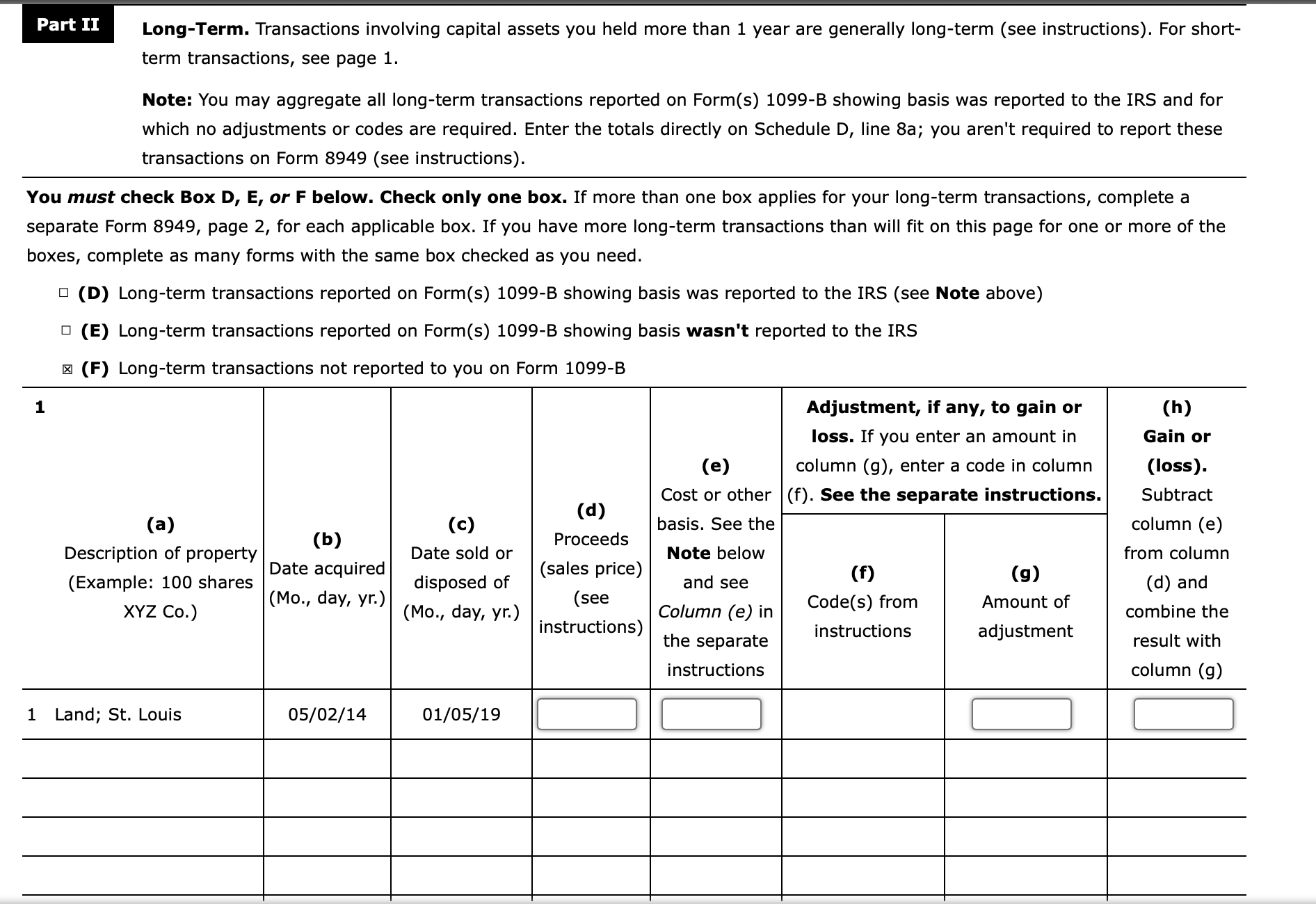

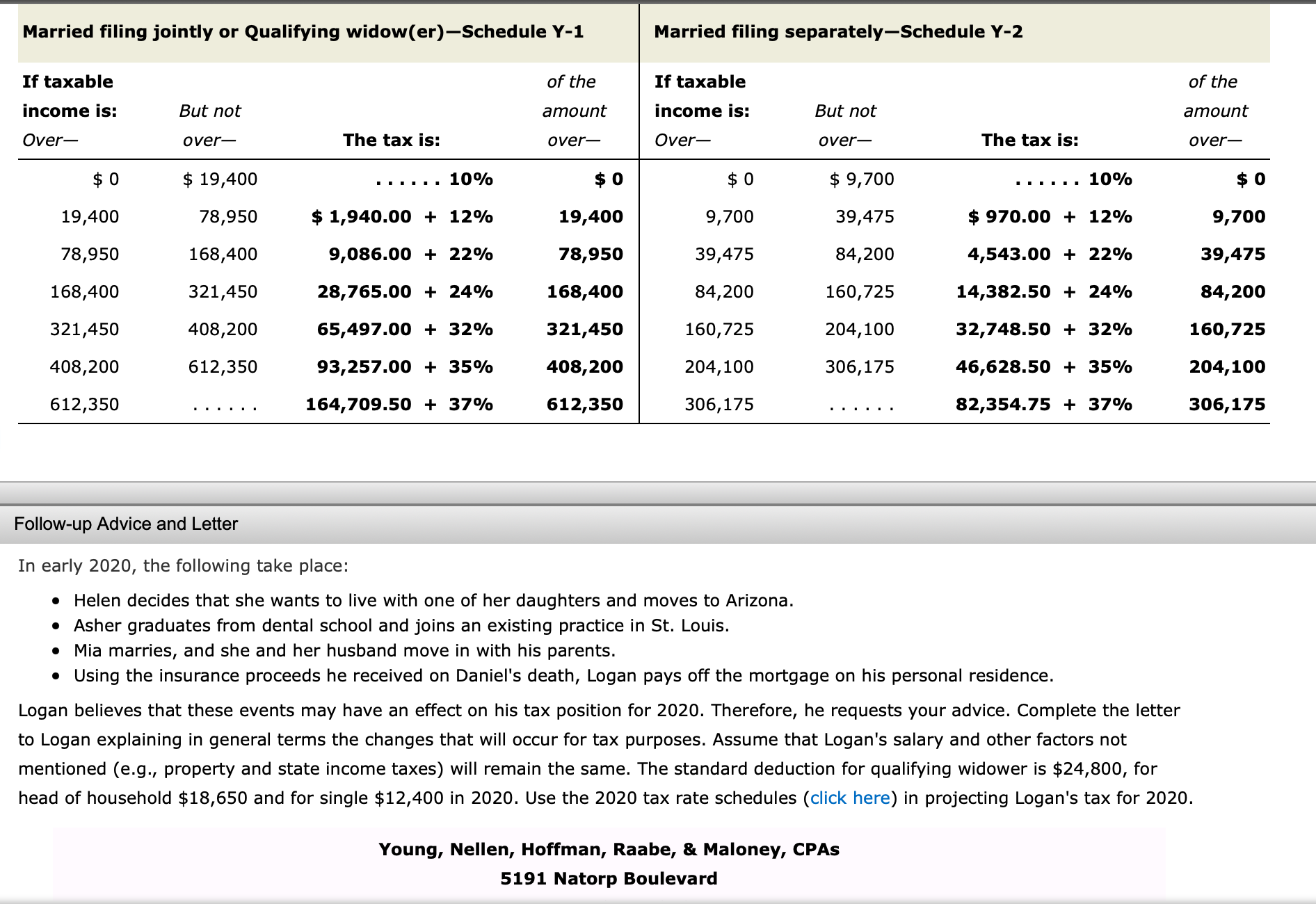

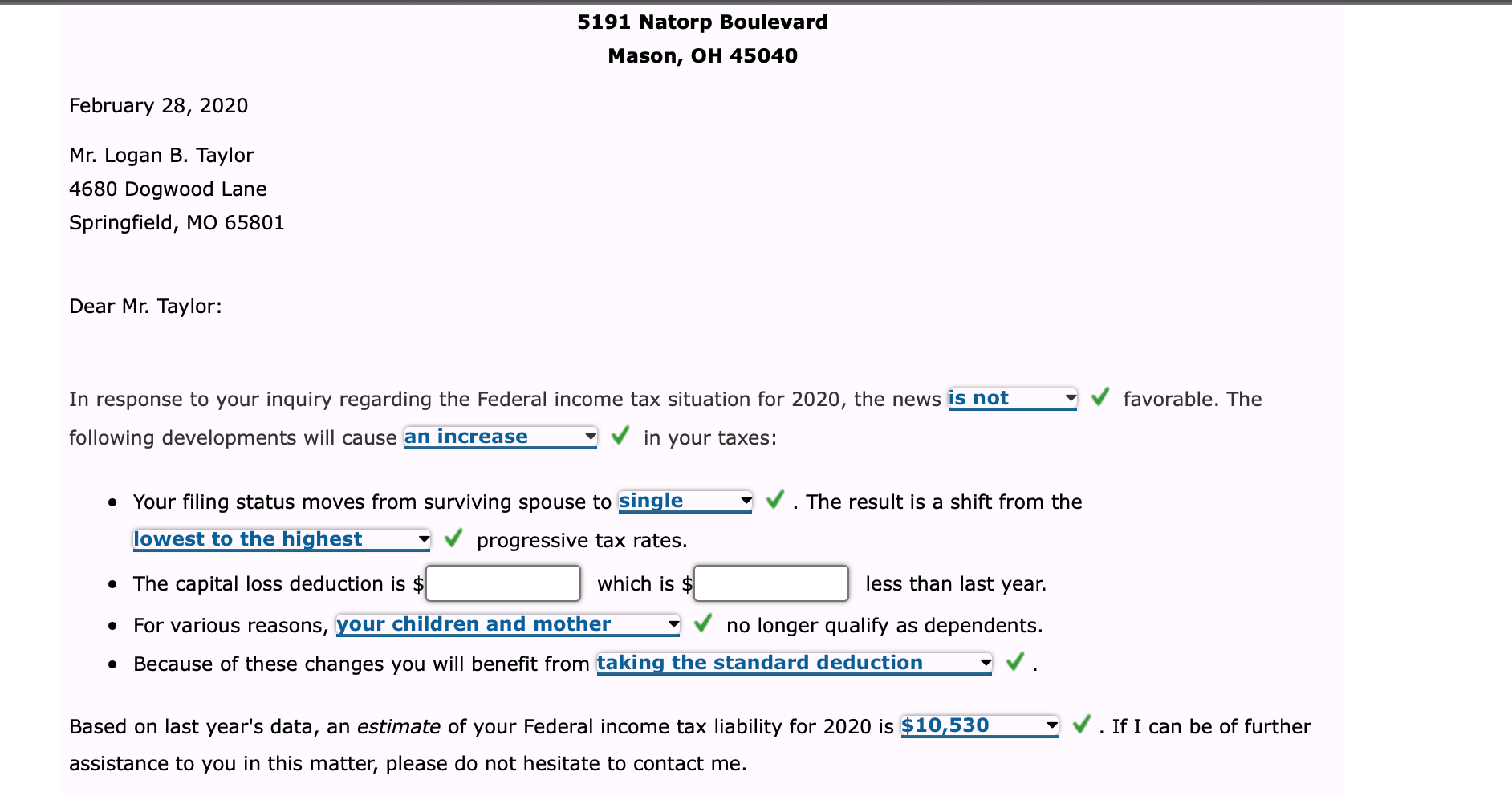

Instructions Form 1040 Schedule A Schedule D Form 8949 2019 Tax rate Schedules Follow-up Advice and Letter Instructions Note: This problem is for the 2019 tax year. Logan B. Taylor is a widower whose wife, Sara, died on June 6, 2017. He lives at 4680 Dogwood Lane, Springfield, MO 65801. He is employed as a paralegal by a local law firm. During 2019, he had the following receipts: Salary $ 80,000 Interest income- Money market account at Omni Bank $300 Savings account at Boone State Bank 1,100 City of Springfield general purpose bonds 3,000 4,400 Inheritance from Daniel 60,000 Life insurance proceeds 200,000 Amount from sale of St. Louis lot 80,000 Proceeds from estate sale 9,000 Federal income tax refund (for 2018 tax overpayment) 700 Logan inherited securities worth $60,000 from his uncle, Daniel, who died in 2019. Logan also was the designated beneficiary of an insurance policy on Daniel's life with a maturity value of $200,000. The lot in St. Louis was purchased on May 2, 2014, for $85,000 and held as an investment. Because the neighborhood has deteriorated, Logan decided to cut his losses and sold the lot on January 5, 2019, for $80,000. The estate sale consisted largely of items belonging to Sara and Daniel (e.g., camper, boat, furniture, and fishing and hunting equipment). Logan estimates that the property sold originally cost at least twice the $9,000 he received and has declined or stayed the same in value since Sara and Daniel died. Logan's expenditures for 2019 include the following:Logan's expenditures for 2019 include the following: Medical expenses (including $10,500 for dental) $11,500 Taxes- State of Missouri income tax (includes withholdings during 2019) $4,200 Property taxes on personal residence 4,500 8,700 Interest on home mortgage (Boone State Bank) 5,600 Contribution to church (paid pledges for 2019 and 2020) 4,800 While Logan and his dependents are covered by his employer's health insurance policy, he is subject to a deductible, and dental care is not included. The $10,500 dental charge was for Helen's implants. Helen is Logan's widowed mother, who lives with him (see below). Logan normally pledges $2,400 ($200 per month) each year to his church. On December 5, 2019, upon the advice of his pastor, he prepaid his pledge for 2020. Logan's household, all of whom he supports, includes the following: Social Security Number Birth Date Logan Taylor (age 48) 123-45-6787 08/30/1971 Helen Taylor (age 70) 123-45-6780 01/13/1949 Asher Taylor (age 23) 123-45-6783 07/18/1996 Mia Taylor (age 22) 123-45-6784 02/16/1997 Helen receives a modest Social Security benefit. Asher, a son, is a full-time student in dental school and earns $4,500 as a part-time dental assistant. Mia, a daughter, does not work and is engaged to be married. Federal income tax of $4,500 was withheld from his wages. Required: Compute Logan's income tax for 2019. If Logan has any overpayment on his income tax, he wants the refund sent to him. Assume that theCompute Logan's income tax for 2019. If Logan has any overpayment on his income tax, he wants the refund sent to him. Assume that the proper amounts of Social Security and Medicare taxes were withheld. Logan does not own and did not use any virtual currency during the year, and he does not want to contribute to the Presidential Election Campaign Fund. - Make realistic assumptions about any missing data. - Enter all amounts as positive numbers except any losses. Use the minus sign to indicate a loss. - If an amount box does not require an entry or the answer is zero, enter "0". - It may be necessary to complete the other tax schedules before completing Form 1040. - Use the included tax rate schedules to compute the tax. When computing the tax liability, do not round your immediate calculations. If required round your final answers to the nearest dollar. Form 1040 Complete Form 1040 below for Logan Taylor. Form Department of the TreasuryInternal Revenue Service (99) 1040 U.S. Individual Income Tax Return 2019 OMB No. 1545-0074 IRS Use Only Filing Status Qualiing widowger) (9W2 v Your first name and middle initial Last name Your social security number Logan B. Taylor 12345-6787 If joint return, spouse's first name and middle initial Last name Spouse's social security number Home address (number and street). If you have a P.O. box, see instructions. Apt. no. Presidential Election 4680 Dogwood Lane Campaign City, town or post ofce, state, and ZIP code. If you have a foreign address, also complete spaces below ChECk here 'f you, or your spouse (see instructions) if filing jointly, want $3 to go to Springfield Mo 65801 this fund. Checking a box below I Foreign country name Foreign province/state/county Foreign postal code If more than four dependents, see instructions and v here DO Standard Someone can claim: None Deduction You: None Age / Blindness Spouse: None Dependents (see instructions): (2) Social security number (3) Relationship to you (4) v if qualifies for (see instructions): (1) First name Last name Child tax credit Credit for other dependents Helen Taylor 123-45-6780 Parent No Asher Taylor 123-45-6783 Child Mia Taylor 123-45-6784 Child 0 1 Wages, salaries, tips, etc. Attach Form(s) W-2 . . . 1 b Taxable interest. Attach Sch. B 2a Tax-exempt interest . . 2a if required 2b Standard b Ordinary dividends. Attach 3a Qualified dividends . . . 3a Deduction for- Sch. B if required 3b Single or 4a IRA distributions . . 4a b Taxable amount . . Married filing . . . 4b separately, c Pensions and annuities 4c Taxable amount . . . . . 4d $12,200 5a . Married filing 5a Social security benefits b Taxable amount . . . . . . . . 5b jointly or 6 Capital gain or (loss). Attach Schedule D if required. If not required, check here . . . 6 QualifyingI" u Head of b Add lines 1, 2b, 3b, 4b, 4d, 5b, 6, and 7a. This is your total income ............ b 7b household, 8a Adjustments to income from Schedule 1, line 22 ............................ 8a $18,350 - If you checked any box under b Subtract line 8a from line 7b. This is your adjusted gross income .............. b 8b C] Standard 9 Standard deduction or itemized deductions (from Deduction, see Schedule A) .................................... 9 :] instructions. 10 Qualified business income deduction. Attach Form 8995 or Form 8995-A ................................... 10 ua Add \"n... and .0 .................................................. :1 b Taxable income. Subtract line 11a from line 8b. If zero or less, enter -0- ........... a :] BAA For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Form 1040 (2019) Form 1040 (2019) Logan B. Taylor 123-45-6787 Page 2 12a Tax (see inst.) Check if any from Form(s): 1 D 8814 2 III 4972 3 III ................... b Add Schedule 2, line 3, and line 12a and enter the total ...................... 5 13a Child tax credit or credit for other dependents ............ 13a :] b Add Schedule 3, line 7, and line 13a and enter the total ...................... b 14 Subtract line 13b from line 12b. If zero or less, enter -0- ....................... 15 Other taxes, including self-employment tax, from Schedule 2, line 10 .............. 16 Add lines 14 and 15. This is your total tax .............................. b 17 Federal income tax withheld from Forms W2 and 1099 ........................ . If you have a 18 Other payments and refundable credits: . . . qualifying child, a Earned income credit (EIC) . . . . . . 18a attach Sch. EIC. If you have b Additional child tax credit. Attach Schedule 8812 . . 18b nontaxable combat pay, see c American opportunity credit from Form 8863, line 8 18c instructions. d Schedule 3, line 14 . . 18d e Add lines 18a through 18d. These are your total other payments and refundable credits . . 18e 19 Add lines 17 and 18e. These are your total payments . . 19 Refund 20 If line 19 is more than line 16, subtract line 16 from line 19. This is the amount you overpaid . . 20 21a Amount of line 20 you want refunded to you. If Form 8888 is attached, check here _ 0 21a Direct deposit? b Routing number c Type: O Checking Savings See instructions. d Account number 22 Amount of line 20 you want applied to your 2020 estimated tax . . 22 Amount 23 Amount you owe. Subtract line 19 from line 16. For details on how to pay, see instructions . . 23 You Owe 24 Estimated tax penalty (see instructions) 24 Third Party Do you want to allow another person (other than your paid preparer) to discuss this return with Yes. Complete below. the IRS? See instructions. x No Designee (Other than Designee's Phone Personal identification paid preparer) name no. number (PIN) Sian Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, andSign panying su to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than Here taxpayer) is based on all information of which preparer has any knowledge. Your signature Date Your occupation If the IRS sent you an Identity Joint return? Protection PIN, enter it here See (see inst.) instructions. Paralegal Keep a copy for Spouse's signature. If a joint Date Spouse's occupation If the IRS sent your spouse an your records. return, both must sign. Identity Protection PIN, enter it here (see inst.) Phone no. Email address Paid Preparer's name Preparer's signature Date PTIN Check if: Self-Prepared 0 3rd Party Designee Preparer Firm's name Phone no. Self-employed Use Only Firm's address Firm's EIN Go to www.irs.gov/Form1040 for instructions and the latest information. Form 1040 (2019) Schedule A Complete Logan's Schedule A for 2019. OMB No. 1545-0074 SCHEDULE A Itemized Deductions (Form 1040 or 1040-SR) Go to www.irs.gov/ScheduleA for instructions and the latest information. 2019 (Rev. January 2020) Attach to Form 1040 or 1040-SR. Department of the Treasury Attachment Caution: If you are claiming a net qualified disaster loss on Form 4684, see the Internal Revenue Service (99) Sequence No. 07Name(s) shown on Form 1040 or 1040-SR Your social security number Logan B. Taylor 123-45-6787 Caution: Do not include expenses reimbursed or paid by others. Medical 1 Medical and dental expenses (see instructions) ............... I and Dental 2 Enter amount from Form 1040 or 1040- Expenses SR, line 8b ...................... 2 S 3 Multiply line 2 by 7.5% (0.075) .......................... l 4 Subtract line 3 from line 1. If line 3 is more than line 1, enter -0- .................... I S Taxes You 5 State and local taxes. Paid a State and local income taxes or general sales taxes. You may include either income taxes or general sales taxes on line Sa, but not both. If you elect to include general sales taxes instead of income taxes, check this box ....................... b I: 5a b State and local real estate taxes (see instructions) ............ 5., c State and local personal prOperty taxes .................... 5c d Add lines 5a through EC ............................... 5d e Enter the smaller of line 5d or $10,000 ($5,000 if married ling separately) ....................................... 5e 6 Other taxes. List type and amount b _______________ Militia 6 7 Add "neg em 6 ..................................................... I [:1 Interest 8 Home mortgage interest and points. If you didn't use all of your - Interest 8 Home mortgage interest and points. If you didn't use all of your _ home mortgage loan(s) to buy, build, or improve your home, see You Paid . . . Instructions and check this box ..................... b D Caution: a Home mortgage Interest and paints reported to you on Form 1098. See instructions if limited .............................. Your mortgage interest deduction may be limited (see b Home mortgage interest not reported to you on Form 1098. See instructions if limited. If paid to the person from whom you bought the home, see instructions and show that person's name, instructions). identifying no., and address > __________________ c Points not reported to you on Form 1098. See instructions for special rules ....................................... d Mortgage insurance premiums (see instructions) .............. e Add lines 8a through 8d .............................. 9 Investment interest. Attach Form 4952 if required. See instructions. 10 Add lines 8e and 9 ...................................................... Gifts to 11 Gifts by cash or check. If you made any gift of $250 or more, Charity see instructions .................................... _ 12 Other than by cash or check. If you made any gift of $250 or more, Caution: see instructions. You must attach Form 8283 if over $500 ....... If you made a _ gi: and got a 13 Carryover from prior year .............................. benefit for it ' 14 Add lines 11 through 13 .................................................. see instructions. Casualty and 15 Casualty and theft loss(es) from a federally declared disaster (other than net qualied disaster Theft Losses losses). Attach Form 4684 and enter the amount from line 18 of that form. See instructions. Other Itemized """""""""""""""""""""""""""""""""""""""""""""""""""""" Ded uctions Otherfrom list in instructions. List type and amount > ___________________ Add the amounts in the far right column for lines 4 through 16. Also, enter this amount on Form 1040 or 1040-SR, line 9 ............................................. Total Itemized _ 18 If you elect to itemize deductions even though they are less than your standard deduction, Deductions . check this box .................................................... b D BAA For Paperwork Reduction Act Notice, see the Instructions Schedule A (Form 1040 or 1040-SR) 2019 for Forms 1040 and 1040-SR. Schedule D Complete Logan's Schedule D for 2019. Use the minus sign to indicate a loss. . . OMB No. 1545-0074 SCHEDULE D Capital Gains and Losses (Form 1040 or 1040-SR) 20 19 > Attach to Form 1040, 1040-SR, or 1040-NR. Department Of the Treasury > Go to www.irs.gov/ScheduleD for instructions and the latest information. Attachment Internal Revenue Service (99) > Use Form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. sequence No. 12 Name(s) shown on return Your social security number Logan B. Taylor 123-45-6787 Did you dispose of any investment(s) in a qualied opportunity fund during the tax year? D Yes IE No If "Yes," attach Form 8949 and see its instructions for additional requirements for reporting your gain or loss. m Short-Term Capital Gains and Losses - Generally Assets Held One Year or Less (see instructions) See instructions for how to figure the amounts to enter on the lines below. (d) (a) This form may be easier to complete if you round off cents to Proceeds (sales COSt (or other whole dollars. price) basis) 1a Totals for all short-term transactions reported on Form 1099-3 for which basis was reported to the IRS and for which you have no adjustments (see instructions). However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 1b . . . . 1b Totals for all transactions reported on Form(s) 8949 with Box A checked ............................... (9) Adjustments to gain or loss from Form(s) 8949, Part 1, line 2, column (9) (h) Gain or (loss) Subtlact column (e) from column (d) and combine the result with column (9) Totals for all transactions reported on Form(s) 8949 with Box B checked ............................... Totals for all transactions reported on Form(s) 8949 with Box C checked ............................... Net short-term gain or (loss) from partnerships, S corporations, estates, and trusts from Schedule(s) Kl ..... Short-term gain from Form 6252 and short-term gain or (loss) from Forms 4684, 6781, and 8824 .......... Short-term capital loss carryover. Enter the amount, if any, from line 8 of your Capital Loss Carryover Worksheet in the instructions ......................................................... Net short-term capital gain or (loss). Combine lines 1a through 6 in column (h). If you have any longterm capital gains or losses, go to Part 11 below. Otherwise, go to Part III on the back ...................... m Long-Term Capital Gains and Losses - Generally Assets Held More Than One Year (see instructions) See instructions for how to figure the amounts to enter on the lines below. This form may be easier to complete if you round off cents to whole dollars. (d) Proceeds (sales price) (e) Cost (or other basis) 8a Totals for all long-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see instructions). However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 8b. . . . 8b Totals for all transactions reported on Form(s) 8949 with Box D checked ............................... (9) Adjustments to gain or loss from Form(s) 8949, Part II, line 2, column (9) (h) Gain or (loss) Subtract column (e) from column (d) and combine the result with column (9) 9 Totals for all transactions reported on Form(s) 8949 with Box E checked ............................... 10 Totals for all transactions reported on Form(s) 8949 with Box F checked ............................... 11 Gain from Form 4797, Part I; long-term gain from Forms 2439 and 6252; and long-term gain or (loss) from 11 Forms 4684, 6781, and 8824 .......................................................... 12 Net long-term gain or (loss) from partnerships, S corporations, estates, and trusts from Schedule(s) K1 ..... 12 13 Capital gain distributions. See the instrs .................................................. 13 14 Long-term capital loss carryover. Enter the amount, if any, from line 13 of your Capital Loss Carryover Worksheet in the instructions ......................................................... 14 15 Net long-term capital gain or (loss). Combine lines 8a through 14 in column (h). Then go to Part III on the back ........................................................................... 15 BAA For Paperwork Reduction Act Notice, see your tax return instructions. Schedule D (Form 1040 or 1040-SR) 2019 Schedule D (Form 1040 or 1040-SR) 2019 Logan B. Taylor 123-45-6787 Page 2 Part III Summary 16 Combine lines 7 and 15 and enter the result ................................................ 16 :1 u If line 16 is a gain, enter the amount from line 16 on Form 1040 or 1040SR, line 6; or Form 1040-NR, line 14. Then go to line 17 below. . If line 16 is a loss, skip lines 17 through 20 below. Then go to line 21. Also be sure to complete line 22. - If line 16 is zero, skip lines 17 through 21 below and enter -0- on Form 1040 or 1040-SR, line 6; or Form 1040-NR, line 14. Then go to line 22. 17 Are lines 15 and 16 both gains? D Yes. Go to line 18. D No. Skip lines 18 through 21, and go to line 22. 18 If you are required to complete the 28% Rate Gain Worksheet (see instructions), enter the amount, if any, from line 7 of that worksheet ................................................... k 19 If you are required to complete the Unrecaptured Section 1250 Gain Worksheet (see instructions), enter the amount, if any, from line 18 of that worksheet .................................... p u 20 Are lines 18 and 19 both zero or blank? D Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and 1040SR, line 12a (or in the instructions for Form 1040-NR, line 42). Don't complete lines 21 and 22 below. D No. Complete the Schedule D Tax Worksheet in the instructions. Don't complete lines 21 and 22 below. 21 If line 16 is a loss, enter here and on Form 1040 or 1040-SR, line 6; or Form 1040-NR, line 14, the smaller of: - The loss on line 16; or - ($3,000), or if married ling separately, ($1,500) } """"""""""""""" Note: When figuring which amount is smaller, treat both amounts as positive numbers. 22 Do you have qualied dividends on Form 1040 or 1040-SR, line 3a; or Form 1040-NR, line 10b? Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and 1040-SR, line 12a (or in the instructions for Form 1040-NR, line 42). D No. Complete the rest of Form 1040, 1040SR, or 1040-NR. Schedule D (Form 1040 or 1040-SR) 2019 Form 8949 w Compute Logan's Form 8949 below. Note: Only page 2 of the form is required to be completed for this problem and is provided below. Form 8949 (2019) Attachment Sequence No. 12A Page 2 SSN or taxpayer identication number 123-45-6787 Name(s) shown on return. Name and SSN or taxpayer identication no. not required if shown on other side Logan B. Taylor Before you check Box D, E, or F below, see whether you received any Form(s) 1099-3 or substitute statement(s) from your broker. A substitute statement will have the same information as Form 1099-3. Either will show whether your basis (usually your cost) was reported to the IRS by m Long-Term. Transactions involving capital assets you held more than 1 year are generally long-term (see instructions). For short- term transactions, see page 1. Note: You may aggregate all long-term transactions reported on Form(s) 1099-B showing basis was reported to the IRS and for which no adjustments or codes are required. Enter the totals directly on Schedule D, line 8a; you aren't required to report these transactions on Form 8949 (see instructions). You must check Box D, E, or F below. Check only one box. If more than one box applies for your long-term transactions, complete a separate Form 8949, page 2, for each applicable box. If you have more long-term transactions than will fit on this page for one or more of the boxes, complete as many forms with the same box checked as you need. El (D) Longterm transactions reported on Form(s) 1099-B showing basis was reported to the IRS (see Note above) D (E) Longterm transactions reported on Form(s) 1099-B showing basis wasn't reported to the IRS 21 (F) Long-term transactions not reported to you on Form 1099-B 1 Adjustment, if any, to gain or (h) loss. If you enter an amount in Gain or (e) column (9), enter a code in column (loss). Cost or other (f). See the separate instructions. Subtract (d) . (a) (c) baSlS. See the column (e) _ _ (b) Proceeds Descrlptlon of property D t I d Date sold or ( I I ) Note below from column a e ac urre sa es rice (Example: 100 shares q disposed of p and see (f) (9) (d) and (Ma. day. yr.) (see Code(s) from Amount of XYZ Co.) (Mo., day, yr.) I t ct' ) Column (e) in combine the Ins ru Ions - - - the separate Instructions adjustment result with instructions column (9) 1 Land; St. Louis [:1:] 05/02/14 01/05/19 2 Totals. Add the amounts in columns (d), (e), (g), and (h) (subtract negative amounts). Enter each total here and include on your Schedule D, line 8b (if Box D above is checked), line 9 (if Box E above is checked), or line 10 (if Box F above is checked) b [:JC] Note: If you checked Box D above but the basis reported to the IRS was incorrect, enter in column (e) the basis as reported to the IRS, and enter an adjustment in column (9) to correct the basis. See Column (9) in the separate instructions for how to gure the amount of the adjustment. Form 8949 (2019) 2019 Tax rate Schedules Use the 2019 Tax Rate Schedules to compute the tax. (Note: Because the tax rate schedules are used instead of the tax tables, the amount of tax computed may vary slightly from the amount listed in the tables.) SingleSchedule X 2019 Tax Rate Schedules Head of householdSchedule Z If taxable of the If taxable of the income is: But not amount income is: But not amount Over over The tax is: aver Over over The tax is: over $ 0 $ 9,700 ...... 10% $ 0 $ 0 $ 13,850 ...... 10% $ 0 9,700 39,475 $ 970.00 + 12% 9,700 13,850 52,850 $ 1,385.00 + 12% 13,850 39,475 84,200 4,543.00 + 22% 39,475 52,850 84,200 6,065.00 + 22% 52,850 84,200 160,725 14,382.50 + 24% 84,200 84,200 160,700 12,962.00 + 24% 84,200 160,725 204,100 32,748.50 + 32% 160,725 160,700 204,100 31,322.00 + 32% 160,700 Married filing jointly or Qualifying widow(er)Schedule Y-1 Married ling separatelySchedule Y-2 If taxable of the If taxable of the income is: But not amount income is: But not amount Over over The tax is: over Over over The tax is: over $ 0 $ 19,400 ...... 1010 $ 0 $ 0 $ 9,700 ...... 1010 $ 0 19,400 78,950 $1,940.00 + 12% 19,400 9,700 39,475 $970.00 + 12% 9,700 78,950 168,400 9,086.00 + 22% 78,950 39,475 84,200 4,543.00 + 22% 39,475 168,400 321,450 28,765.00 + 24% 168,400 84,200 160,725 14,382.50 + 24% 84,200 321,450 408,200 65,497.00 + 32% 321,450 160,725 204,100 32,748.50 + 32% 160,725 408,200 612,350 93,257.00 + 35% 408,200 204,100 306,175 46,628.50 + 35% 204,100 612,350 ...... 164,709.50 + 37% 612,350 306,175 ...... 82,354.75 + 37% 306,175 Follow-up Advice and Letter In early 2020, the following take place: Logan believes that these events may have an effect on his tax position for 2020. Therefore, he requests your advice. Complete the letter Helen decides that she wants to live with one of her daughters and moves to Arizona. Asher gladuates from dental school and joins an existing practice in St. Louis. Mia marries, and she and her husband move in with his parents. Using the insumnce proceeds he received on Daniel's death, Logan pays off the mortgage on his personal residence. to Logan explaining in general terms the changes that will occur for tax purposes. Assume that Logan's salary and other factors not mentioned (e.g., property and state income taxes) will remain the same. The standard deduction for qualifying widower is $24,800, for head of household $18,650 and for single $12,400 in 2020. Use the 2020 tax rate schedules (click here) in projecting Logan's tax for 2020. Young, Nellen, Hoffman, Raabe, & Maloney, CPAs 5191 Natorp Boulevard 5191 Natorp Boulevard Mason, OH 45040 February 28, 2020 Mr. Logan B. Taylor 4680 Dogwood Lane Springeld, MO 65801 Dear Mr. Taylor: In response to your inquiry regarding the Federal income tax situation for 2020, the news 'is not w J favorable. The following developments will cause an increase v. V/ in your taxes: 0 Your filing status moves from surviving spouse to single ' v' . The result is a shift from the lowest to the highest 1 v' progressive tax rates. a The capital loss deduction is s:] which is is: less than last year. 0 For various reasons, your children and mother 1 VI no longer qualify as dependents. 0 Because of these changes you will benefit from taking the standard deduction v V/ . Based on last year's data, an estimate of your Federal income tax liability for 2020 is i510,530 'i v' . If I can be of further assistance to you in this matter, please do not hesitate to contact me

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts