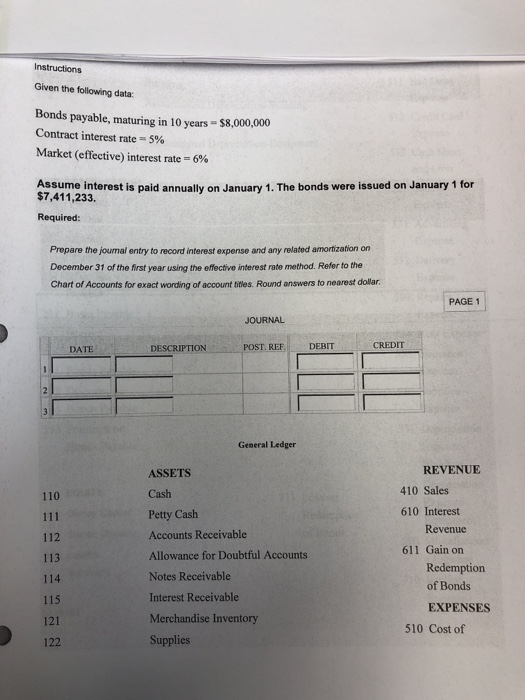

Question: Instructions Given the following data: Bonds payable, maturing in 10 years $8,000,000 Contract interest rate-5% Market (effective) interest rate = 6% Assume interest is paid

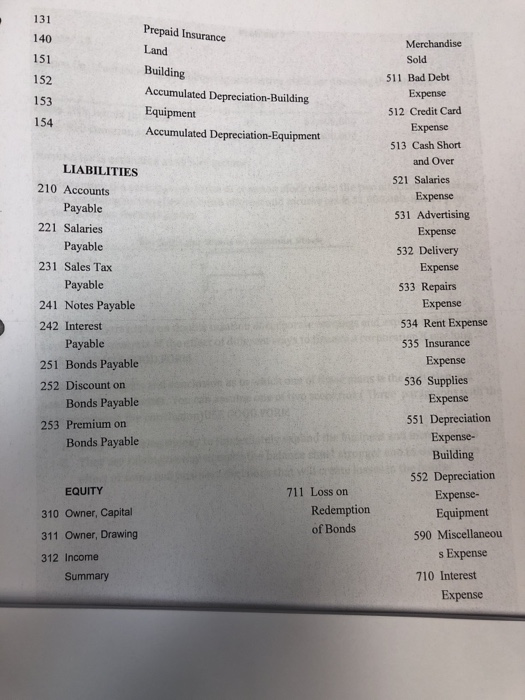

Instructions Given the following data: Bonds payable, maturing in 10 years $8,000,000 Contract interest rate-5% Market (effective) interest rate = 6% Assume interest is paid annually on January 1. The bonds were issued on January 1 for $7,411,233. Required: Prepare the jounal entry to record interest expense and any related amortization on December 31 of the first year using the effective interest rate method. Refer to the Chart of Accounts for exact wording of account titles. Round answers to nearest dollar. PAGE 1 OURNAL DATE DESCRIPTION POST. REFDEBIT CREDIT General Ledger REVENUE ASSETS Cash Petty Cash Accounts Receivable Allowance for Doubtful Accounts Notes Receivable Interest Receivable Merchandise Inventory Supplies 410 Sales 110 610 Interest Revenue 112 113 114 115 121 122 611 Gain on Redemption of Bonds EXPENSES 510 Cost of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts