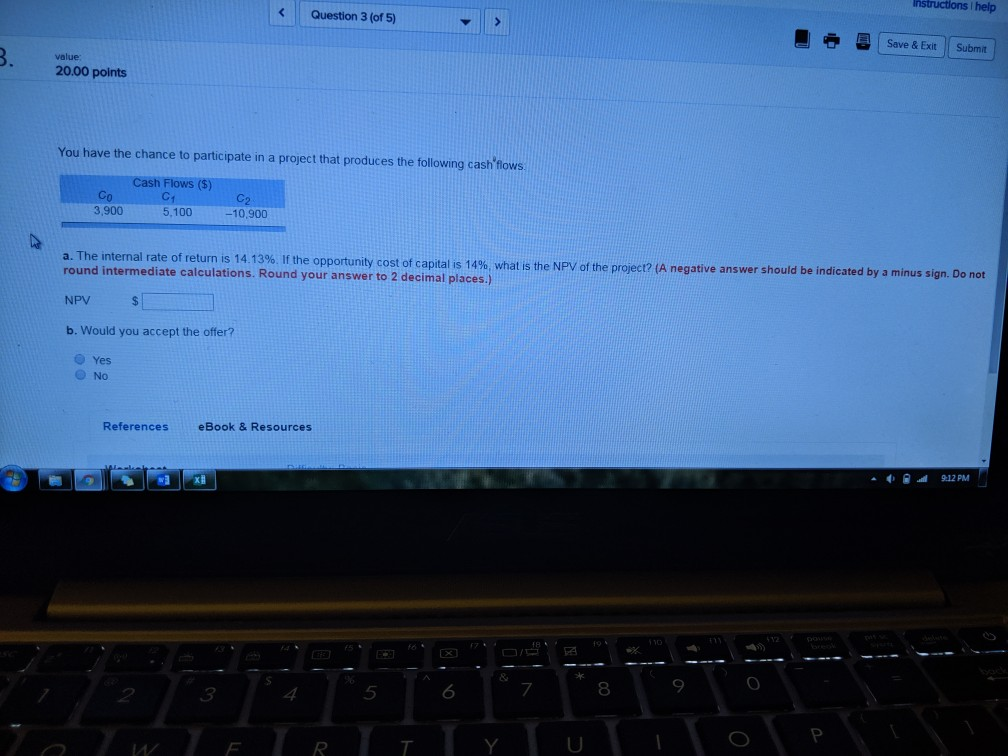

Question: Instructions I help Question 3 (of 5) Save & Exit Submit value 20.00 points You have the chance to participate in a project that produces

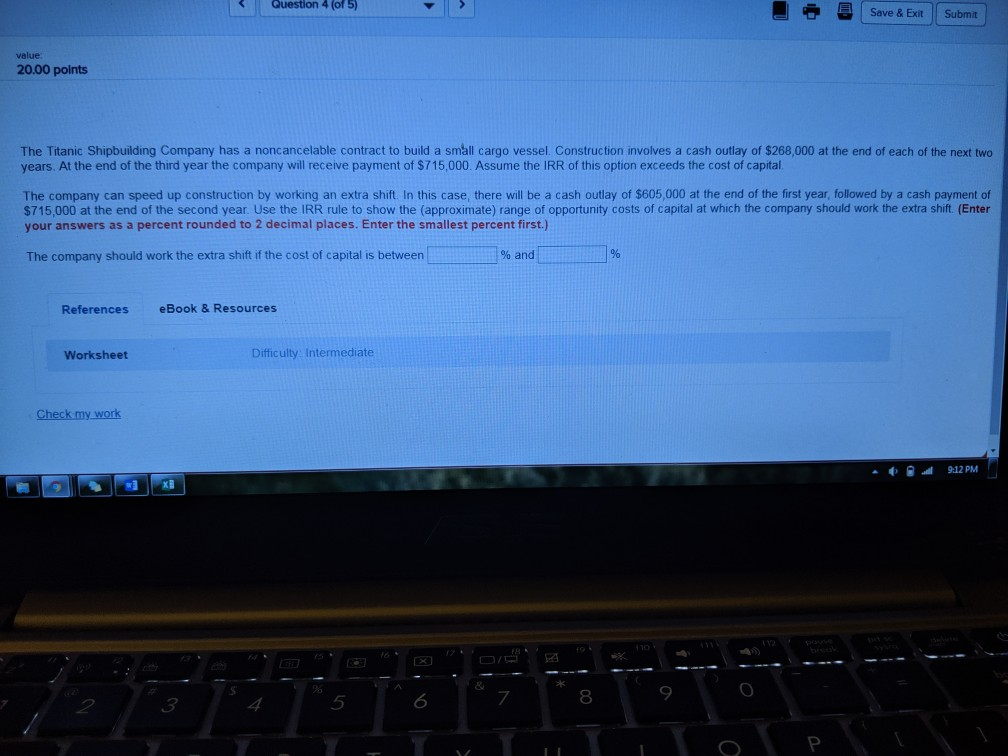

Instructions I help Question 3 (of 5) Save & Exit Submit value 20.00 points You have the chance to participate in a project that produces the following cash flows Cash Flows ($) C1 5,100 3,900 -10,900 a. The internal rate of return is 14.13%. If the opportunity cost of capital is 14%, what is the NPV of the project? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places.) NPV $ b. Would you accept the offer? Yes No References eBook & Resources . 9:12 PM WEBT YU o P. I Question 4 (of 5) Save & Exit Save & Ext Submit Subme value 20.00 points The Titanic Shipbuilding Company has a noncancelable contract to build a small cargo vessel. Construction involves a cash outlay of $268,000 at the end of each of the next two years. At the end of the third year the company will receive payment of $715,000. Assume the IRR of this option exceeds the cost of capital The company can speed up construction by working an extra shift. In this case, there will be a cash outlay of $605,000 at the end of the first year, followed by a cash payment of $715,000 at the end of the second year. Use the IRR rule to show the (approximate) range of opportunity costs of capital at which the company should work the extra shift. (Enter your answers as a percent rounded to 2 decimal places. Enter the smallest percent first.) The company should work the extra shift if the cost of capital is between % and References eBook & Resources Worksheet Difficulty: Intermediate Check my work 0 9 :12 PM 2 00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts