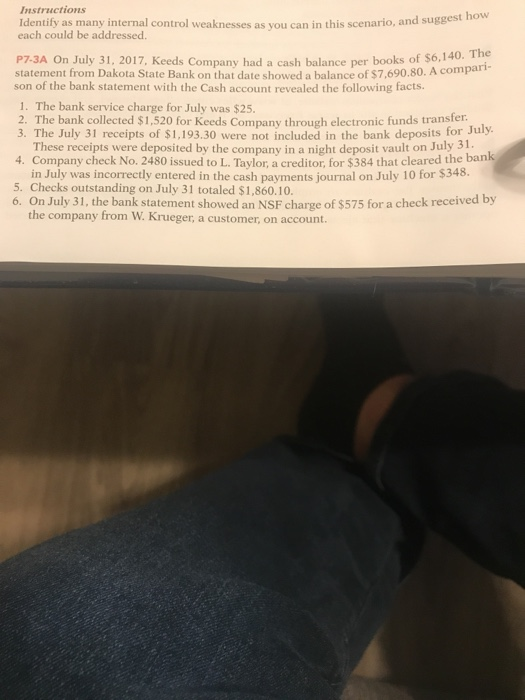

Question: Instructions Identify as many internal control weaknesses as vou can in this scenario, and suggest ho each could be addressed. P7-3A On July 31, 2017,

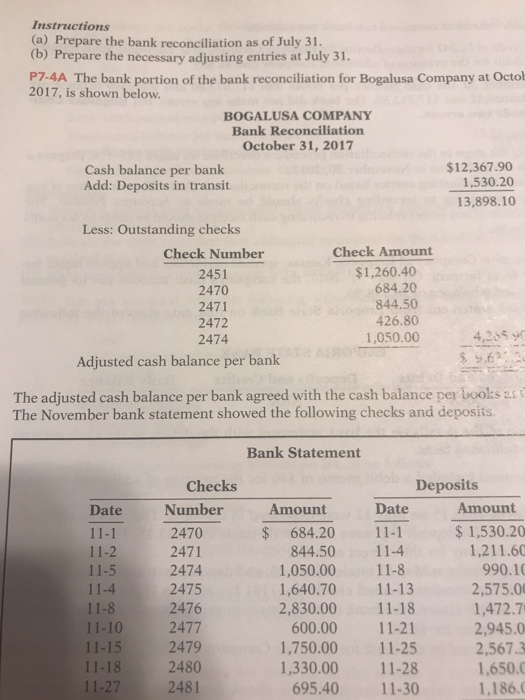

Instructions Identify as many internal control weaknesses as vou can in this scenario, and suggest ho each could be addressed. P7-3A On July 31, 2017, Keeds Company had a cash balance per books of $6,140. The statement from Dakota State Bank on that date showed a balance of $7,690.80. A compa son of the bank statement with the Cash account revealed the following facts. 1. The bank service charge for July was $25 2. The bank collected $1,520 for Keeds Company through electronic funds transter. 3. The July 31 receipts of $1,193.30 were not included in the bank deposits for July These receipts were deposited by the company in a night deposit vault on July 31 4. Company check No. 2480 issued to L. Tavlor, a creditor, for $384 that cleared the bank in July was incorrectly entered in the cash payments journal on July 10 for $348. 5. Checks outstanding on July 31 totaled $1,860.10. 6. On July 31, the bank statement showed an NSF charge of $575 for a check received by the company from W. Krueger, a customer, on account. Instructions (a) Prepare the bank reconciliation as of July 31. (b) Prepare the necessary adjusting entries at July 31 P7-4A The bank portion of the bank reconciliation for Bogalusa Company at Octol 2017, is shown below BOGALUSA COMPANY Bank Reconciliation October 31, 2017 $12,367.90 Cash balance per bank Add: Deposits in transit 1,530.20 13,898.10 Less: Outstanding checks Check Amount Check Number 2451 2470 2471 2472 2474 $1,260.40 684.20 844.50 426.80 1,050.00425 4,265 yr Adjusted cash balance per bank The adjusted cash balance per bank agreed with the cash balance per books t The November bank statement showed the following checks and deposits Bank Statement Checks Deposits Date Number 11-1 11-2 11-5 11-4 11-8 11-10 2477 11-15 11-18 Date Amount 1,530.20 1,211.60 990.1 2,575.0 1,472.7 2,945.0 2,567.3 1,650.0 1,186. Amount 684.20 11-1 2470 2471 2474 2475 2476 11-4 844.50 1,050.00 1,640.70 11-8 11-13 2,830.00 11-18 600.00 11-21 1,750.00 11-25 1,330.00 11-28 2479 2480 2481 695.40 11-30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts