Question: Instructions In this activity, you are considering different strategies using options on SPY, an ETF that replicates the performance of the S&P 500 index. This

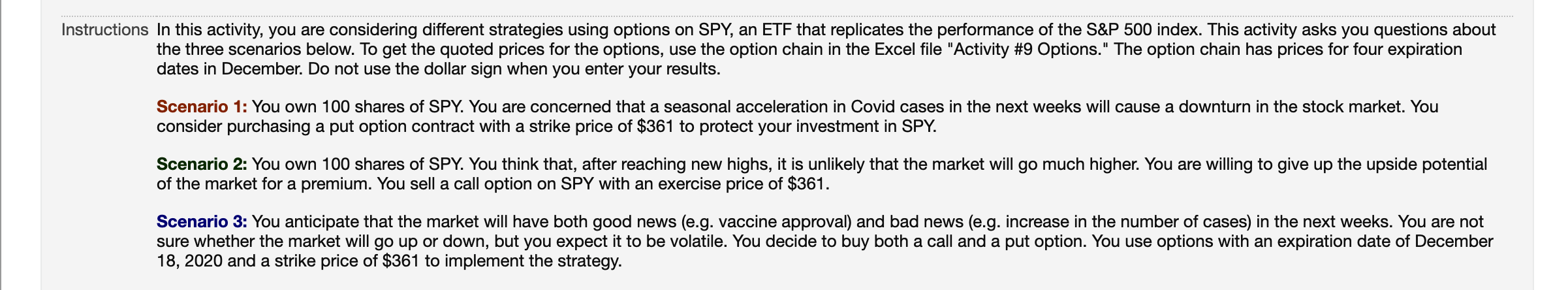

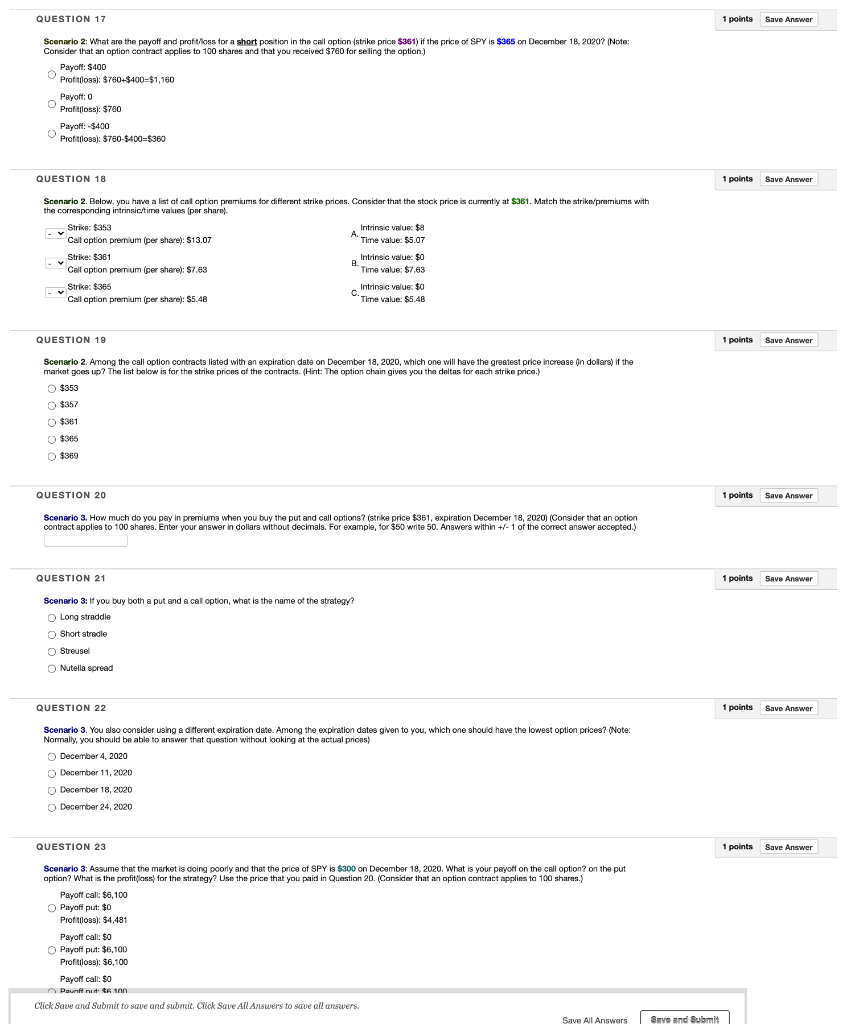

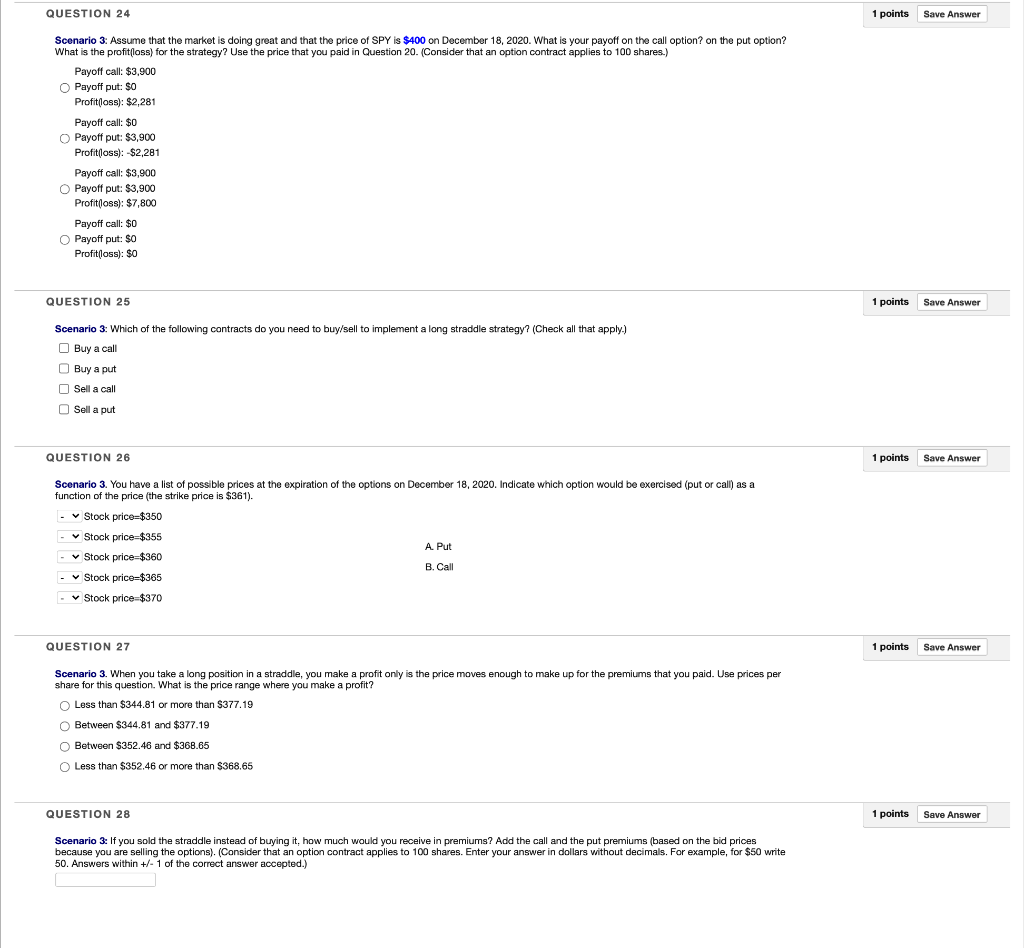

Instructions In this activity, you are considering different strategies using options on SPY, an ETF that replicates the performance of the S&P 500 index. This activity asks you questions about the three scenarios below. To get the quoted prices for the options, use the option chain in the Excel file "Activity #9 Options." The option chain has prices for four expiration dates in December. Do not use the dollar sign when you enter your results. Scenario 1: You own 100 shares of SPY. You are concerned that a seasonal acceleration in Covid cases in the next weeks will cause a downturn in the stock market. You consider purchasing a put option contract with a strike price of $361 to protect your investment in SPY. Scenario 2: You own 100 shares of SPY. You think that, after reaching new highs, it is unlikely that the market will go much higher. You are willing to give up the upside potential of the market for a premium. You sell a call option on SPY with an exercise price of $361. Scenario 3: You anticipate that the market will have both good news (e.g. vaccine approval) and bad news (e.g. increase in the number of cases) in the next weeks. You are not sure whether the market will go up or down, but you expect it to be volatile. You decide to buy both a call and a put option. You use options with an expiration date of December 18, 2020 and a strike price of $361 to implement the strategy. QUESTION 17 1 points Save Answer Scenario 2: What are the payoff and profit loss for a short position in the call option (strike price $361) if the price of SPY is $365 on December 18, 20207 (Note: Consider that an option contract applies to 100 shares and that you received $760 for selling the option.) Payoff: $400 Profifloss): $760-$400-$1,160 Payoft: 0 Profitfloss): $760 Payoff: -$400 Proftilosa): $760-9400-$360 QUESTION 18 1 points Save Answer Scenario 2. Below, you have a list of cal option premiums for different strike prices. Consider that the stock price is currently at $361. Match the strikepremiums with the corresponding intrinsic/time values (per shara Strike: $353 Intrinsic value: $a A Call option premium (per share): $13.07 A Time value: $5.07 Strike: $361 Intrinsic value: $0 B. Call option premium (per share): $7.63 Time value: $7.63 Strice: $365 Intrinsic value $o Call option premium (per share): 55.48 c. Time value: $5.48 QUESTION 19 1 points Save Answer Scenario 2. Among the call option contracts listed with an expiration date on December 18, 2020, which one will have the greatest price increase in dollars) if the markat goes up? The list below is for the strike prices of the contracts. (Hint: The option chain gives you the deltas for each strike price.) $353 $357 $365 $369 QUESTION 20 1 points Save Answer Scenario 3. How much do you pay in premiums when you buy the put and call options? (strike price $361, expiration December 18, 2020) (Consider that an option contract applies to 100 shares. Enter your answer in dollars without decimals. For example, for $50 write 50. Answers within +/- 1 of the correct answer accepted.) QUESTION 21 1 points Save Answer Scenario 3: If you buy both a put and a cal option, what is the name of the strategy? : a O Long straddle O Short stredie Streusel Nutella spread QUESTION 22 1 points Save Answer Scenario 3. You also consider using a different expiration date. Among the expiration dates given to you, which one should have the lowest option prices? (Note: a ( Normally, you should be able to answer that question without looking at the actual prices) December 4, 2020 December 11, 2020 December 18, 2020 December 24, 2020 QUESTION 23 1 points Save Answer Scenario 3: Assume that the market is doing poorly and that the price of SPY la $300 on December 18, 2020. What is your payoff on the call option on the put aption? What is the protitoss) for the strategy? Use the price that you paid in Question 20. (Consider that an option contract applies to 100 shares.) Pavoff call: $6,100 Payoff put: $0 Profitfloss): $4,481 Payoff call: $0 O Payoff put: $6,100 Profilloso): $6,100 Payoff call: $0 Pauni nunta on Click Save and Submit to save and submit. Click Save All Answers to see all answers. Save All Answers Save and Submit QUESTION 24 1 points Save Answer Scenario 3: Assume that the market is doing great and that the price of SPY is $400 on December 18, 2020. What is your payoff on the call option? on the put option? What is the profit(loss) for the strategy? Use the price that you paid in Question 20. (Consider that an option contract applies to 100 shares.) Payoff call: $3,900 O Payoff put: $0 Profit(loss): $2,281 Payoff call: $0 Payoff put: $3,900 Profit loss): -$2,281 Payoff call: $3,900 O Payoff put: $3,900 Profit(loss): $7,800 Payoff call: $0 O Payoff put: $0 Profit(loss): $0 QUESTION 25 1 1 points Save Answer Scenario 3: Which of the following contracts do you need to buy/sell to implement a long straddle strategy? (Check all that apply.) Buy a call Buy a put Sell a call Sell a put QUESTION 26 1 points Save Answer Scenario 3. You have a list of possible prices at the expiration of the options on December 18, 2020. Indicate which option would be exercised (put or call) as a function of the price (the strike price is $361). Stock price=$350 Stock price $355 A. Put Stock price $360 B. Call - Stock price=$365 - Stock price $370 QUESTION 27 1 points Save Answer Scenario 3. When you take a long position in a straddle, you make a profit only is the price moves enough to make up for the premiums that you paid. Use prices per share for this question. What is the price range where you make a profit? Less than $344.81 or more than $377.19 Between $344.81 and $377.19 Between $352.46 and $368.65 Less than $352,46 or more than $368.65 QUESTION 28 1 points Save Answer Scenario 3: If you sold the straddle instead of buying it, how much would you receive in premiums? Add the call and the put premiums (based on the bid prices because you are selling the options). (Consider that an option contract applies to 100 shares. Enter your answer in dollars without decimals. For example, for $50 write 50. Answers within +/- 1 of the correct answer accepted.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts