Question: Instructions: In this section, please show all calculations. Partial credit will be given wherever possible, when your calculations are shown and they are completed correctly.

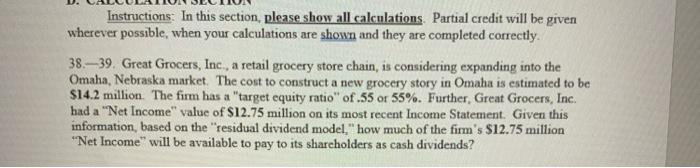

Instructions: In this section, please show all calculations. Partial credit will be given wherever possible, when your calculations are shown and they are completed correctly. 38.-39. Great Grocers, Inc., a retail grocery store chain, is considering expanding into the Omaha, Nebraska market. The cost to construct a new grocery story in Omaha is estimated to be $14.2 million. The firm has a "target equity ratio of .55 or 55%. Further, Great Grocers, Inc. had a "Net Income" value of $12.75 million on its most recent Income Statement. Given this information, based on the residual dividend model." how much of the firm's $12.75 million "Net Income will be available to pay to its shareholders as cash dividends

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts