Question: Instructions: Indicate in the True/False column, whether the journal entry is correct (True) or not correct (False). For the journal entries that are not correct

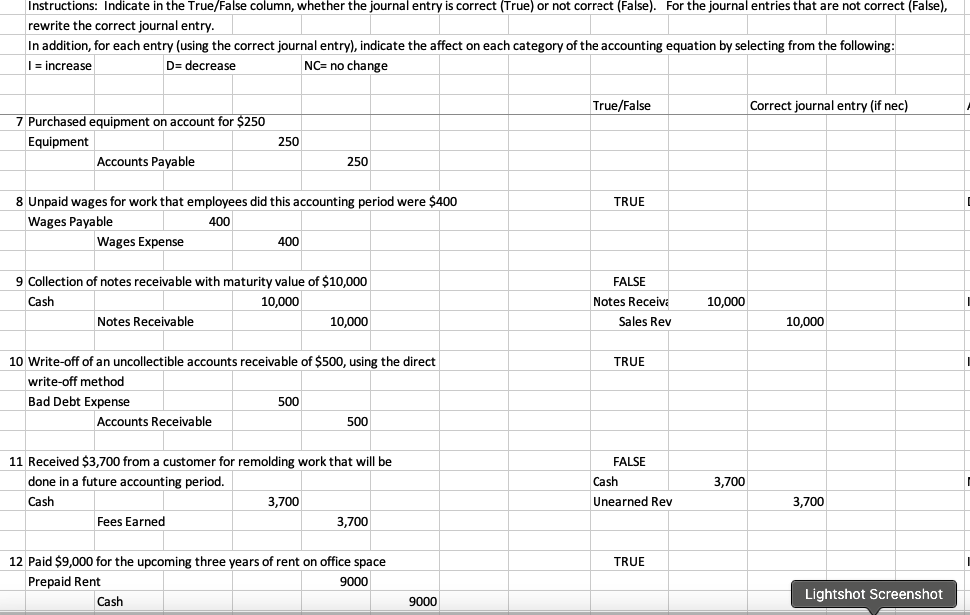

Instructions: Indicate in the True/False column, whether the journal entry is correct (True) or not correct (False). For the journal entries that are not correct (False), rewrite the correct journal entry. In addition, for each entry (using the correct journal entry), indicate the affect on each category of the accounting equation by selecting from the following: I=increaseD=decreaseNC=nochange True/False Correct journal entry (if nec) 7 Purchased equipment on account for $250 \begin{tabular}{|l|l|l} \hline Equipment & & 250 \end{tabular} Accounts Payable 250 8 Unpaid wages for work that employees did this accounting period were $400 TRUE Wages Payable 400 Wages Expense 400 9 Collection of notes receivable with maturity value of $10,000 FALSE Cash Notes Receivi 10,000 Notes Receivable 10 Write-off of an uncollectible accounts receivable of $500, using the direct TRUE write-off method Bad Debt Expense Accounts Receivable 500 11 Received $3,700 from a customer for remolding work that will be FALSE done in a future accounting period. Cash 3,700 Cash 3,700 Unearned Rev 3,700 Fees Earned 12 Paid $9,000 for the upcoming three years of rent on office space TRUE Prepaid Rent Cash 9000 Lightshot Screenshot Instructions: Indicate in the True/False column, whether the journal entry is correct (True) or not correct (False). For the journal entries that are not correct (False), rewrite the correct journal entry. In addition, for each entry (using the correct journal entry), indicate the affect on each category of the accounting equation by selecting from the following: I=increaseD=decreaseNC=nochange True/False Correct journal entry (if nec) 7 Purchased equipment on account for $250 \begin{tabular}{|l|l|l} \hline Equipment & & 250 \end{tabular} Accounts Payable 250 8 Unpaid wages for work that employees did this accounting period were $400 TRUE Wages Payable 400 Wages Expense 400 9 Collection of notes receivable with maturity value of $10,000 FALSE Cash Notes Receivi 10,000 Notes Receivable 10 Write-off of an uncollectible accounts receivable of $500, using the direct TRUE write-off method Bad Debt Expense Accounts Receivable 500 11 Received $3,700 from a customer for remolding work that will be FALSE done in a future accounting period. Cash 3,700 Cash 3,700 Unearned Rev 3,700 Fees Earned 12 Paid $9,000 for the upcoming three years of rent on office space TRUE Prepaid Rent Cash 9000 Lightshot Screenshot

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts