Question: Instructions Journalize all entries required on the above dates, including entries to update depreciation, Where applicable, on assets disposed of. Gene Company uses straightline depreciation.

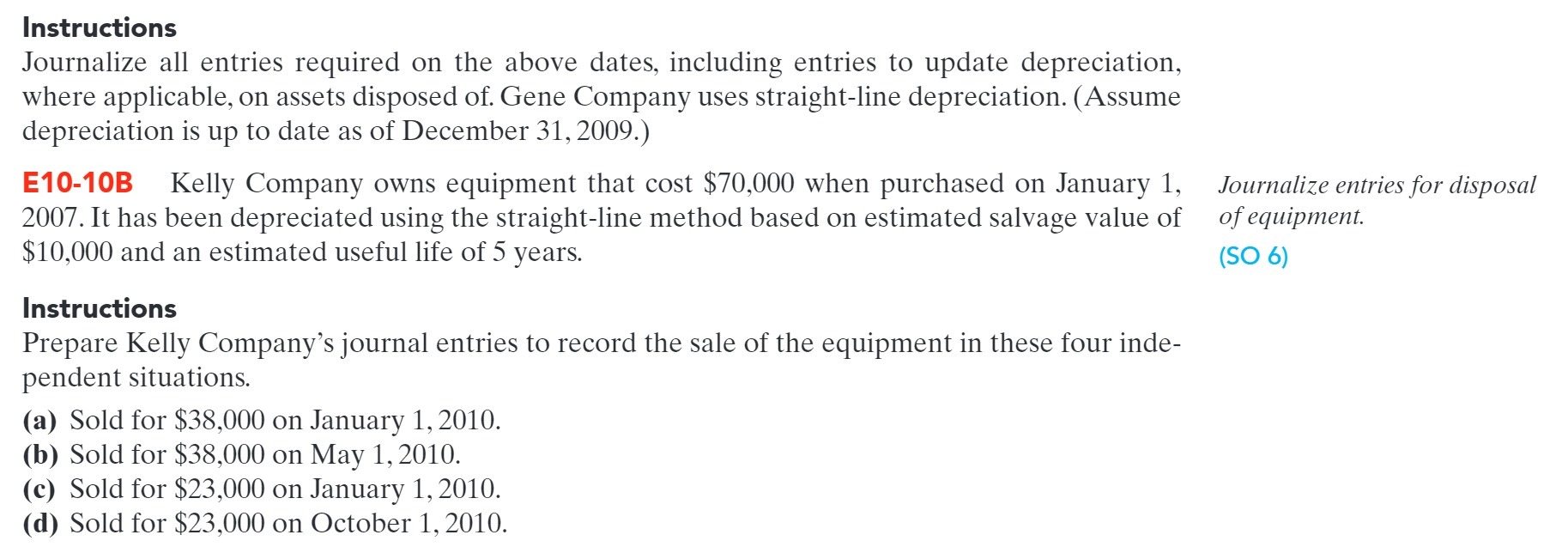

Instructions Journalize all entries required on the above dates, including entries to update depreciation, Where applicable, on assets disposed of. Gene Company uses straightline depreciation. (Assume depreciation is up to date as of December 31, 2009.) E10-1OB Kelly Company owns equipment that cost $70,000 when purchased on January 1, 2007. It has been depreciated using the straightline method based on estimated salvage value of $10,000 and an estimated useful life of 5 years. Instructions Prepare Kelly Company's journal entries to record the sale of the equipment in these four inde pendent situations. (2) Sold for $38,000 on January 1,2010. (b) Sold for $38,000 on May 1, 2010. (c) Sold for $23,000 on January 1, 2010. ((1) Sold for $23,000 on October 1,2010. Journalize entries for disposal of equipment. (SO 6)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts