Question: Instructions Lily Bhd ( LB ) purchased Roses Bhd ( RB ) and Daisy Bhd ( DB ) on 1 Jan 2 0 2 0

Instructions

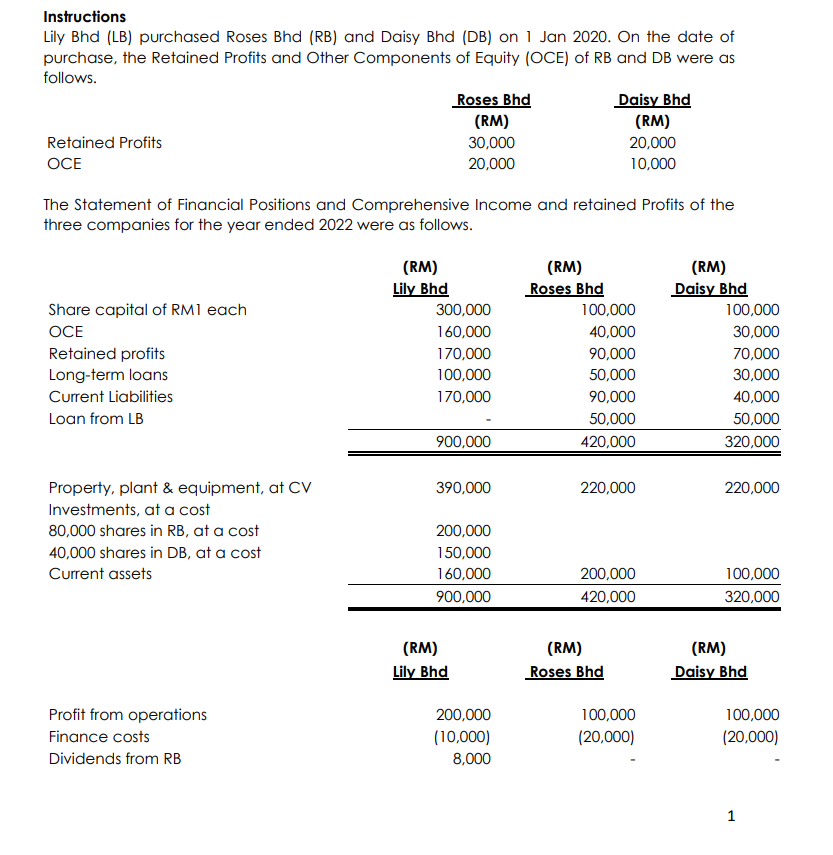

Lily Bhd LB purchased Roses Bhd RB and Daisy Bhd DB on Jan On the date of purchase, the Retained Profits and Other Components of Equity OCE of RB and DB were as follows.

begintabularlccc

& Roses Bhd & & Daisy Bhd

& & & RM

Retained Profits & & &

OCE & & &

endtabular

The Statement of Financial Positions and Comprehensive Income and retained Profits of the three companies for the year ended were as follows.

begintabularcccc

hline & begintabularl

RM

Lily Bhd

endtabular & begintabularl

RM

Roses Bhd

endtabular & begintabularl

RM

Daisy Bhd

endtabular

hline Share capital of RMI each & & &

hline OCE & & &

hline Retained profits & & &

hline Longterm loans & & &

hline Current Liabilities & & &

hline Loan from LB & & &

hline & & &

hline Property, plant & equipment, at CV & & &

hline Investments, at a cost & & &

hline shares in RB at a cost & & &

hline shares in DB at a cost & & &

hline Current assets & & &

hline & & &

hline & RM & RM & RM

hline & Lily Bhd & Roses Bhd & Daisy Bhd

hline Profit from operations & & &

hline Finance costs & & &

hline Dividends from RB & & &

hline

endtabular

Dividends from DB

Profit before tax

Taxation

Profit after tax

Retained profits brought forward

Available for appropriation

Dividends paid

Retained profits carried forward

Additional information:

a Included in the property, plant & equipment of RB and DB were freehold land at costs of RM and RM respectively. At the date of acquisition of these two companies, the fair value of RBs land was RM while that of DB was RM No adjustments have been made in the accounts of these two companies for the fair values and there were no subsequent movements in the freehold land account.

b On Jan LB sold Plant & Equipment PE to RB at RM The PPE's costs to LB were RM RB classified the assets purchased as another PPE. Depreciation charges for the group are at per annum.

c On December LB held stocks purchased from DB amounting to RMinvoiced price The intercompany sales in the current year amounted to RM These sales had a profit margin of from the invoice price.

d On December DB sold Plant & Equipment PE to LB at RM The PPE's costs to LB were RM LB classified the assets purchased as another PPE. Depreciation charges for the group are at per annum.

e The intercompany loans were interestfree loans.

f At the end of the year, LBs RM closing inventories were damaged due to a flash flood. These inventories were unable to be sold. LB can only recover RM from the insurance company.

g The full goodwill method is to be used for the group. There was no impairment of Goodwill for the current year.

h Assume an income tax rate of tax expenses are rounded to simplified calculation Ignore the taxeffect on intercompany transactions.

Required: Required:

a Prove the status of DB and RB to LB through calculations and supporting reasons. Discuss the financial reporting standards LB will use to record both companies in the group accounts.

marks

b Prepare the journal entries to consolidate LBs group. Show all your workings.

c Prepare a worksheet to consolidate the Group.

d Discuss the impact of disclosing Related Party Transactions to LBs financial statement.

marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock