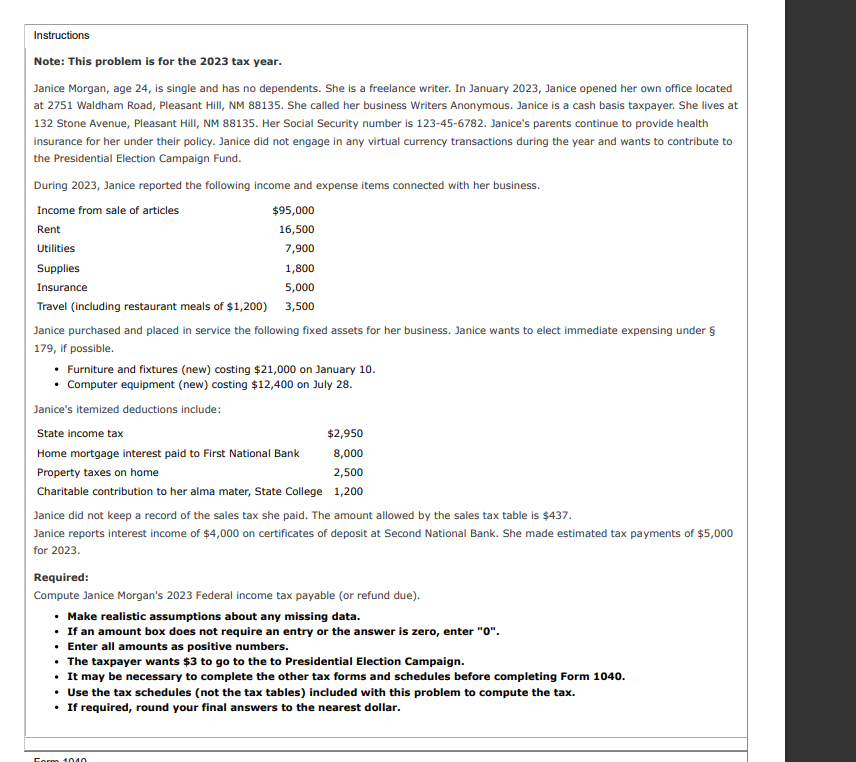

Question: Instructions Note: This problem is for the 2 0 2 3 tax year. Janice Morgan, age 2 4 , is single and has no dependents.

Instructions

Note: This problem is for the tax year.

Janice Morgan, age is single and has no dependents. She is a freelance writer. In January Janice opened her own office located

at Waldham Road, Pleasant Hill, NM She called her business Writers Anonymous. Janice is a cash basis taxpayer. She lives at

Stone Avenue, Pleasant Hill, NM Her Social Security number is Janice's parents continue to provide health

insurance for her under their policy. Janice did not engage in any virtual currency transactions during the year and wants to contribute to

the Presidential Election Campaign Fund.

During Janice reported the following income and expense items connected with her business.

Janice purchased and placed in service the following fixed assets for her business. Janice wants to elect immediate expensing under

if possible.

Furniture and fixtures new costing $ on January

Computer equipment new costing $ on July

Janice's itemized deductions include:

State income tax

Home mortgage interest paid to First National Bank

Property taxes on home

$

Charitable contribution to her alma mater, State College

Janice did not keep a record of the sales tax she paid. The amount allowed by the sales tax table is $

Janice reports interest income of $ on certificates of deposit at Second National Bank. She made estimated tax payments of $

for

Required:

Compute Janice Morgan's Federal income tax payable or refund due

Make realistic assumptions about any missing data.

If an amount box does not require an entry or the answer is zero, enter

Enter all amounts as positive numbers.

The taxpayer wants $ to go to the to Presidential Election Campaign.

It may be necessary to complete the other tax forms and schedules before completing Form

Use the tax schedules not the tax tables included with this problem to compute the tax.

If required, round your final answers to the nearest dollar.

please help with schedule c form

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock