Question: Instructions Note: This problem is for the 2 0 2 2 tax year. Janice Morgan, age 2 4 , is single and has no dependents.

Instructions

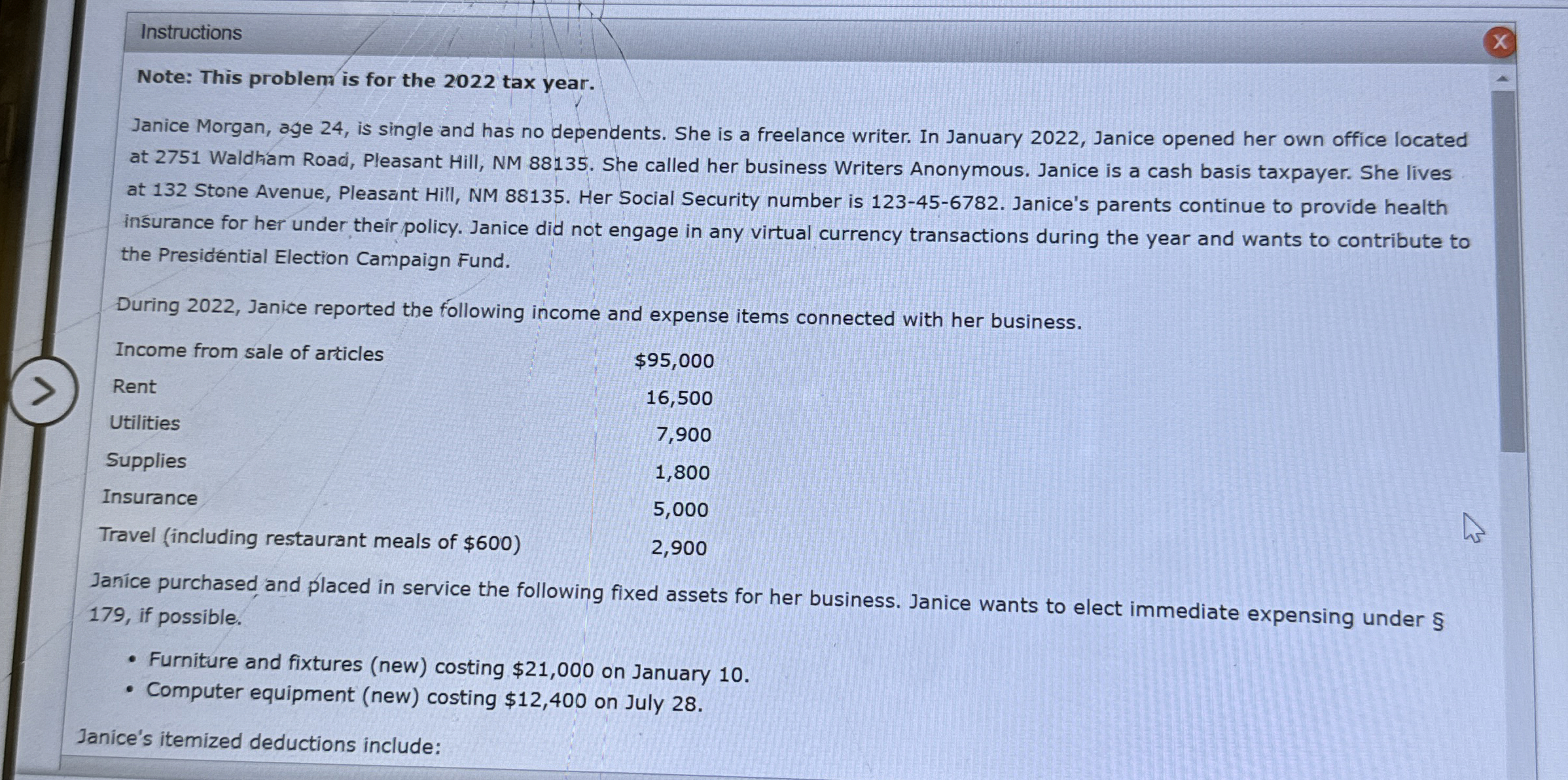

Note: This problem is for the tax year.

Janice Morgan, age is single and has no dependents. She is a freelance writer. In January Janice opened her own office located at Waldham Roadi, Pleasant Hill, NM She called her business Writers Anonymous. Janice is a cash basis taxpayer. She lives at Stone Avenue, Pleasant Hill, NM Her Social Security number is Janice's parents continue to provide health insurance for her under their policy. Janice did not engage in any virtual currency transactions during the year and wants to contribute to the Presidential Election Campaign Fund.

During Janice reported the following income and expense items connected with her business.

tableIncome from sale of articles,$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock